The Bank of Lithuania’s blockchain-based LBChain platform developers, together with FinTechs from Lithuania, Belgium and Finland, have been testing six different financial products within their LBChain prototypes.

At this time, the LB Chain project is at its high point. To assess the adaptability, possibilities and reliability of the developed LBChain platforms, FinTech companies are testing innovative and entirely different products. This is useful to both companies and developers as it allows to better assess advantages and disadvantages of the proposed solutions,’ said Andrius Adamonis, Project Manager at the Bank of Lithuania.

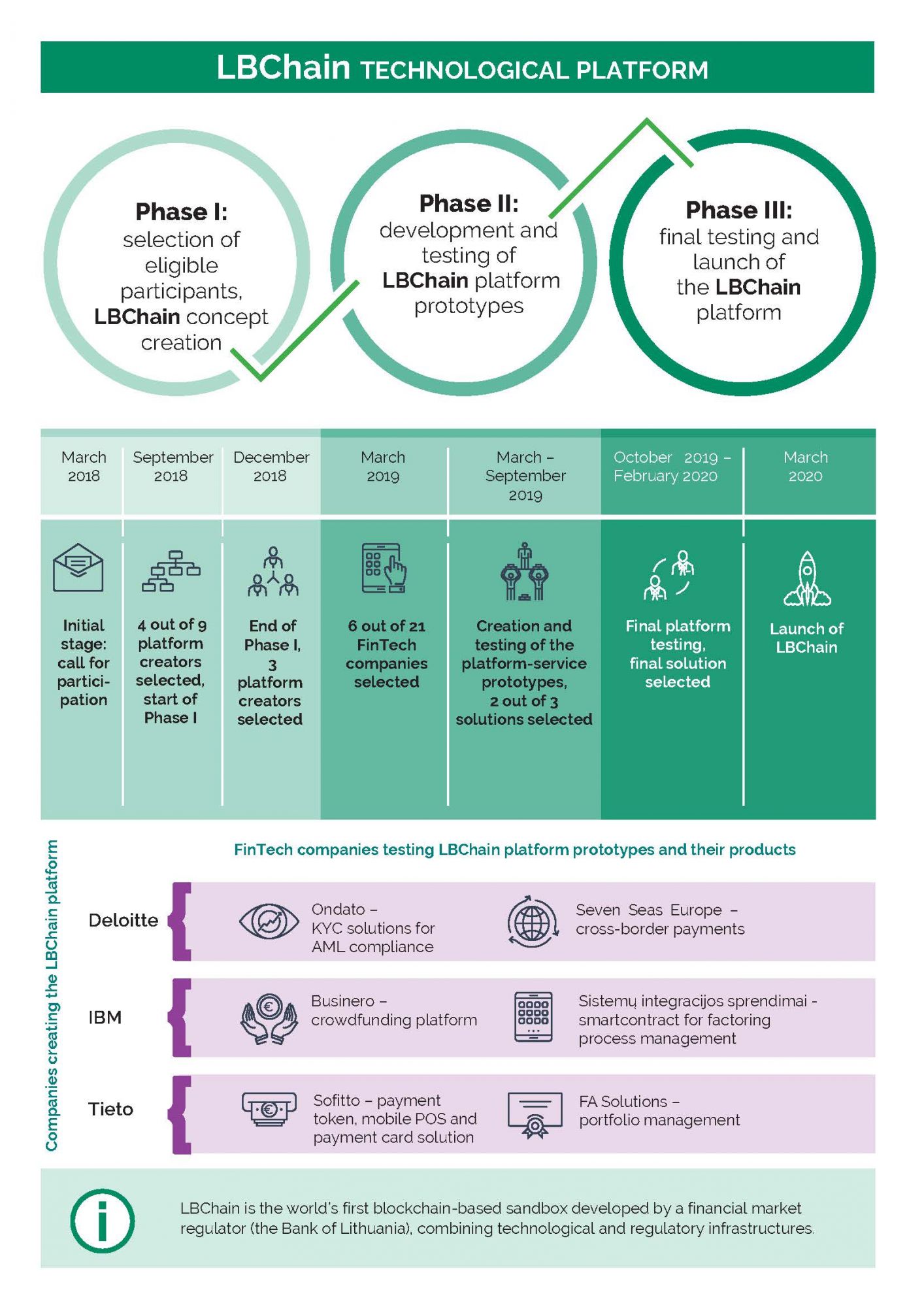

Three service providers selected during the first stage offer their LBChain technological solutions: IBM Polska Sp. z.o.o., UAB Tieto Lietuva and UAB Deloitte verslo konsultacijos in collaboration with Deloitte EMEA Blockchain Lab. They are joined by 6 (out of 21) FinTech companies selected this spring: Astronautika, UAB (operating under the brand name Businero), Ondato, UAB, UAB Seven Seas Europe, UAB Sistemų integracijos sprendimai (Lithuania), Sofitto NV (Belgium) and FA Solutions Oy (Finland). They contribute to creating and testing LBChain platform prototypes and test their developed products as well.

Each service provider works with 2 FinTech companies: Deloitte, together with Ondato, UAB, is testing a KYC solution for anti-money laundering and with Seven Seas Europe – a cross-border payment solution. IBM collaborates with Businero, which is creating a crowdfunding platform, and with UAB Sistemų integracijos sprendimai, which is testing smartcontract for factoring process management. In the technological platform offered by Tieto, Sofitto tests a payment token, mobile POS and payment card solutions, and FA Solutions – an unlisted shares trading platform.

The Bank of Lithuania’s LBChain project is mid-way to completion. LBChain platform prototypes and FinTech companies’ products are expected to be presented in September. This will mark the end of the second stage, after which two out of three solutions for the LBChain platform service will be selected. During the third stage, the Bank of Lithuania will invite companies for further testing of LBChain platform solutions and will choose the most viable one of them.

LBChain is a blockchain-based sandbox combining technological and regulatory infrastructures. The platform will enable Lithuanian and international start-ups as well as financial and FinTech companies to gain new knowledge, carry out blockchain-oriented research, test and adapt blockchain-based services and offer state-of-the-art innovations to their customers. LBChain is the world’s first such platform developed by a financial market regulator (the Bank of Lithuania). The platform is expected to be launched in March 2020.

To create the platform, the Bank of Lithuania invoked service providers selected through an innovative pre-commercial procurement.