Asian indices finished mixed today as investors turn cautious after better NFP data from the USA last Friday and increased trade tensions around the globe. The Nikkei225 finished 0.14 percent higher at 21,565 the Hang Seng slipped 0.62 percent at 28,156. The Shanghai Composite finished 0.32 percent lower to 2,924, while in Singapore the FTSE Straits Times index finished 0.04 percent higher to 3,335. Australian equities and ASX200 ended down 0.25 percent to 6,655.

European equities also trading lower today. DAX30 is giving up 0.20 percent to 12,543 CAC40 is 0.08 percent lower at 5,589 while the FTSE MIB in Milan is trading 0.04 percent lower at 21,976. The London Stock Exchange is 0,05 percent lower to 7,549 amid non-deal Brexit worries.

In commodities markets, crude oil trades 0.31 percent lower at $57.41 as traders turn cautious on trade war headlines. Brent oil trades also lower at $64,09 per barrel despite major oil producers have agreed to cut output. Gold today trades lower at 1,393 keeping the bullish momentum as the price holds above all the major daily moving averages. On the upside, strong resistance will be met at 1,400 round figure and then at 1,437 recent high.

In cryptocurrencies market, bitcoin (BTCUSD) rallies above 12,000 at 12,650, hitting the daily low at 12,189 and the daily high at 12,808. Immediate support for BTC stands now at $12,000 while next support stands at 11,500. On the upside, strong resistance now stands at 12,808 the daily high and then at 13,000 round figure. Ethereum (ETHUSD) also trades higher at 312 with capitalization now to 33.50 billion, on the upside the immediate resistance stands at 317 daily high while the support stands at 243 the 50-day moving average, Litecoin (LTCUSD) also trades higher at 121. The crypto market cap now stands above $349.0 billion.

On the Lookout: The National Australia Bank’s Business Conditions came in at 3 in June matching expectations. Aussie business confidence index fell to 2 in June as analysts’ expected from 7 in May. The ANZ-Roy Morgan Australian Consumer Confidence index came in at 1.1% percent below the previous week reading.

In Canada, the housing starts and building permits data will be published at 12:30 GMT while the US JOLTS job openings data will be published at 14:00 GMT and API crude stockpiles at 20:30 GMT.

Trading Perspective: In forex markets, USD trades 0.18 percent higher at 97.54 after strong NFP data last Friday. The Aussie dollar consolidates trades lower at 0.6945, while Kiwi also trades lower at 0.6614.

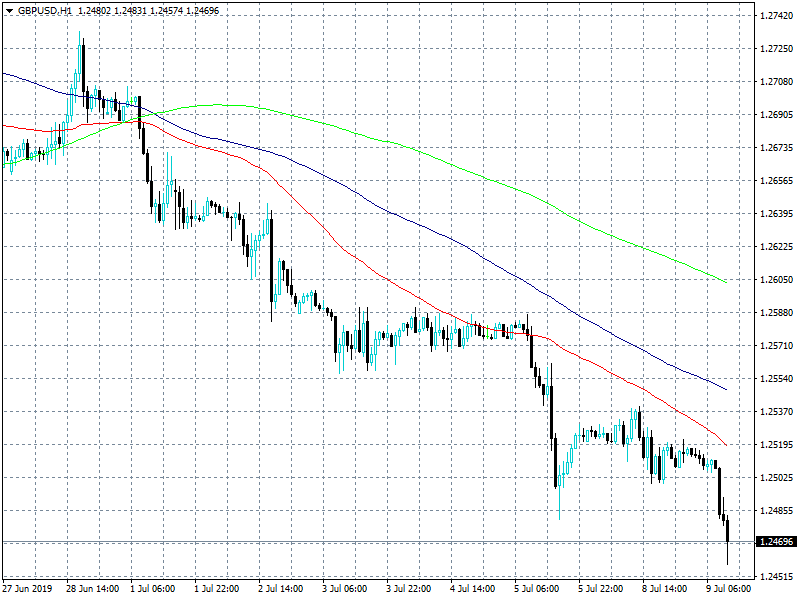

GBPUSD is trading sharply lower breaking below the 1.25 mark at 1.2466 as traders are still cautious around the Brexit developments. Major support now stands at 1.24 which if broken might accelerate the slide further towards 1.23 round figure. On the upside, immediate resistance now stands at 1.2518, the 50-hour moving average while more offers will emerge at 1.2547, the 100-hour moving average.

Sterling futures markets open interest increased by 1.100 contracts while volume also decreased by 58,300 contracts.

EURUSD trades lower at 1.1200 after yesterday the German industrial production output rose 0.3% m/m in May, easing investors worries of a slowdown in Europe’s largest economy. On an annualized basis, the German industrial production came in at -3.7% versus -1.1% expected and -1.8% booked in April. Euro traders are awaiting Jerome Powell’s speech later today for fresh cues about the FED’s next move.

Euro futures markets open interest increased by 267 contracts while volume also decreased by 110,000 contracts.

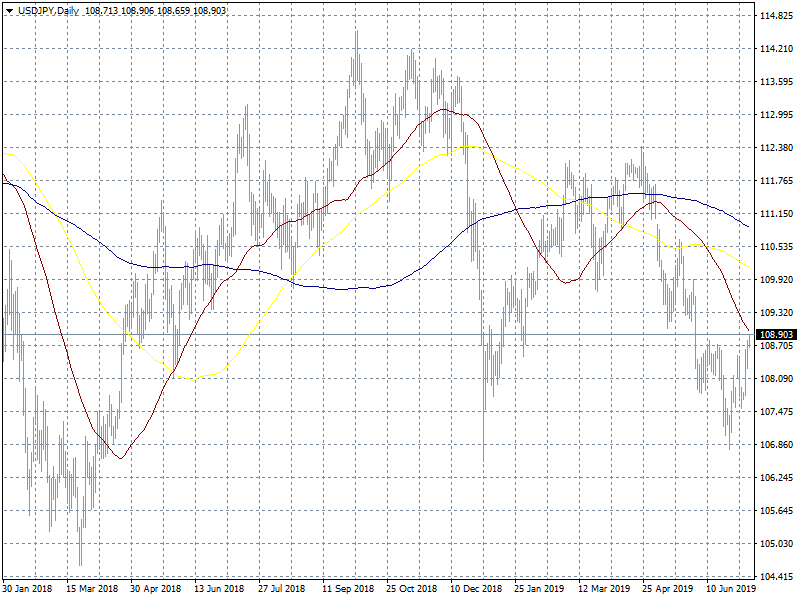

USDJPY is trading 0.18 percent higher at 108.84 having hit the daily low at 108.65 and the daily high at 108.90. USDJPY pair will find support around 108 round figure and then at 107.50. On the upside, immediate resistance for the pair now stands at 108.90 the daily high and then at 109.07 the 50-day moving average.

USDCAD rebounds above the 1.31 level at 1.3130 amid broadly USD strength, the daily high was at 1.3132, despite the crude oil prices retreat, Canada’s main export item seems to have added further weakness in the Canadian Dollar (CAD). The pair will find immediate support at 1.3060 the low from February 1st while extra support stands at 1.30 round figure. On the upside immediate resistance now stands at the 1.32 zone before an attempt to 1.3450 recent high from 31st May.