Summary: In early Sydney, risk-off hit markets after US President Trump via a tweet on Twitter said the US is set to lift tariffs on Chinese imports from 10% to 25%. The US leader also said he may add another USD 325 billion of goods into the 25% import duty. Trump’s announcement comes ahead of a new round of trade talks between the US and China this week. The news report On Friday, Trump said that negotiations with China had been going well.

USD/JPY, down 0.37% at 111.10 on Friday, slumped further to 110.56. The Australian Dollar turned negative after closing 0.33% up, at 0.7025 to 0.6985. EUR/USD fell back to 1.1180.

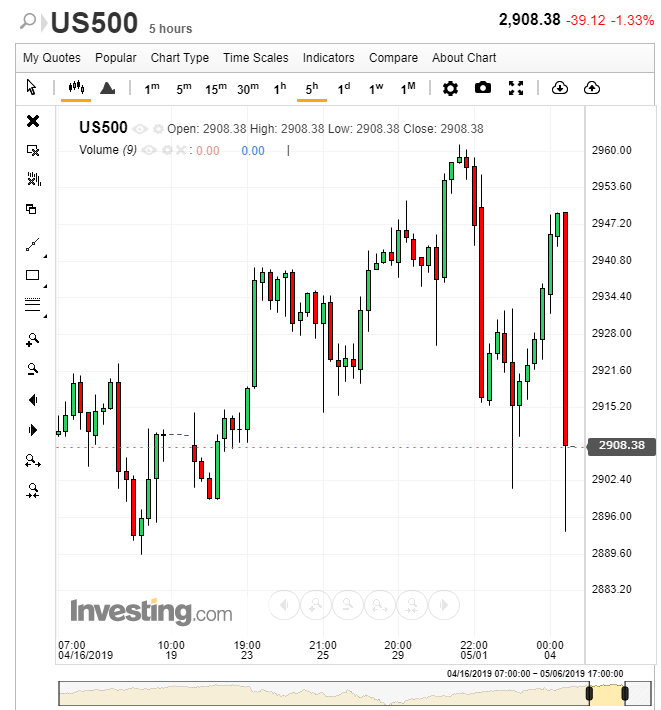

The DOW Futures dropped 400 points. The S&P 500 slumped 1.5%.

On Friday, the Dollar fell despite a stronger-than-forecast employment report. A total of 263,000 jobs (190,000 forecast) were added to the US economy in April while the Jobless Rate fell to a 49-year low 3.6% (3.8% expected). The pace in wage growth slowed to 0.2% (against a forecast of 0.3%). US ISM Services PMI fell to a 20-month low at 55.5 in April. Fed speak from St Louis President James Bullard and Chicago Fed President Charles Evans supported the view that rates could fall should inflation and the economy soften. At the end of the day, it was the already long big Dollar bets that started heading for the exits that turned the currency lower. At the close in New York, the Dollar Index (USD/DXY), which tracks the Greenback against a basket of six rivals, fell 0.36% to 97.478 (97.84). The Euro jumped to close at 1.1203, up 0.25%. Sterling, best performing currency of the day, soared 1.05% to 1.3175 from 1.3035. Ahead of a long weekend in the UK, the leader of the opposition Labour party said there was a huge “impetus” for every lawmaker to deliver a Brexit deal.

- USD/JPY – USD/JPY closed at 111.10 on Friday, slumping further in early trade this morning to a low of 110.52 before settling at 110.75. USD/JPY could see a further reversal to the low 110/s before settling. Expect a volatile start.

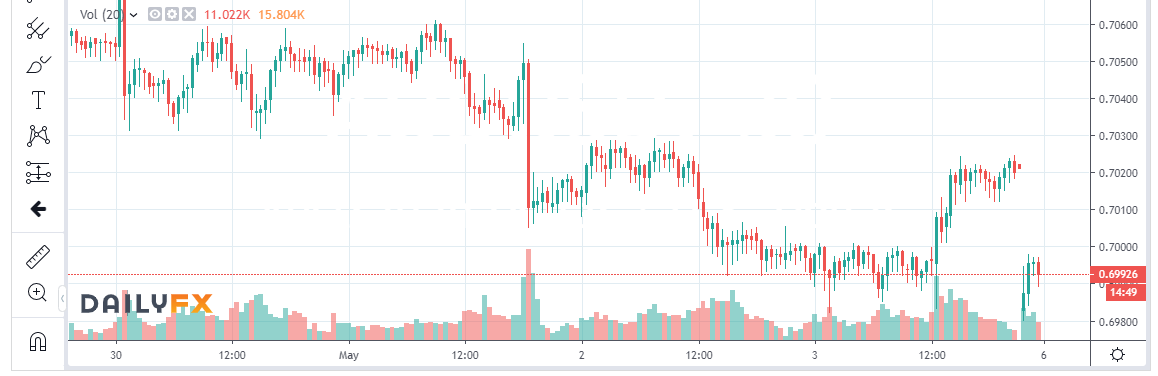

- AUD/USD – The risk sensitive Aussie fell sharply to 0.69635 following the Trump new tariff threat after closing at 0.7025 on Friday. AUD/USD settles at 0.6990 currently.

- EUR/USD – the Single Currency slipped to 1.1165 before settling at 111.85 in early trade. The Single Currency closed at 1.1203 in New York.

- US S&P 500 – closed at 2947 and dropped to 2895 after a positive session on Friday and a sense of security that a trade deal between the world’s two largest economies was imminent. Trump’s latest tweet poured cold water on that, for now.

On the Lookout: Trump’s Twitter announcement marks a major shift from his optimism on Sunday on current trade negotiations between the two countries. Trump’s move reversed what he said in February, not to increase tariffs from 10% to 25% on USD 200 billion of goods as the trade talks were progressing well. Trump’s reasoning was that the tariffs paid did not impact production costs, mostly borne by China. Trump is impatient with the slow progress of the trade negotiations.

Now we wait for China’s reaction to Trump’s tweet. It may not come immediately. But we should see more volatile times in May.

In the mix of all of this, data releases this morning include Australia’s ANZ Job Ads and Chinese Caixin Services PMI. Euro area Services PMI’s, Eurzone PMI, Retail Sales and Sentix Investor Confidence reports follow later.

Trading Perspective: The Dollar’s overall fall on Friday puts the Greenback on the defensive at the start of the week. The RBA, RBNZ, the Malaysian, Thai and Philippine central banks meet on policy this week. Rate reductions in Malaysia and the Philippines are likely. The RBA and RBNZ could act as well. The RBA meets tomorrow while the RBNZ has its policy meet on Wednesday.

The strong US Payrolls gain and drop in the Jobless was offset by softer wages and a weaker than forecast US Services Activity report. Bullard and Evans, true to their dovish bent, suggested rates could fall if the economy and inflation soften. While global rivals are more dovish, with Asian central banks likely cutting rates this week, market positioning remains long US Dollar bets.

- USD/JPY – The Dollar Yen slumped to March 29 lows on the risk-off mode this morning. Expect USD/JPY to remain under pressure with immediate support at 110.50 (110.52 low earlier today). The next support level at 110.10 is strong. Immediate resistance can be found at 111.00 followed by 111.40. Japan is back from their Golden Week break today and there may be commercial interests on both sides of USD/JPY. Expect a choppy session today with a likely range of 110.40-111.20. Prefer to sell rallies.

- AUD/USD – The Aussie Battler slumped to a low of 0.69635 in thin early trade after the Trump tweet hit the markets. AUD/USD has immediate support at 0.6980 followed by 0.6960. Ahead of tomorrow’s RBA meeting, and an overall weaker US Dollar, expect 0.6960 to hold. Immediate resistance lies at 0.7000 and 0.7040. Look to buy dips with a likely range of 0.6980-0.7030 today.

- EUR/USD – The Single Currency soared above 1.1200 from Friday’s overnight low of 1.1135 after the US Jobs report. EUR/USD closed at 1.1203, slipped to an early low of 1.1164 before settling at its current 1.1193. Euro zone Headline and Core CPI beat forecasts with core inflation climbing 1.2% on an annual basis (against a forecast of 1.0%). EUR/USD has immediate support at 1.1170 and 1.1140. Immediate resistance can be found at 1.1200 and 1.1230. Look for a likely range of 1.1180-1.1230 today with the preference to buy dips.

Tin helmets on, we could be in for a roller coaster ride. Happy trading all.