Summary: The Dollar gained versus its Rivals following pre-Christmas losses lifted by surging US stocks in thin, illiquid trading conditions. Many financial centres were still closed yesterday. The S&P 500 staged a furious rally, up 5.3% at this time of writing. Better-than-expected US holiday shopping sales data led by Amazon.com ignited the rally. A combination of factors from Donald Trump “talking up” equities, to his economic advisor Kevin Hassett assuring that Mnuchin and Powell’s jobs are secure, to a large buy-order, further lifted Wall Street. Bond prices slumped while yields climbed. The benchmark US 10-year treasury yield rose 6 basis points to 2.80%. The Dollar Index (USD/DXY), which measures the US currency against six Rivals rallied 0.46% to 97.022. Haven-Yen under performed, down 0.85% against the Greenback.

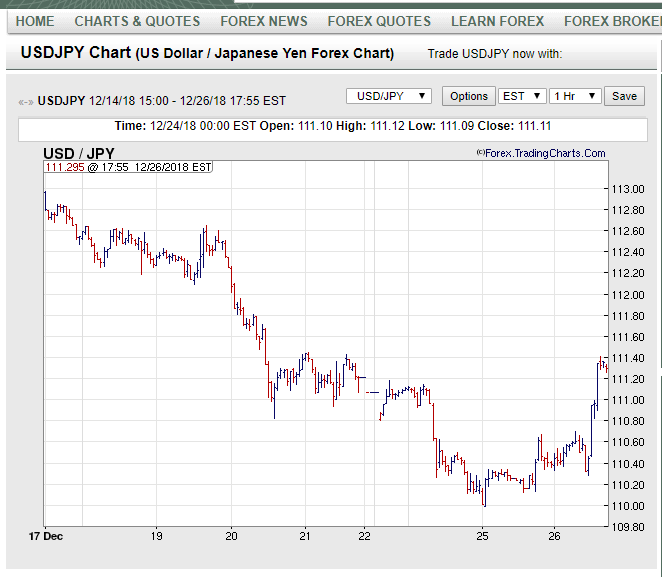

- USD/JPY – The Dollar rebounded against the safe-haven Yen lifted by surging Wall Street stocks. USD/JPY jumped to 111.41 high early this morning, easing 111.33. On Friday, the Dollar slumped to a low of 110.93 before climbing to settle at 111.20 Christmas Eve. A slew of Japanese economic data is due tomorrow in a holiday-shortened week.

- EUR/USD – the Single currency rallied to a high at 1.1420 on a generally weaker Greenback before slipping to close at 1.1355. Right smack in the middle of its recent range. The Euro dropped to 1.1342 lows early this morning.

- AUD/USD – The Aussie managed to keep its modest gains despite the stronger Greenback. AUD/USD currently trades at 0.7060 following a drop to 0.70324 yesterday. With Australian markets closed yesterday, volumes were light. The bounce in Oil prices and CRB (New-York Commodity Research Bureau) lifted the Aussie off its lows.

- US S&P 500 – The Index jumped to an overnight high of 2477 from its close on the weekend at 2412. Online giant Amazon.com saw its shares surge 7% sparked by record holiday sales on discounts.

On the Lookout: The strong rise in stocks and higher bond yields enabled the Dollar to climb off its lows against its Rivals. The furious rebound in Wall Street equities occurred in volatile conditions. Stocks have fallen almost 20% from their record. A bounce of 5% which could have been the result of one large buy order, was inevitable. Volumes were light and are expected to continue for this holiday-shortened week. While a risk-on mood currently exists, things could easily change. The prospect of a US government shutdown, a big issue before Christmas has been shrugged aside. US President Trump criticized the Federal Reserve for raising rates once again in his Christmas message.

Economic data releases are light. Japan reports on its Annual Housing Starts this afternoon followed by the ECB’s Economic Bulletin. The US Conference Board’s Consumer Confidence Index, New Home Sales, and Weekly Jobless Claims are also out tonight.

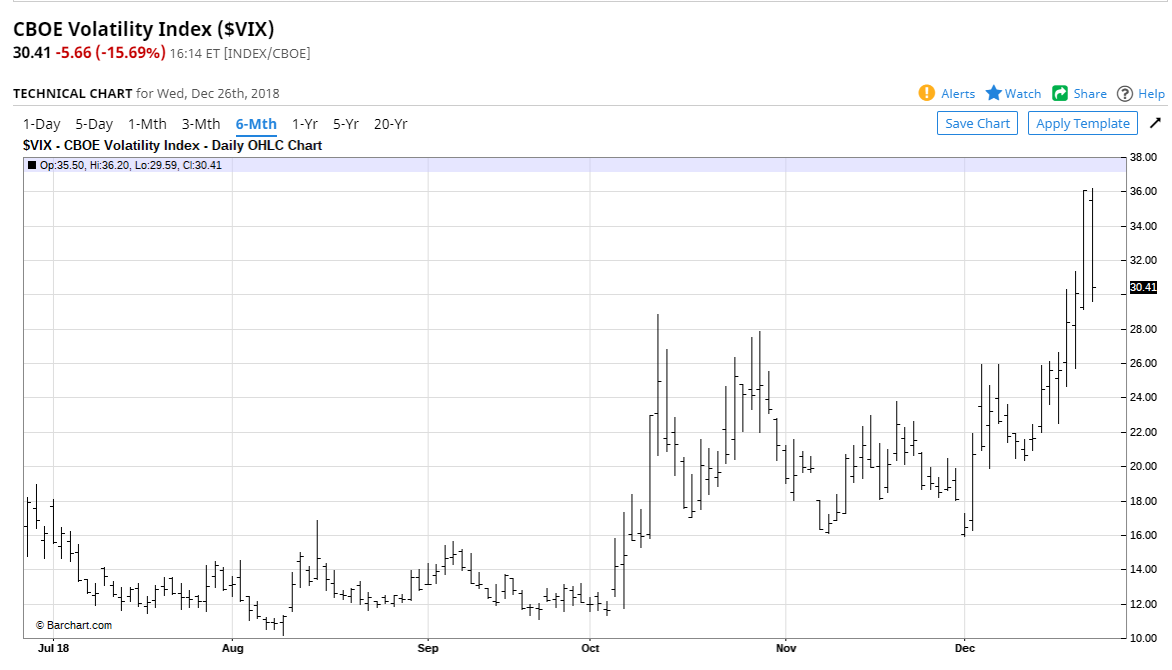

The VIX (Volatility Index) remained elevated despite a 15 % fall overnight, closing above the 30-mark at 30.41.

Trading Perspective: The jump in US yields should keep the Dollar supported as we head into the last full trading week of 2018. Two-year bond yields were up 7 basis points to 2.61%. Trading volumes will stay light until at the middle of next week. Any large orders will see exaggerated prices. The speculative market remains long of US Dollars. Keep this in mind given the current trading conditions.

- USD/JPY – The rally in the safe-haven Yen which began in mid-December has not yet run its course. USD/JPY soared almost 1% to it’s current 111.30 lifted by the 6-basis point rebound in the US 10-year bond yield to 2.80%. In contrast, Japan’s 10-year JGB yield rose one basis point to 0.01%. The improvement in risk appetite buoyed the Dollar. USD/JPY has immediate resistance at 111.40 followed by 111.70. Immediate support can be found at 111.20 and then 110.80.

- EUR/USD – The Single Currency topped out at 1.1420 yet again. The overall weaker US Dollar weighed by softer US yields weighed on the Euro. EUR/USD finished near its lows at 113.55. Immediate support can be found at 1.1320 followed by 1.1280. Immediate resistance lies at 1.1380 and then 1.1400. With little data of importance out of Europe, the US Dollar will dictate the Euro’s next move.

- AUD/USD – the Aussie slumped on Christmas Day following heightened risk-off sentiment. The subsequent rally in the Dollar Index, where the Aussie has no official weight, did not deter the Oz from rallying off its lows and keeping modest gains. AUD/USD finished at 0.7065 after slumping to a low of 0.70324, within striking distance of 0.70 cents, psychological support. Improved risk sentiment should keep the Aussie and other risk currencies stable at current levels. AUD/USD has immediate resistance at 0.7080 and then 0.7120. Immediate support can be found at 0.7030 and then 0.7000. While markets remain choppy, prefer to buy dips. The Aussie will drift higher in the new year.

- US 10-year bond yield – dropped to a low of 2.74% into Christmas. The benchmark 10-year yield hit a lot of 2.725 yesterday before rebounding strongly to 2.80% currently. Any rallies should be limited to 2.85/2.86% while support is found at 2.75%.

- US S&P 500 – The S&P 500 bounced to 2477 highs in early Asia before easing to 2467. The overnight low traded was 2324. A rally to 2490 cannot be discounted. Immediate support comes in at 2430 and then 2380. Expect more volatility as we approach year-end with further downside tests in 2019.