Summary: The Dollar backed off the psychological 110 Yen level following a report that the US would maintain tariffs on Chinese goods until after November’s presidential election. USD/JPY traded to an overnight and 8-month high at 110.21 before easing to close at 109.95. The Swiss Franc outperformed the majors, up 0.4% against the Greenback (USD/CHF 0.9672 from 0.9705). The US added Switzerland to its watchlist of currency manipulators. China’s Yuan eased, USD/CNH to 6.89 from 6.88. Sterling rebounded off its lows to close at 1.3032 (1.3000) supported by comments from Boris Johnson. The UK PM said that he considers “very likely” that Britain will get a comprehensive trade deal with the EU by the year end. The Euro was little changed in cautious trade, closing in NY at 1.1132 (1.1137). The Australian Dollar held its level around 0.69 cents, at 0.6903. The Battler was sandwiched in between a strong Chinese trade balance and possible disappointment on a Sino/US trade deal. Wall Street stocks turned negative after touching intra-day record highs while treasuries rose, and bond yields declined. The US 10-year treasury yield fell two basis points to 1.82%. The 2-year yield was at 1.57% from 1.58%.

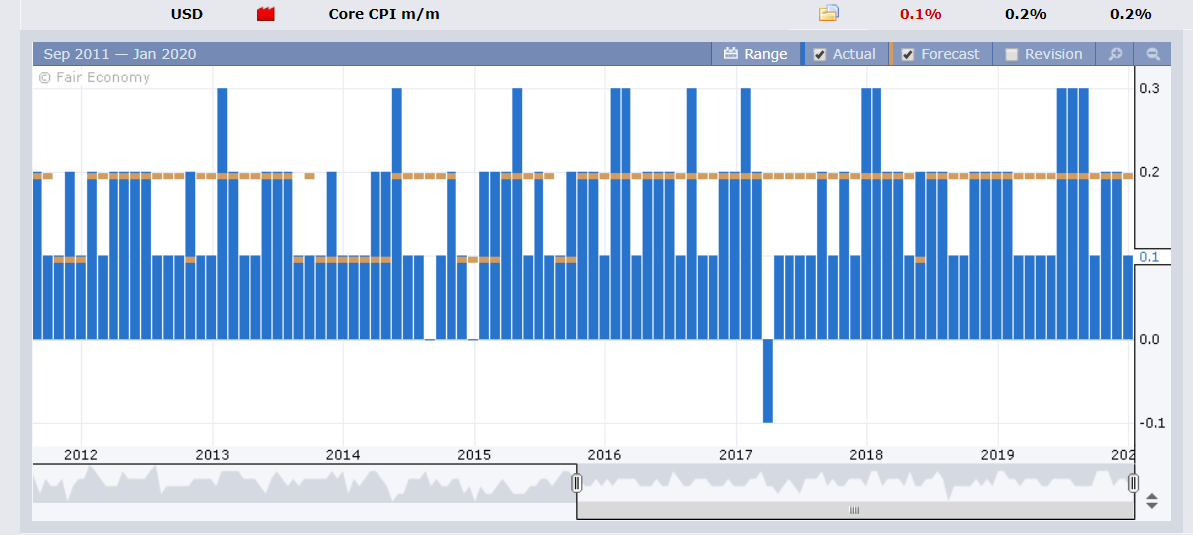

China’s December Trade Surplus rose to CNY 329 billion beating forecasts at CNY 315 billion and a previous CNY 224 billion. Exports climbed by 7.6% in December following November’s decline of 1.3%. Economists had forecast exports to rise by 3.2%. US Headline CPI matched forecasts, rising 0.2% in December. However, Core Inflation rose by 0.1% against expectations of a 0.2% rise.

- EUR/USD – The shared currency was stable at 1.1131 after slipping to an overnight low of 1.11043 as FX returned their focus on the US-China Phase One deal. There were no major economic reports out of Europe yesterday.

- USD/JPY – After rising to an overnight and fresh 8-month high at 110.212, the Dollar slipped back under 110 to close at 109.95 following the news report that US tariffs on Chinese goods would be maintained until after the US presidential election. Japan’s 10-year JGB yield rose one basis point to 0.00%.

- GBP/USD – The British currency slumped to 1.29543 overnight lows following Monday’s soft UK GDP and Manufacturing Production report. Comments from BOE’s Vlieghe, an MPC voting member) that he would vote for a cut if economic data does not improve pressurised the Pound. Boris Johnson’s statement supporting a comprehensive trade deal with the EU lifted Sterling off the base back above 1.3000.

On the Lookout: Asia will kick off on a cautious note and with global trade returning to the spotlight. The signing ceremony of Phase One of the trade deal is scheduled today (in Washington DC). No other details have been released ahead of the event. FX will keep their eyes on the news wires.

Meantime data released today begins with New Zealand’s Food Price Index followed by Japan’s Preliminary Machine Tool Orders (December). Bank of Japan Governor Haruhiko Kuroda addresses a BOJ bank manager’s meeting in Tokyo today in the opening remarks. The UK follows next with a plethora of reports; Headline and Core CPI, RPI (Retail Price Index), PPI Input and Conference Board Leading Index. Europe sees Eurozone Industrial Production and Trade Balance. The US rounds up the day’s reports with its Headline and Core PPI and Empire State Manufacturing PMI Index.

Trading Perspective: While the focus has been on global trade with the signing of the US-China phase one deal a formality, US economic data has underperformed in the background. Friday’s softer than expected employment and wages report preceded a retreat in underlying inflation pressures. The latest Commitment of Traders report saw a Dollar selling accelerate into the year-end as market positions went to cover long bets. At the end of the day, apart from Sterling and the Canadian Dollar, market positioning is still long USD bets, short currency in the Euro, Yen, Australian Dollar, Swiss Franc and New Zealand Dollar. Watch the Dollar’s performance against the Yen and Swiss Franc as this couple may be the leading indicators of the next move for the Greenback.

- EUR/USD – The Euro traded a cautious and muted range between 1.1104 and 1.11445 before closing to settle at 1.1131. EUR/USD has immediate support at 1.1105 followed by 1.1085. Immediate resistance can be found at 1.1150 and 1.1180. Today sees the return of a couple of European reports (see On the Lookout). Look for a likely trading range today of 1.1110-1.1150. Prefer to buy dips.

- USD/JPY – the Dollar slipped back under the psychological 110 level to 109.95 after trading to a fresh 8-month high at 110.212. “Live by the trade, die by the trade”, in this case global trade. Japanese 10-year JGB yields were up one basis point to 0.00% while the US 10-year rate dipped to 1.82% from 1.84%. BOJ Governor Kuroda speaks today in Tokyo at a BOJ branch manager’s meeting. Immediate resistance lies at 110.20 followed by 110.50. Immediate support can be found at 109.85 followed by 109.55. Look to sell USD/JPY rallies in a likely range today of 109.60-110.10.

- GBP/USD – Sterling bounced back above 1.3000 from an overnight low at 1.29543 after Boris Johnson’s statement on the likelihood of a comprehensive trade deal between Britain and the EU. The latest UK economic reports have underwhelmed and comments by the BOE’s Vlieghe, an external member of the rate-setting committee have added to dovish remarks from MPC members. Another risk factor for Sterling is that net speculative GBP longs increased in the week to January 7 to +GBP 16,510 bets from +GBP 12,393 the prior week. GBP/USD has immediate resistance at 1.3035 followed by 1.3065. Immediate support can be found at 1.2990 followed by 1.2950. Look for a likely range today of 1.2965-1.3035. Prefer to sell rallies.

Happy trading all.