Summary: The Dollar ended little-changed while stocks declined anew after the US began action against Chinese technology giant Huawei. The Australian Dollar steadied (0.6910) after jumping as much as 1% (0.6934) on Monday following the incumbent Liberal National Party’s surprise election victory. Sterling consolidated its losses to finish 0.11% higher at 1.2725 with no new disruptive Brexit developments. The Euro steadied to 1.1168 (1.1158) ahead of this week’s EU Parliamentary Elections (Thursday) even as German Producer Prices and the Eurozone Current Account Surplus beat forecasts. USD/JPY closed flat at 110.05. Japan’s Q1 GDP beat forecasts climbing 0.5% against

-0.1%. The previous quarter’s GDP reading was revised up to +0.5% from +0.3%.

Wall Street stocks pared losses at the close while bond yields climbed.

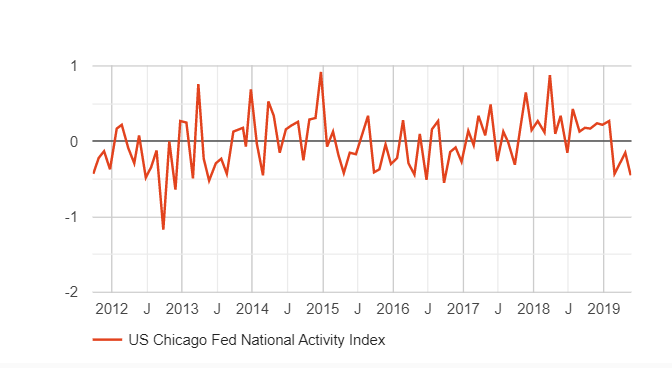

In the only US data released yesterday, the US Chicago Fed National Activity Index dropped to -0.45 in April from +0.05 in March due to a factory slump.

- AUD/USD – The Aussie, boosted by the surprise return to power of the incumbent Liberal rightest party, steadied to 0.6910, up 0.64%. AUD/USD traded to a high of 0.6934 early Monday morning.

- GBP/USD – Sterling steadied to 1.2725 at the close in New York after plummeting to 1.2713 from 1.2795 on Friday. Traders await the Bank of England’s MPC UK Inflation report due later today as well as the CPI on Wednesday.

- EUR/USD – The Euro bounced off it’s lows at 1.11507 to 1.11748 in subdued trading to close at 1.1167. Europe’s big event is Thursday’s Parliamentary Elections (every 5 years). Euro area and Eurozone Flash Manufacturing PMI reports (April) are released on Thursday too.

- USD/JPY – after hitting a low of 109.335 on Friday, the Dollar rallied to 110.319 overnight after US bond yields stabilised. The haven crown went to the Swiss Franc. Recent Japanese economic data has bettered forecasts.

On the Lookout: Fed Chair Jerome Powell is currently hitting headlines as I write. At the New York close, stocks pared earlier losses, the result from US action against Chinese tech giant Huawei. The US Commerce Department scaled back some of its restrictions on Huawei. Global economies prepare for a new cold trade war between the world’s two biggest economies.

Powell’s speech, entitled “Addressing Risks to Our Financial System” highlighted the Fed Chair’s concern on current US business debt, which has moderated. A “fast rise” in business debt could increase vulnerability “appreciably”. The Dollar edged lower on Powell’s observation. On the current trade situation, Powell said that the outlook on trade talks is unknown, so it was premature to judge. The Fed Chairman also said that he doesn’t see any threat to the Dollar’s role as reserve currency.

Today sees the RBA’s latest Monetary Policy Meeting Minutes released (11.30 am Sydney). The Bank of England releases its UK Inflation Hearings Report as well as the Confederation of British Industry’s Industrial Order Expectations (April). April Eurozone Consumer Confidence is the lone European report. US Existing Home Sales for April round up today’s data releases.

Trading Perspective: The latest Commitment of Traders/CFTC report for the week ended 14 May saw a reduction of net USD longs which were mainly against the Euro and Yen. Net speculative Euro and Yen short bets were trimmed. The Australian Dollar was one of the few currencies where speculators added to their already short bets. This was due to the expectation that the leftist leaning Labour party would blitz the election and take government.

Powell’s latest speech at the Financial Markets Conference in Florida highlighted the risks to the US economy. The reaction from the forex markets was muted, though the Dollar eased further.

- AUD/USD – The Australian Dollar should continue to have the most volatility with the RBA meeting minutes released shortly. The election win for Scott Morrison’s Liberal National Party will help stabilise the Aussie Dollar, which is close to its decade lows. Meantime the latest COT/CFTC report saw an increase of Aussie Dollar short bets to -AUD 64,000 contracts from -AUD 57,000. RBA Governor Philip Lowe speaks to an Australian economic society launch in Brisbane on Wednesday on the country’s economic outlook and monetary policy. AUD/USD has immediate resistance at 0.6940 followed by 0.6980. Immediate support can be found at 0.6900 and 0.6870. Look to buy dips with a likely range today of 0.6905-0.6945.

- EUR/USD – The Euro traded in a narrow 15-point range without any fresh catalysts to take it too far either way. Immediate support at 1.1160 should hold on the day. The next support level lies at 1.1140. Immediate resistance can be found at 1.1180 and 1.1210. European events and data heat up on Thursday where we could see some big moves. Meantime the latest COT/CFTC report saw net Euro short bets pared to -EUR 95,300 contracts from -EUR 106,100. Look for a likely range of 1.1160-1.1210. Prefer to buy dips.

- GBP/USD – Sterling consolidated near its 4-month lows, closing at 1.2725 from 1.2715 on Monday. GBP/USD has immediate resistance at 1.2760 (overnight high 1.27574). Immediate support can be found at 1.2710. The latest COT/CFTC report saw net speculative GBP shorts cut to -GBP 3,300 contracts from the previous week’s -GBP 6,900. UK data releases tonight and tomorrow will determine how much Brexit has affected sentiment and the economy. Likely range today 1.2715-1.2785. Prefer to buy on dips from current levels as it seems a lot of the bad news is already in the currency.

Happy trading all.