Asian equities finished lower today as traders worry that the China-U.S. trade war escalates, following reports that the US will look at imposing a blacklist on up to five China surveillance companies and the FOMC minutes added nothing new as “Members observed that a patient approach to determining future adjustments to the target range for the federal funds rate would likely remain appropriate for some time,” according to minutes of the Federal Open Market Committee’s two-day meeting in late April.

The Nikkei225 finished 0.76 percent lower to 21,122 the Hang Seng benchmark in Hong Kong finished 1.51 percent lower at 27,284. The Shanghai Composite finished 1.02 percent lower to 2,862 below the 100-day MA, while in Singapore the FTSE Straits Times index finished 0.71 percent lower to 3,184. Australian equities snapped a six-session winning streak, weighed down by falls in the Materials, Financial and Energy sectors. The losses outweighed solid gains in the Consumer Discretionary, Telco, Industrials, and IT sectors. The ASX200 ended the day down 18 points or 0.3% to 6,491.

European session started lower today amid geopolitical concerns and as the European election voting began, the DAX30 is 1.07 percent lower to 12,038 and CAC40 is 0.99 percent lower at 5,325 while the FTSE MIB in Milan is trading 0.92 percent lower at 20,383. The London Stock Exchange is giving up 0.63 percent to 7,286 as Brexit is back in focus as May’s fourth attempt at getting her deal across the board faces significant backlash.

In commodities markets, crude oil plunged today at 60.85 after American Petroleum Institute data showed that U.S. crude stockpiles rose unexpectedly the previous week. Brent oil also trades lower at $70,33 per barrel as major oil producers have yet to agree on adjustments on output. Gold continues the consolidation around 1273 zone at two-week lows. The precious metal breached the 100-day moving average and that gave the control back to bears. XAUUSD technical picture is bearish now after yesterdays sell-off. Gold will find support at 1272 the April low while more bids will emerge at 200-day moving average at 1255. On the upside, resistance stands at 1296 the 100-day moving average.

In cryptocurrencies market, Bitcoin (BTCUSD) breaks lower after two days consolidation below the 8,000 mark. The daily low for BTC was at 7,481 and the daily high at 7,816. The move breached the major hourly moving averages during the Asia session and bears took control for the short term. Immediate support for BTC stands now at $7,000 round, on the upside strong resistance stands at 8,300 the recent high. Ethereum (ETHUSD) gives up over 20 dollars to 236. On the upside, the immediate resistance stands at 263 the high during yesterday session while the support stands at 235 and the 100 hour SMA, Litecoin (LTCUSD) also trades lower at 86.50. The crypto market cap holds above $173.0B.

On the Lookout: In European macro news, the France Business Climate came above forecasts (101) in May: Actual (104) and the France Markit Services PMI also beat analyst’s forecasts (50.8) for May: Actual (51.7).

In the US, the mortgage applications increased 2.4% week-on-week, according to the Mortgage Bankers Association.

In the America economic calendar, we await the US weekly jobless claims and the Canadian wholesale sales data will drop in at 12:30GMT, followed by the US Markit manufacturing and services PMI reports due at 13:45GMT. Next follows the US new home sales data slated for release at 14:00GMT.

Trading Perspective: In forex markets, the US dollar finally brakes higher above 98 and looks north at YTD high at 0.9830, as traders digest the escalation in US-Sino trade war. The Aussie consolidates down to multi-month lows at 0.6871 as RBA Governor Philip Lowe said the board “will consider the case” for an interest rate cut on June 4. Kiwi trades below the critical 0.65 mark for the second day, and as of writing the pair is trading at 0.6487.

GBPUSD bearish momentum is still intact as growing concerns over the PM May’s resignation are back in play. The pair hit the daily low at 1.2604 a four and a half month low and the daily high at 1.2665. Bears are in full control now and a test of 1.26 bottoms looks possible. On the upside, immediate resistance now stands at 1.2686 the high from yesterday and the 50-hour moving average while more sellers will emerge at the 100-hour moving average at 1.2712.

In Sterling futures the open interest increased by 7K contracts to their open interest positions on Wednesday, reaching the eighth consecutive build, volume kept the choppy activity and dropped by around 43.2K contracts.

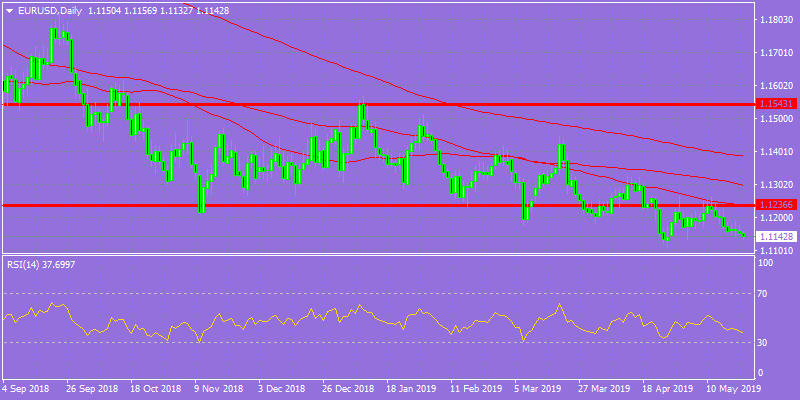

EURUSD remains fragile and trades at three-week lows at 1.1134 as any attempt to the upside meets strong offers. The pair made the Asian high at 1.1156 and the low at 1.1132. The pair breached all major moving averages last Friday and now is looking for support at the yearly low down to 1.1115. On the upside, the immediate resistance stands at 1.1180 the high from yesterday, while more offers will emerge at 1.1245 the 50-day moving average.

In euro futures, the open interest rose by around 5.5K contracts the volume shrunk by nearly 43K contracts in choppy trading.

USDJPY trades at 110.20 amid general USD strength across the board. Today the pair hit the low at 110.12 and the high at 110.35. The pair will find support at 109.54 Friday low, on the upside immediate resistance for the pair stands at 110.51 the 100-day moving and then at 111.01 the 50-day moving average.

In Yen futures the open interest shrunk for the second straight session on Wednesday, now by around 1.6K contracts. Volume decreased by more than 29K contracts.

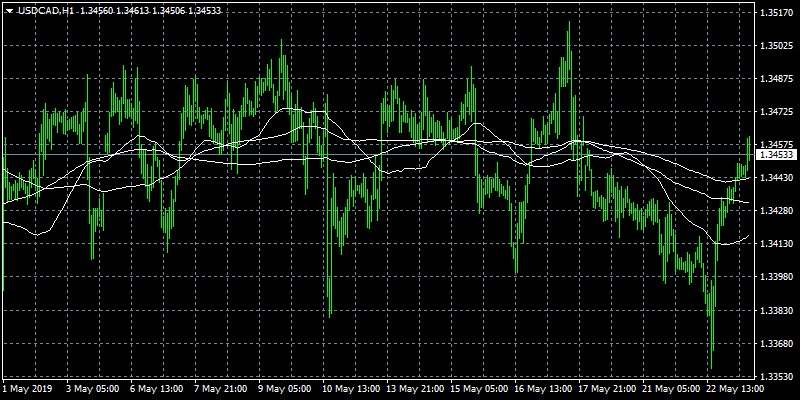

USDCAD managed to rebound from the recent trading range (1.3390-1.3490) low and now is heading to mid 1.34. The pair will find immediate support at the 50-day moving average around 1.3392 while extra support stands at 1.3300 round figure. On the upside, immediate resistance stands at 1.3435 the 100-hour moving average, while a break above can escalate the rebound towards the 1.35 zone.