Summary: Federal Reserve Chair Jerome Powell chose to remain patient on policy, with no bias to hike or cut rates. Powell said that “job growth was stronger than expected while inflation has been somewhat weaker”, which was what the markets anticipated. The Fed kept interest rates unchanged following its two-day meeting. At the end of trading, the Dollar Index (USD/DXY), a measure of the Greenback’s strength against six of its rivals, edged 0.11% higher at 97.62. The Kiwi ended up worst performing currency at 0.6625 (0.6675) after a worse-than-expected employment report, dragging the Australian Dollar lower to 0.7018 (0.7050). The Euro slipped 0.12% to 1.1202 (1.1216) while Sterling kept its firm tone to close at 1.3055 (1.3037), up 0.13%. The Dollar was little-changed against the Yen at 111.35 (111.40). Currency volatility remained near 5-year lows despite Tokyo’s absence for their Golden Week holidays.

Wall Street stocks slumped. The Dow closed at 26,380 (26,658). The S&P 500 fell to 2,916 (2,953).

The yield on the benchmark US 10-year bond closed flat at 2.5%. Two-year yields rose to 2.3%.

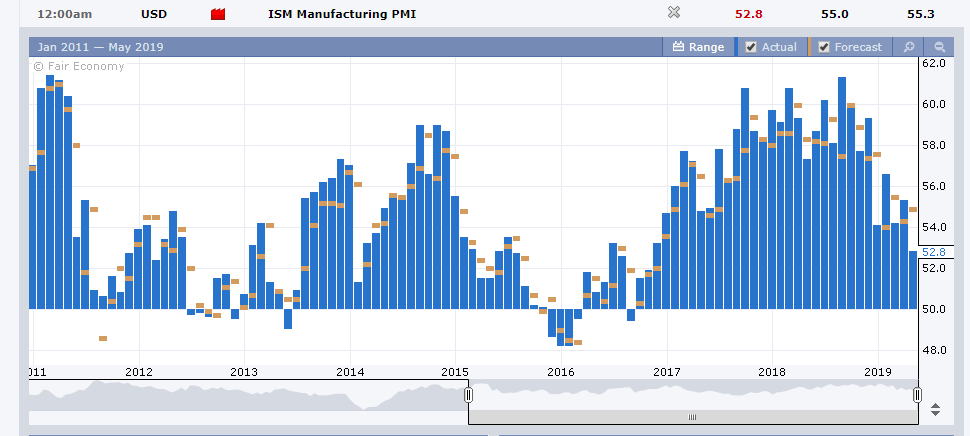

Economic releases were mixed. US ADP Employment (private sector) surged to 275,000 jobs added in April from a revised gain of 151,000. Manufacturing activity slumped to a 2.1/2 year low with April’s ISM Index down to 52.8 from 55.3 in March.

- EUR/USD – the Euro ended with modest losses at 1.1202 from 1.1216 yesterday. Earlier in the day, the Single currency rallied to a high of 1.12647 on short-covering. Euro area Manufacturing PMI’s are released later today.

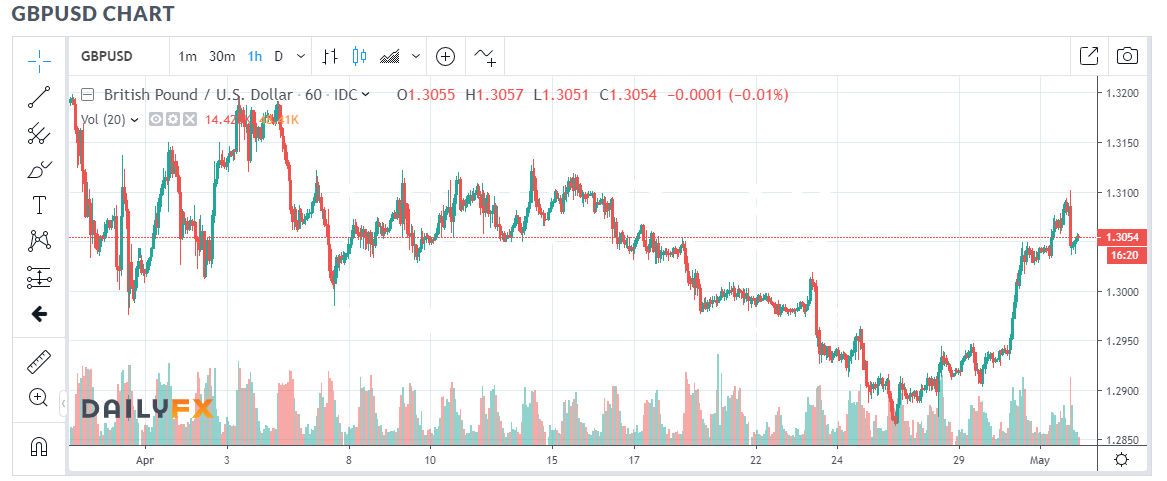

- GBP/USD – The Pound stayed steady ahead of tonight’s Bank of England interest rate policy meeting. Overnight Sterling climbed to a high of 1.31025 as PM May comments on signs of progress in Brexit talks between her government and opposition Labour party. GBP/USD dropped back to finish at 1.3055.

- AUD/USD – The Australian Dollar slumped to an overnight low of 0.7007 before settling at 0.7018 at the New York close. March HIA New Home Sales figures are due later this morning.

- USD/JPY – the Dollar ended little-changed against the Japanese Yen at 111.36 (111.43 yesterday). With stocks lower and no-change in the US 10-year bond yield, USD/JPY struggled to gain ground despite Powell’s playing down a Fed interest rate cut.

On the Lookout: While Fed Chair Jerome Powell played down an interest rate cut, markets are not convinced. The benchmark US 10-year bond yield stayed stuck at 2.5%, near one-week lows. Implied interest rate futures traders see a 55% chance of a rate cut this year, down from 66% yesterday. Which is still above 50%.

Following the stronger-than-expected rise in private job employment, tomorrow’s Payrolls report will be closely monitored. Manufacturing in the US continues to suffer. On Tuesday, Chicago’s PMI slumped to 52.6 in April from March’s 58.7. Last night the Institute of Supply Management reported its barometer for the US factory sector plummeted to 52.8 in April from the previous months 55.3.

Today data releases begin with Australia’s HIA New Home Sales for April. German Retail Sales (April) start off the data from Europe. Manufacturing PMI reports from the Euro area, including Switzerland follow. UK Construction PMI report then precedes the Bank of England’s policy meeting. The BOE is not expected to change interest rates but could provide more clarity on Brexit.

Trading Perspective: While the Dollar did stabilise following Powell’s speech, it failed to gain fresh ground. The two-year bond yield climbed 3 basis points to 2.30% but the benchmark 10-year yield was flat at 2.5%. Without fresh yield support the Dollar will struggle to move higher.

The rally in the Dollar’s Rivals earlier this week was mainly due to position adjustments, with traders paring their USD long bets against respective rivals. Speculative market positioning is still long US Dollars.

- EUR/USD – The Euro stabilised to close just above the 1.1200 area. Markets will keep a close eye on the Euro area PMI reports later today to see whether April’s concerns of a slowdown in the European economy are overdone. Tuesday’s Euro zone reports allayed some of those concerns. EUR/USD has immediate resistance at 1.1230 followed by 1.1270. Immediate support can be found at 1.1190 followed by 1.1160. Look for a likely range of 1.1190-1.1240 today with the preference to buy Euro dips.

- GBP/USD – Sterling ripped higher to 1.31025 on optimism from PM May’s positive comments on Brexit talks between the British government and leading opposition Labour party. Markets will be closely watching BOE Governor Mark Carney’s press conference following their interest rate policy meeting. While the BOE is not expected to change interest rates, they may provide clarity on Brexit. GBP/USD has immediate resistance at 1.3070 and 1.3110. Immediate support can be found at 1.3030 and 1.3000. Look for a likely trading range today of 1.3010-1.3110. Keep trading the range on this puppy.

- AUD/USD – The Aussie held 7-week lows just above 0.70 cents. The market keeps trying to sell it lower but hits a rock near 0.70 cents. AUD/USD traded to an overnight low at 0.7007 before grinding back in true Battler fashion to 0.7015. AUD/USD has immediate support at 0.7000 followed by 0.6970. Immediate resistance can be found at 0.7040 and 0.7060 (overnight high 0.70611). Look for a likely trading range today of 0.7005-0.7065. Prefer to buy dips.

Happy trading all.