With most Asian markets closed on Wednesday, New Zealand equities fell, and Australian equities rebounded from a two-session slump, kicking off May in positive territory. The benchmark ASX200 Index was boosted by a rally in the financial sector, while the energy and mining stocks reclaimed some recent losses. Also, the index finished the session up 50 points or 0.8% to 6,375. Almost all sectors improved, with the Utilities and Consumer Discretionary sectors being the exceptions.

In commodities markets, crude oil rebounds above 63.25 after the two-day correction from the five-month high as markets digest the US additional sanctions on Iran. Oil industry analysts expect that the sanctions could potentially remove up to 1.2 million barrels of oil per day from international markets. Brent oil gives up 15 cents at $71,56 per barrel. Gold stabilizes around 1281 after hitting a 3-day low at $1277. XAUUSD’s technical picture is negative, and now the support stands at the 200-day moving average down to $1251, which if broken can accelerate the downward move to 1200 as sellers will take full control. Strong resistance stands at 1291 and the 100-day moving average, and then at the $1300 round figure.

In cryptocurrencies market, Bitcoin (BTCUSD) whose market capitalization accounts for more than half of all other cryptocurrencies combined, trades higher at the 5,280 mark, enhancing the bullish outlook. The daily low for BTC was at 5,224 and daily high at 5,329. BTCUSD immediate support stands at the 200-day moving average at 5,093 while the next strong support stands at the $5,000 level and then at the recent low at 4,937. On the upside, strong resistance stands at 5600 the recent high. Ethereum (ETHUSD) is adding 4 dollars at 157, holding above the 50-day moving average at 138 and facing the immediate resistance at 185 the 200-day moving average, while Litecoin (LTCUSD) trades higher at 71.52. The cryptocurrencies market cap holds above $170.0B.

On the Lookout: European data has come in slightly better than expected. In Germany, GfK consumer confidence stayed unchanged from the month prior at 10.4 (vs forecasts of 10.3). Unemployment remained unchanged at 4.9% (vs 4.9% expected). In Italy, unemployment fell to 10.2% from 10.5% the month prior (vs 10.7% expected). The Australia RBA Commodity Index SDR (YoY) came above expectations (7.3%) in April: Actual (14.4%).

Investors awaiting today the outcome of an important meeting of FOMC, The consensus amongst most analysts suggest that the Fed will likely keep its current policy rate unchanged, and in addition, they are expecting that the Fed will likely maintain its patient approach stance.

The Bank of England intends to meet on Thursday, May 2nd as traders looking for clues to enter new positions on GBPUSD.

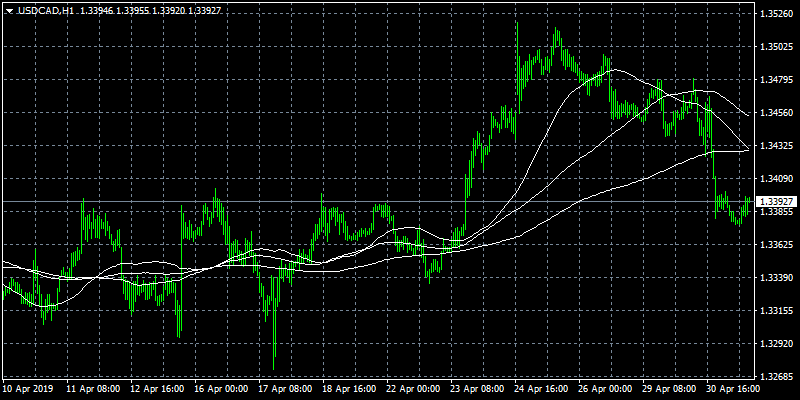

The focus on the US macro front will be the US ADP jobs due at 12:15GMT, followed by the ISM and Markit manufacturing PMI reports slated for release around 14:00GMT. Ahead of that, the Canadian Markit manufacturing PMI will be reported at 13:30GMT. The USDCAD and crude oil traders will await the release of the EIA weekly crude oil stocks data at 14:30GMT.

Trading Perspective: In FX markets, the US dollar gives up 30 cents to 97,10 as traders reposition ahead of the FOMC meeting. A stronger US dollar will likely increase the US trade deficit, adding the risk that Trump’s administration continues to target those nations with a significant trade surplus with the US (China – Germany – Europe). The Aussie dollar trades higher at 0.7056 in thin volumes, and low volatility as cash rate futures now see a 71.0% probability of a rate cut in next RBA meeting coming in two weeks. Kiwi adds 10 pips from yesterday’s sell-off and trades at 0.6667 as traders renewed RBNZ rate cut bets following New Zealand’s jobs data disappointment and weaker oil prices.

GBPUSD managed to break higher at a 6-day high after a two-week consolidation around 1.29 and breached the 200 and 100-day moving average on renewed hopes of positive Brexit developments and better UK macro data. On the downside, major support will be found at 1.2967 where the 200 and 100-day moving averages cross and then at 1.2830 the support line from February. On the upside, immediate resistance stands at 1.3104, the 50-day moving average.

In GBP futures markets, open interest shrunk by almost 3.5K contracts on Tuesday after eight consecutive daily builds. Volume increased by nearly 75K contracts, extending the choppy performance.

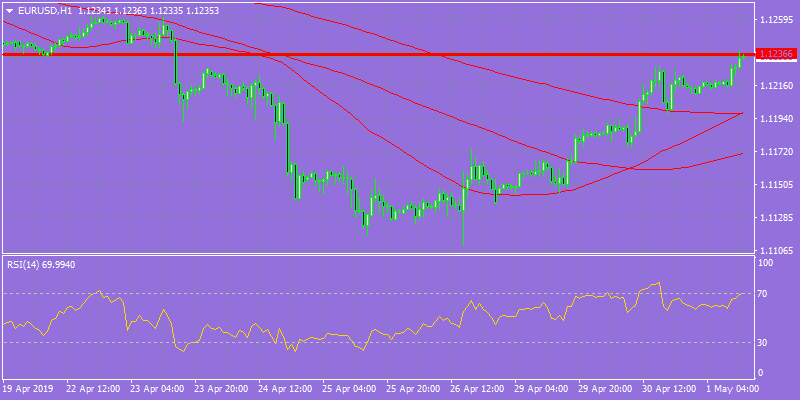

EURUSD continues higher for third straight day and trades at the daily high at 1.1235 turning the short term momentum to bullish as the pair crossed the key hourly averages. The pair made the Asian high at 1.1227 and the low at 1.1210. Immediate support can be found at 1.1191 the low from yesterday while more solid support can be found at the yearly low at 1.1115. On the upside, the immediate resistance stands at 1.1236, the bottom of the horizontal resistance line from the three-month trading range, while more offers will emerge at 1.1275 at the 50-day moving average

In Euro futures markets, traders added nearly 3K contracts to their open interest positions on Tuesday, advancing uninterruptedly since April 16. In the same line, volume reversed the previous drop and increased by around 96.5K contracts.

USDJPY trades 0.12 percent lower at 111.30, testing the 50-day moving average, a level which if breached can drive prices down to 110.73 the 100-day moving average. Today the pair hit the low at 111.28 and the high at 111.54. Immediate resistance for the pair stands 111.68 the 50-hour moving average and then at 112.18, the April 2019 high.

In JPY futures markets the open interest shrunk by around 3.8K contracts on Tuesday while volume went up by around 42.8K contracts.

USDCAD crushed to 1.3392 as the rebound in crude oil seems to have added further strength in the Canadian Dollar (CAD). The pair will find immediate support at the 100-day moving average around 1.3335 while extra support stands at 1.3300 round figure. On the upside, immediate resistance stands at 1.3428 the 200-hour moving average a break of which can escalate the rebound towards 1.3457 and the 100-hour moving average.