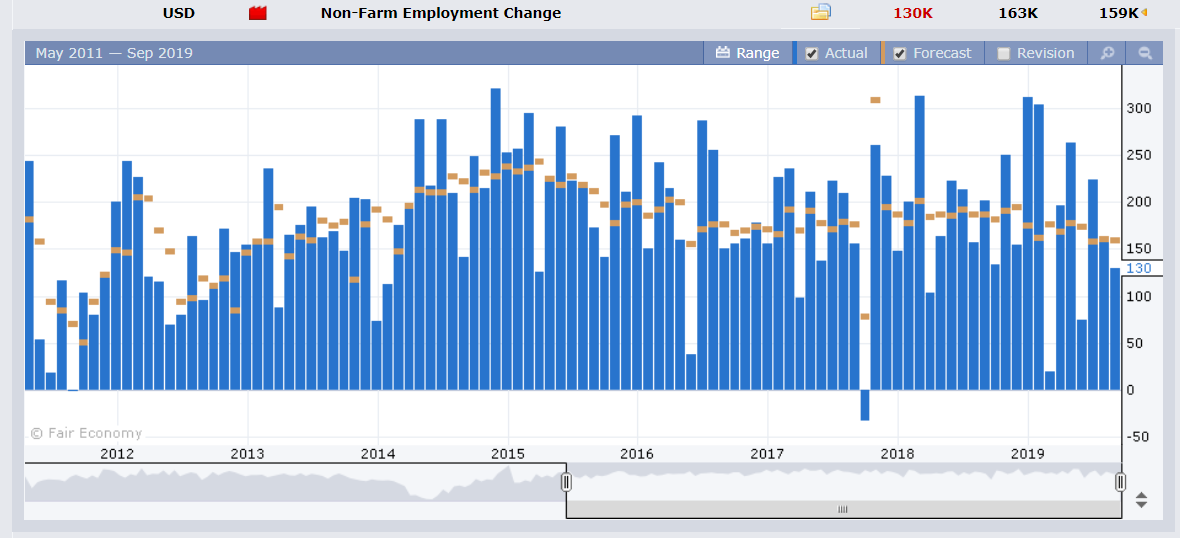

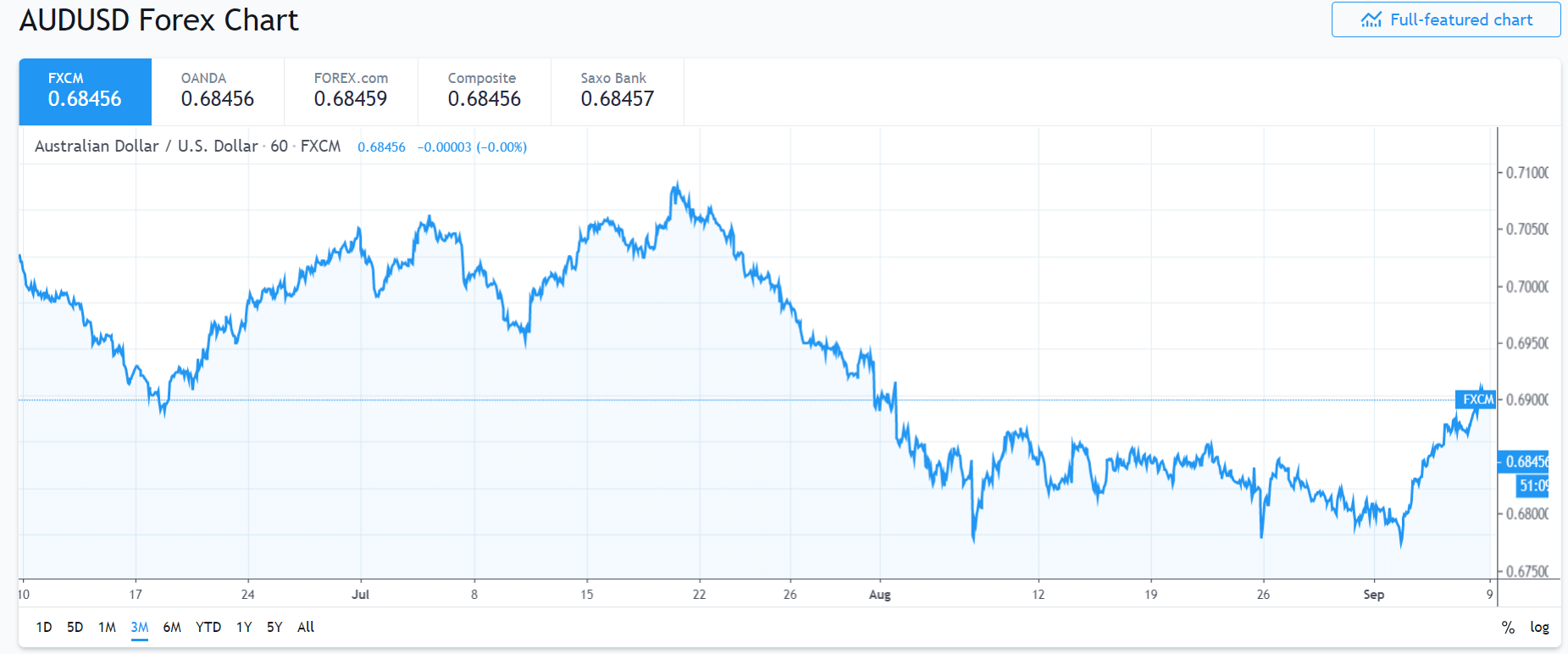

Summary: A less-than-impressive gain in US Payrolls offset a rise in Wages which saw the Dollar dip against most of it’s rivals. The US Labour Department reported that Job Gains were up 130,000 in August, missing median expectations of +160,000. Average weekly earnings (Wages) though were up 0.4% vs 0.3% forecast. Market expectations of a 0.25% Fed rate cut in their September 17-18 meeting remained on track. The Dollar Index (USD/DXY) fell 0.41% to 98.012 (98.40 Friday). Sterling fell back to 1.2287 (1.2327) after another of Boris Johnson’s Conservatives resigned over the weekend. The Guardian reported that the French foreign minister signalled that the EU is running out patience on the lack of progress on Brexit. The Euro was modestly lower to 1.1027 (1.1035) ahead of this week’s ECB policy meeting and rate announcement. Risk currencies were up the most against the Greenback. The Aussie climbed to 0.6850 from 0.6815 while the Kiwi rose 0.55% to 0.6427 (0.6377). Emerging Market currencies lifted on the prospects of lower US interest rates. USD/CNH (US Dollar versus offshore Chinese Yuan) slumped to 7.1070 from 7.1370, off 0.5%.

Equities posted gains on the prospects of renewed US-China trade talks. The DOW rose 0.46%.

The yield on the benchmark US ten-year treasury note slipped one basis point to 1.55%.

Yesterday, China posted a fall in its Trade Surplus to CNY 239.60 billion from CNY 310.26 billion. Imports were down 5.6%, slightly better than forecasts of -6.0%. August Exports fell 1.0% from July’s rise of 3.3%. The fall was mostly expected from the markets given the escalation of the trade war.

- GBP/USD – After it’s impressive rally to 1.23437, 2-week highs, the British Pound retreated following the weekend news that another UK minister from Boris Johnson’s government resigned. Amber Rudd, Secretary of State for Work and Pensions and Minister for Women and Equalities citied the party’s lack of effort to get a new Brexit deal with the EU.

- EUR/USD – The shared currency closed little changed, down 0.09% to 1.1027 from 1.1035 Friday but still managed to end the week above 1.1000. The week’s main event is the ECB’s policy meeting and rate announcement (Thursday). Traders are expecting a dovish outcome from Mario Draghi and his colleagues. Market positioning remains short.

- AUD/USD – The Aussie rallied with risk appetite as prospects of renewed trade negotiations between the US and China improved last week. The Aussie was buoyed by the rise in Asian EM currencies led by China’s offshore Yuan. A fall in China’s official trade surplus was expected and didn’t have much impact on the Battler.

On the Lookout: The data week ahead is a busy one. Expect a quiet Monday start in Asia which should pick up as the day wears on. The big event is Thursday’s ECB policy meeting and US Headline and Core CPI. Friday sees the US Retail Sales report.

On the geopolitical front CNN reported that tens of thousands of Hongkong protestors demonstrated in front of the US Embassy asking President Donald Trump to help end their confrontation with the government. Trump has not taken a side in the dispute as he fights to make trade war progress with China.

New Zealand’s Q2 Manufacturing Sales data (just out) fell to -0.7% from Q1’s +1.0%. Japan is up next with August Current Account, Final Q2 GDP, and GDP Price Index and Economic Watchers Sentiment. Australia reports on its August Home Loans. European data see Germany’s Trade Balance, Swiss Unemployment Rate, and the Eurozone’s Sentix Investor Confidence Index. UK GDP, Manufacturing Production, Construction Output, Industrial Production and Goods Trade Balance round up today’s reports.

Trading Perspective: The Dollar Index (USD/DXY) extended its retreat to finish down 0.41% to 98.012 from Friday’s 98.40. The popular gauge of the value of the US Dollar against a basket of -foreign currencies closed at its low for the week, after hitting a high at 99.37 mid-week. US Payrolls failed to impress which puts the Fed on track to cut rates by 0.25% at its meeting later this month (Sept 17-18). Trade news has been positive so far, but traders will want to see more substance to it.

Economic data just released (US Payrolls and Chinese Trade) show that global growth needs this trade dispute to get settled.

The latest Commitment of Traders report (week ended 3 September) saw little change in the market’s positioning of the Dollar against the 4 major IMM currencies (EUR, JPY, GBP, AUD). Apart from the Yen, Dollar shorts remain versus the Euro, Sterling and Aussie near multi-year highs.

- EUR/USD – The Euro finished modestly lower against the Dollar and its Rivals as markets expect a dovish outcome from the ECB’s meeting on Thursday. Market positioning remains short at multi-year highs. Immediate support for today can be found at 1.1020 followed by 1.0990 and 1.0960. Immediate resistance lies at 1.1050/60 (overnight high 1.1057). The next resistance can be found at 1.1080. The latest COT/CFTC report (week ended 03 August) saw net speculative EUR shorts increased to -EUR 49,100 contracts from -EUR 38,800 the previous week. Which are still near multi-year highs. A clean break through 1.1080 could see 1.1120. Look for a likely range today of 1.1010-1.1060. Prefer to buy dips.

- AUD/USD – The Aussie Battler continues to grind higher in true Battler fashion. AUD/USD closed at 0.6850 after trading to an overnight and 2-week high at 0.68615. Immediate resistance lies at 0.6860 followed by 0.6880 and 0.6900. Immediate support can be found at 0.6830 and 0.6810. With a less dovish RBA outlook, the Australian Dollar has further to go, particularly on a Trade Weighted basis. Speculative AUD short bets were trimmed to -AUD 59,300 contracts from -AUD 61,000 in the week ended 03 August. Look to buy dips in a likely range today of 0.6820-0.6870.

- USD/JPY – The Dollar was little-changed against the Yen, closing at 106.92 from Friday’s 107.00. USD/JPY traded a relatively tight 106.627-107.101 range. The rally in risk kept the USD/JPY from edging lower. US 10-year yields were a tad lower to 1.55%. USD/JPY has immediate support at 106.80 followed by 106.60. Immediate resistance lies at 107.10 followed by 107.30. The latest COT/CFTC report saw net speculative JPY longs pared to +JPY 27,700 contracts from +JPY 33,600 in the prior week. Look for a likely range today of 106.60-107.20. Just trade the range shag on this one.

Have a good week ahead. Happy trading.