Summary: In thin Asian trading due to the antipodean holidays, USD/JPY jumped to 112.24 overnight highs after the Bank of Japan kept policy unchanged. The Dollar then slumped 0.48% to 111.65 Yen after BOJ Governor Kuroda put a time frame on its forward guidance for the first time. JPY shorts then scrambled for cover in low volume trade. The Euro extended its slide to near 2-year lows (1.1118) weighed by upbeat US data. Sterling stayed stuck around 1.2900 near ten-week lows. The Australian Dollar stabilised above 0.70 cents, ending little-changed at 0.7017. Other resource currencies, the Kiwi and Loonie managed modest gains versus the Greenback. Emerging Market Currencies were mixed. The Swedish Krona collapsed to a 17 year low after the Swedish Central Bank (Riksbank) delayed an interest rate hike.

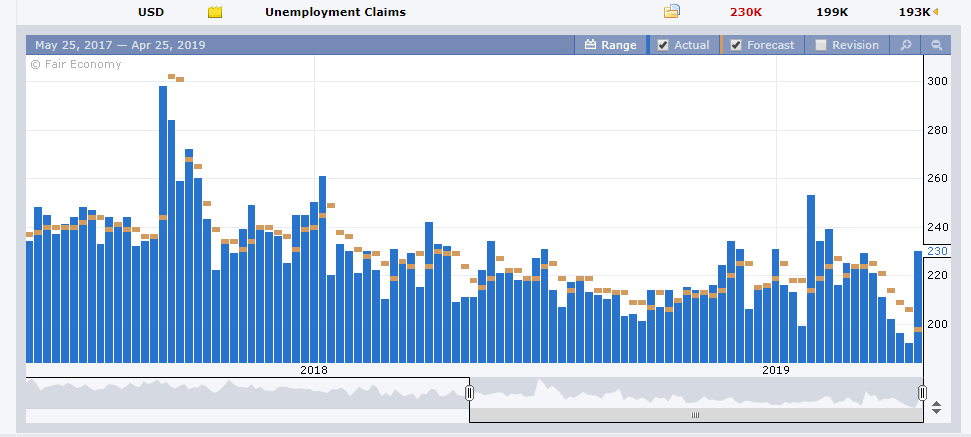

Wall Street stocks ended mixed with differing earnings from tech and industrial sectors. Bond yields were little-changed. Orders for March US-made capital goods beat forecasts with the biggest increase in 8 months. However, Claims for Unemployment Benefits in the latest week of April rose to 230,000 from 192,000 the previous week, the largest in 2.1/2 months.

- EUR/USD – the Single Currency extended it’s slide to March 2017 lows at 1.1118 as the mostly upbeat US data boosted demand for the Greenback. The Euro rallied in late New York trade to close at 1.1235, down 0.21% from yesterday. Spain’s Jobless Rate rose to 14.7% from 14.5% previously.

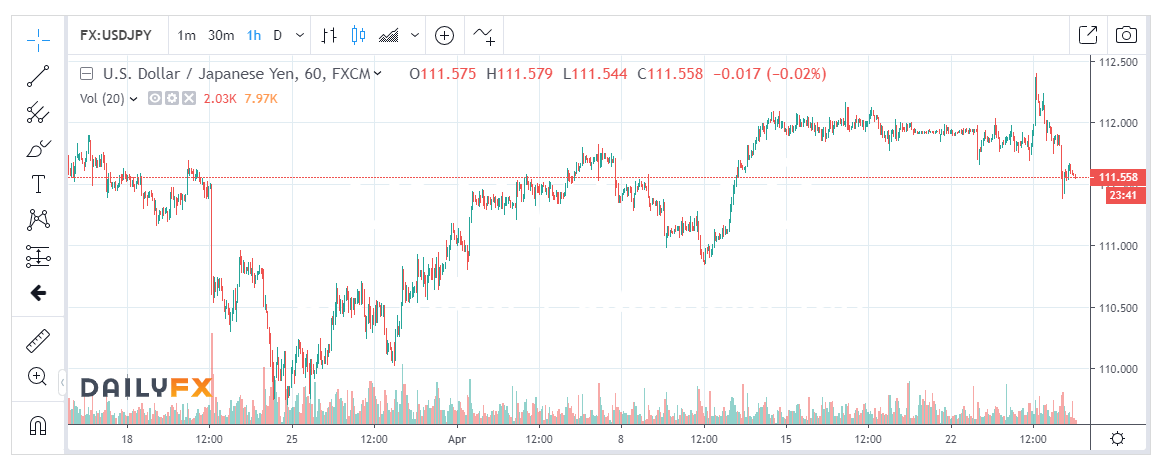

- USD/JPY – The Dollar initially jumped against the Yen to 112.24 after the BOJ kept its QQE (Qualitative and Quantitative Easing) policy unchanged. BOJ Governor Haruhiko Kuroda said they would keep the current stimulus in place at least through to mid-2020, marking the first time they put a time frame on it.

- AUD/USD – The Aussie Battler traded to an overnight low at 0.6988, the first time since the flash crash on January 3. AUD/USD then settled and climbed above the 0.70 cent handle to close at 0.7017, little-changed from yesterday.

On the Lookout: Traders and investors will await the release of the US Advance GDP for the first quarter in 2019. Prior to that, a plethora of data from Australasia will keep Asia occupied. New Zealand’s Trade Balance starts off the day where an improvement is forecast. Japanese data see Tokyo’s Annual Core CPI, Japanese Unemployment Rate, Industrial Production, Retail Sales, and Housing Starts follow. Australia sees its Q1 Import Prices and PPI. The UK sees its CBI (Confederation of British Industry) Realised Sales and High Street Lending data. US Advance Q1 GDP and GDP Price Index, University of Michigan Consumer Sentiment and Inflation Expectations follow. Finally, the US Treasury’s Currency Report round up today’s data. Market forecasts are for 2.2% reading for Q1 2019 following the downward revision to 2.2% from 2.6% in Q4 2018.

The US GDP report will determine whether the US can retain its attractiveness over its other global counterparts.

Trading Perspective: Overnight the Japanese Yen was the best performing G10 currency as JPY shorts scrambled to cover given the BOJ’s minor tweak to its policy stance. While the US Dollar remains bid because the US economy is still more attractive than its global counterparts, most traders already own Greenbacks. The Dollar ended mixed against its Rivals, unable to take advantage of the robust PPI data. The Yen’s performance overnight highlights the importance of market positioning.

- EUR/USD – The Euro extended its slide as the market’s bearishness grows on the Single Currency. Technically the break of 1.1200 signals 1.100 first. However, speculative market positioning remains short of Euro bets at multi-year highs. EUR/USD has immediate support at 1.1110 followed by 1.1080. Immediate resistance can be found at 1.1160 followed by 1.1200. Look for consolidation today between 1.1110-1.1170. The preference is to buy dips.

- USD/JPY – The Dollar failed to clear 112.24 following the BOJ’s policy announcement. USD/JPY slumped to 111.37 before settling currently at 111.55. Immediate support can be found at 111.40 followed by 111.10. Strong support lies at 110.80. The immediate resistance lies at 111.90 followed by 112.20. Look for a likely trade today of 111.25-111.75. Prefer to sell rallies.

- AUD/USD – The Australian Dollar managed to hold above 0.70 cents and close little-changed at 0.7017. AUD/USD traded to 0.6988, the lows when the January 3 flash-crash occurred. The Aussie found good buying support under 0.70 cents which should keep the Battler stable at these lower levels. Speculative market positioning is also short of Aussie bets. Today, immediate support can be found at 0.6990 followed by 0.6950. Immediate resistance lies at 0.7030 and 0.7060. Look to buy dips with a likely range today of .7005-0.7075.

Happy Friday and trading all.