Summary: Markets re-discovered volatility following Donald Trump’s tweets yesterday which ended the tariff truce with China. China’s Foreign Ministry said they would still send a trade delegation to Washington. Risk assets (stocks, commodities, the Aussie and USD/JPY) pared losses. Just at the bell, US top trade negotiator, Robert Lighthizer accused Beijing of reneging on commitments it made during negotiations. And that the US plans to raise tariffs on Chinese goods. Volatility returned, stocks, yields and risk assets fell. China’s Offshore Yuan plummeted, USD/CNH closed 6.7910 from 6.7350, it’s weakest since January. The Dollar Index (USD/DXY) ended little-changed at 97.557 (97.48). USD/JPY rallied back from near 3-week lows to 110.72 (111.10 yesterday). The Australian Dollar extended its fall to 0.6989 (0.7023), down 0.4% while the Kiwi fell to 0.6608 (0.6645). The Dollar was higher against the Emerging Market currencies. USD/ZAR soared 1.73% to 14.4425 (14.3300). USD/TRY (Dollar – Turkish Lira) rallied 1.97% to 6.0800 ((5.9800 yesterday). Bond yields are lower. The US 10-year Treasury yield fell 6 basis points to 2.47%. Australia’s 10-year bond yield dropped to 1.73% from 1.79%. Stocks fell back but clawed back from their lows. The DOW closed at 26,290 (26,525 yesterday) while the S&P 500 was at 2,932 (2,945).

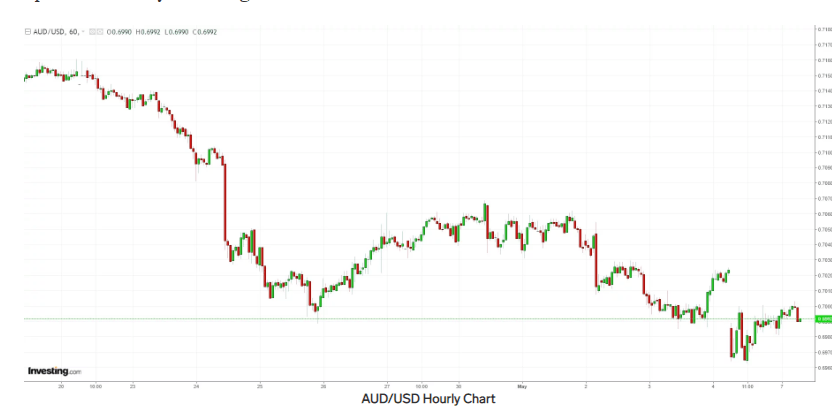

- AUD/USD – The Australian Dollar remained under pressure with the market’s risk-off stance and today’s RBA rate decision. The line ball call saw AUD/USD close at 0.6989, under the 0.780 cent psychological support level. AUD/USD traded to an overnight low at 0.69627.

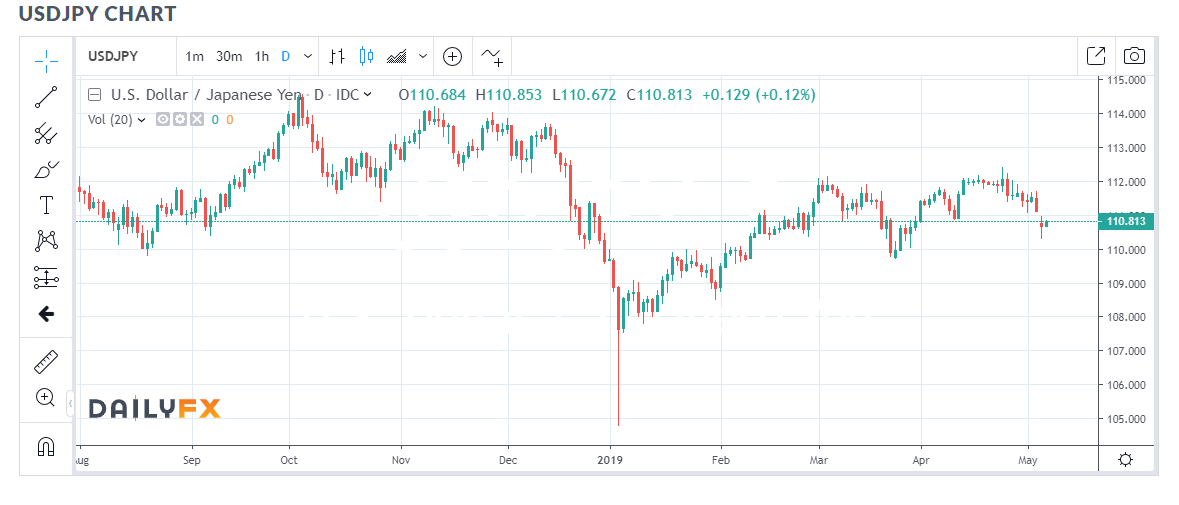

- USD/JPY – Risk aversion continued to favour the Yen. The Dollar slid to 110.282, near 3-week lows before settling at 110.72.

- EUR/USD – the Euro was little-changed, finishing around 1.1200 (1.1202 yesterday). Euro area Services PMI’s were in line with expectations while Retail Sales saw a small improvement. EUR/USD traded to an overnight low of 1.11642. The deterioration in trade negotiations between Beijing and Washington puts pressure on the EU, who have their trade issues with the US.

On the Lookout: Welcome back volatility! Markets were lulled into a false sense of security with majority of participants expecting that a trade settlement between the US and China was a gimme. President Trump and his trade team are not happy with China’s backpedalling on some of its commitments and responded.

Australia’s central bank (RBA) will announce its monetary policy decision in the most anticipated interest rate verdict in recent years. Almost half of the analysts polled by Bloomberg expect the RBA to cut rates by 0.25% to 1.25% (1.5%) for the first time since August 2016. Australia’s economic growth has slowed markedly since the second half of last year while inflationary pressures weakened.

Today sees Australian April Retail Sales and Trade Balance data before the RBA rate decision. German Factory Orders and the EU Economic forecasts are top of the European reports. The US JOLT Job Openings round off the day’s economic data.

Trading Perspective: The Dollar remains supported but within a range overall against most of its major Rivals. The market’s risk-off stance and central bank meetings this week will keep the pressure on the Aussie, Kiwi and EM Asian currencies. Asian central banks from Malaysia, Thailand and Philippines meet on policy this week. Subdued inflation in Malaysia and the Philippines could see rate cuts from both countries central banks. The Bank of Thailand is more likely to stay on hold. Renewed drama on trade between the US and China provides added threat to global economic risks.

In Europe, local issues will have more impact on their currencies. Euro area composite Services PMI’s were mostly in line with forecasts. Progress on Brexit talks between the UK’s main two parties remain elusive.

- AUD/USD – Half of the market are expecting the RBA to cut its Official Cash rate to 1.25% from 1.5% today. Me thinks not. The Australian Dollar made a decent recovery overnight from the lows triggered at 0.6962 following Trump’s tweet yesterday to 0.6990 at the close. The 0.6960 support level is immediate and should hold regardless of what the RBA’s decision is. The Aussies current level reflects the market expectations. Immediate resistance lies at 0.7005 followed by 0.7030. Expect a range initially between 0.6960 and 0.7010.

- USD/JPY – The Dollar will stay on the defensive against the Yen. US 10-year yields fell 6 basis points to 2.47%. Japan’s 10-year JGB yield was unchanged at -0.06%. The combination of risk-aversion and a narrowing differential between US and Japans yields favours a continuation of USD/JPY’s downtrend. USD/JPY has immediate resistance at 111.00 (overnight high 110.99). Immediate support can be found at 110.50 followed by 110.20. Look to sell rallies with a likely range today of 110.30-111.00.

- EUR/USD – The Euro should continue to trade within its overnight range for today. Let’s not forget the speculative Euro short bets are at multi-year highs. EUR/USD has immediate resistance at 112.10 (overnight high 1.1209). Immediate support can be found at 1.1170 followed by 1.1140. Look to buy dips with a likely range today of 1.1170-1.1240.

Happy trading all.