Asian markets indices took a hit on the chin led by technologies stocks after Canadian authorities arrested the chief financial officer of Huawei Technologies for allegedly violating Iran sanctions. Huawei is one of the world’s largest makers of smartphones and telecommunications network equipment.

In Tokyo Japan’s Nikkei fell 1.9%, South Korea’s Kospi fell 1.5%, and Singapore stocks fell over 1%.

European stock markets started the session in negative tone with Germany’s DAX down 1.5%, FTSE100 in London give up 1% and France’s CAC40 is trading 1.40% lower.

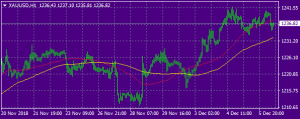

Gold bullish momentum is still intact as investors looking for safe heaven, with the price trading near five month highs touching the $1240 level yesterday, just to fall in the Asian trading session to 1235 amid modest US dollar demand. 1228 is the first strong support area while yesterday’s high at 1240 is the short term resistance.

Gold bullish momentum is still intact as investors looking for safe heaven, with the price trading near five month highs touching the $1240 level yesterday, just to fall in the Asian trading session to 1235 amid modest US dollar demand. 1228 is the first strong support area while yesterday’s high at 1240 is the short term resistance.

USDJPY is trading around 113 after hitting the daily lows at 112.56. I expect the pair to keep in consolidation mood with 114 level a quite strong resistance and 11.80 the first test in the downside. CME Group’s preliminary figures for JPY futures markets, open interest dropped by almost 1.8K contracts on Wednesday from Tuesday’s final 226,835 contracts. In the same direction, volume dropped noticeable by nearly 101K contracts, although greatly influenced by the holiday in the US markets.

The recent rejection from the 1.14 level for EURUSD gave power to bears following headlines from the Italian budget crisis, after rumors that PM Conte could be assessing the probability of lowering the 2020/21 budget, while Italian newspaper La Repubblica says Salvini and Di Maio will not revise the deficit below the 2% level. I don’t expect any major look for major gains at this point because there are so many concerns for European Union right now.

In the latest Reuters poll of more than 60 currency analysts, taken Nov. 28-Dec. 5, the dollar was forecast to be weaker against major currencies in a year, leaving the Euro at $1.20, up over 6% from around $1.1340 seen on Thursday.

While sterling was forecast to gain over 7% to $1.37 in 12-months from $1.28 on Wednesday, it was slightly lower than the $1.38 predicted last month.

But the dollar index .DXY, which measures the greenback against a basket of six major currencies, was forecast to close out 2019 at 91.90, down over 5% from around 97.20 last minutes. That suggests the greenback will reverse and shave off all the gains made this year in 2019

In our calendar today, German Factory Orders expanded at a monthly 0.3% in October. Later in the session, US ADP report is due along with Initial Claims, Services PMIs, Factory Orders and the key ISM Non-manufacturing.