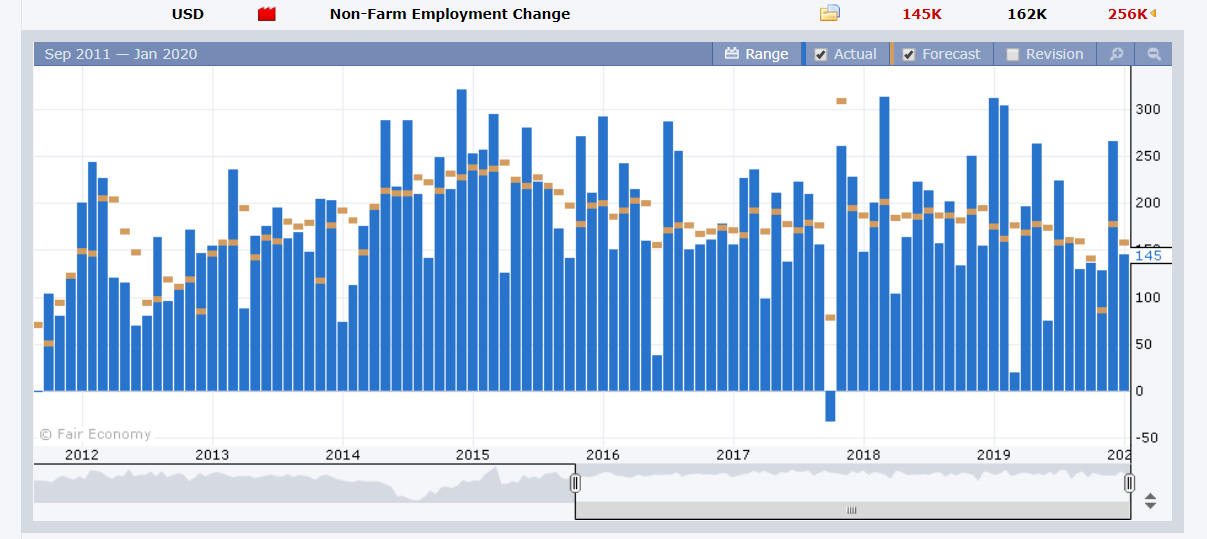

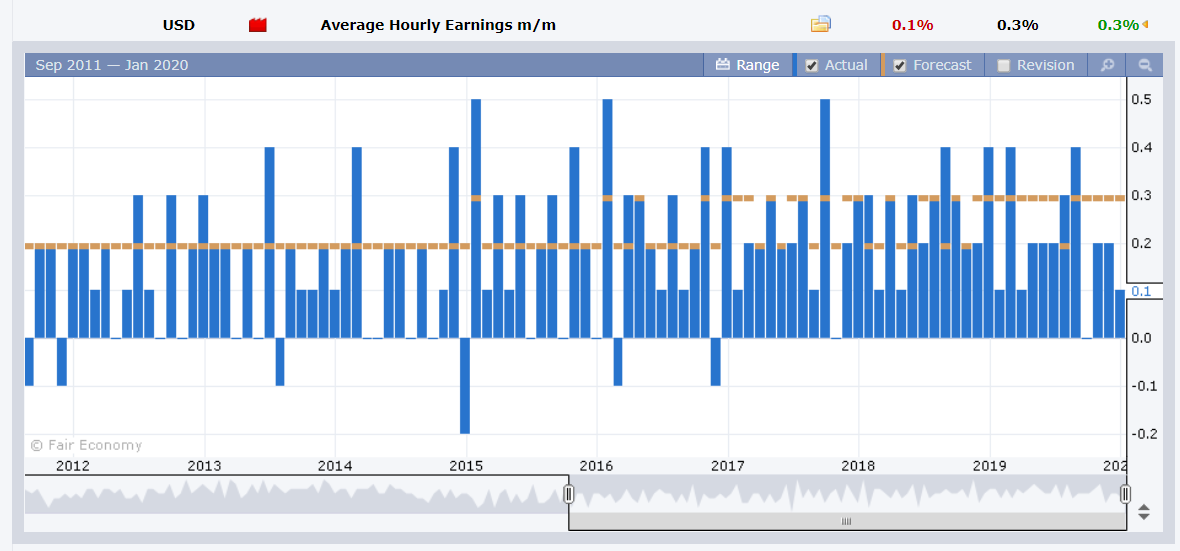

Summary: The Dollar retreated against most Peers as data showed a slower-than-expected US Employment gain in December. Jobs increased by 145,000, missing median forecasts for a rise of 162,000 while November’s increase was revised down to 256,000 from 266,000. The Unemployment Rate held at 3.5%, near a 50-year low while Wage growth slowed to 0.1%, missing forecasts of 0.3% and a previous 0.2%.

China and the US were on schedule to sign phase-one of their trade deal (January 15) while war between Iran and the US was averted, for the weekend. The Dollar Index (USD/DXY) eased to 97.35 from 97.43. The Euro was up to 1.1123 (1.1107) after falling to near 2-week lows at 1.1085. Sterling ended flat at 1.3065. Bank of England policymaker Gertjan Vleighe said he would vote for a rate cut later this month unless he sees a significant improvement in UK data. The Australian Dollar outperformed after a strong Retail Sales report, rallying to 0.6897 from 0.6854, up 0.57%, Against the safe-haven Yen, the Greenback dipped to 109.50 from 109.58. Wall Street stocks slid. The DOW finished 0.48% lower to 28,812 while the S&P 500 lost 0.29% to 3,265. The benchmark US 10-year treasury yield fell 3 basis points to 1.82%. Two Year US bond rates were unchanged at 1.57%.

Other data released Friday showed Australia’s December Retail Sales climb to 0.9% from 0.00%, beating forecasts of a 0.4% gain. Japanese Household Spending fell 2%, matching expectations. Canada created 35,200 Jobs in December, beating a forecast employment gain of 24,900. The Jobless Rate decreased to 5.6% from 5.9% and an expected 5.8%.

- EUR/USD – The shared currency bounced off a fresh weekly at 1.1085 to finish at 1.1122 in New York on the generally softer US Dollar. Germany’s 10-year Bund yield was two basis points lower to -0.20%.

- GBP/USD – Sterling ended with a mild gain to 1.3065 from 1.3060. The British Pound slipped to an overnight low at 1.3029 before settling to edge higher.

- AUD/USD – The Aussie, under pressure after a break of the 0.6900 level, bounced straight back from an overnight and one-week low at 0.6850 on the strong domestic Retail Sales report to close at 0.6900.

On the Lookout: The softer-than-expected US Payrolls rise to 145,000 from expectations of a 162,000 gain didn’t push the Dollar much lower. Most regarded the employment trend growth remaining fairly strong. However, the weakness in Hourly Earnings (Wages) may return to haunt the Dollar. US Ten-year bond yields fell back to 1.82% while treasury rates of global peers were mixed.

Today’s report schedule is light. Japanese markets are closed for a bank holiday. Australia releases its M1 Inflation Gauge report. The Euro area follow with German Wholesale Price Index, Italian Retail Sales. The UK reports on its December GDP, Manufacturing Production, Construction Output and Goods Trade Balance. The Bank of Canada’s Business Outlook Survey rounds up the day’s reports.

Trading Perspective: Positive trade sentiment on the imminent signing of phase-one of the China US trade deal is countered by recent news of Iran’s attack on a US base in Iraq, hosting US troops. The weakness in US Wage growth will keep the Dollar under pressure in Asia today.

- EUR/USD – The shared currency managed to climb back above 1.1100 after falling to 1.1085, near two-week lows. EUR/USD closed at 1.1122 and may have found a short-term base at 1.1085. Immediate support lies at 1.1100 followed by 1.1085. Immediate resistance can be found at 1.1130 (overnight high 1.11292). The next resistance level is found at 1.1150. Look to trade a likely range of 1.1105-1.1145. Prefer to buy dips.

- USD/JPY – The Dollar was modestly lower against the Yen, finishing at 109.50 from 109.58. Japan’s 10-year JGB yield was unchanged at -0.01% while that of its US counterpart fell 3 basis points. Immediate resistance for USD/JPY lies at 109.60 followed by 109.90. Immediate support can be found at 109.40 (overnight low 109.432) and 109.10. With Tokyo on holiday, look for USD/JPY to consolidate with a likely range today of 109.10-60. Prefer to sell rallies.

- AUD/USD – The Aussie bounced back in true Battler fashion after slipping to 0.68508 overnight and one-week low. AUD/USD closed at 0.6900, up 0.57%. The upbeat Australian December Retail Sales report contrasted with the weaker-than-expected US Payrolls report. Australian Ten-Year Bond yields were up 2 basis points to 1.25%, narrowing the gap with its US counterpart at 1.82%. AUD/USD has immediate resistance at 0.6910 (overnight high 0.69110) followed by 0.6925 and 0.6940. Immediate support can be found at 0.6880 and 0.6850. Look for consolidation within a likely range of 0.6885-0.6935 today. Prefer to buy dips.

Have a good week ahead all, happy trading.