Summary: The US Dollar and bond yields dipped as optimism on new stimulus measures from global central banks faded just days ahead of the Jackson Hole, Wyoming gathering. Fed Chair Jerome Powell will open annual symposium with a speech where several other central bank heads are expected to speak. Markets were cautious but remained calm. US President Trump stepped up his attacks on the Federal Reserve, saying Jerome Powell should cut rates 100 basis points and add QE as well. The Dollar Index (USD/DXY) a popular gauge of the currency’s value against 6 majors, dipped 0.18% to 98.171. US bond yields retreated. Benchmark US 10-year rate finished at 1.56% from 1.61% yesterday, trading more like a currency. In Italy PM Giuseppe Conte resigned, opening prospects for new elections and adding to global uncertainties. The Euro recovered to 1.1100 after hitting near two-year lows. Earlier, Australia’s central bank, the RBA revealed a “steady as she goes” policy from its latest meeting minutes. The Australian Dollar bounced off its lows to close at 0.6777, up 0.3% (0.6752). Risk aversion led to a lower Dollar versus the haven sought Yen to 106.20 from 106.62 and Swiss Franc, 0.9778 from 0.9817.

Wall Street stocks gave back most of their gains. The DOW dipped 0.83% to 25,897, from 26,115. The S&P 500 lost 0.9% to 2,895. (2,922.)

- EUR/USD – managed to rally on the back of weaker US Dollar to 1.110 (1.1080 yesterday) despite Italy’s growing political turmoil. In his resignation Conte accused Deputy Minister Mateo Salvini of breaking up the government and putting the country at risk. Earlier the Euro dropped to near 2-year lows at 1.10656.

- AUD/USD – The Australian Dollar rallied against the Greenback to 0.6777 from 0.6752 after the RBA latest meeting minutes revealed a “steady as she goes” policy. Market sentiment though remains bearish on the Battler. AUD/USD kept within a two-week trading range.

- USD/JPY – the Dollar dipped against the Yen weighed by lower 10-year bond yields and a more risk-averse market stance. USD/JPY closed at 106.20 from 106.62 yesterday.

- GBP/USD – The British Pound rallied against the generally weaker Greenback to 1.2170 (1.2130 yesterday). Sterling was aided by comments from German Chancellor Angela Merkel who said that the EU would think about practical solutions to the backstop, which is the agreed insurance policy for the Irish border. Boris Johnson’s UK government wants it scrapped.

On the Lookout: Yesterday saw a light economic calendar while in Italy, politics heated up. The trade front produced little headway which traders will keep a lookout for in Asia today. China has yet to respond to the recent US moves.

Today data releases pick up. Australia opens with its M1 Leading Index followed by New Zealand’s annual Credit Card Spending (August). The UK reports on its Public Sector Net Borrowing, the difference between government spending and income. Canada reports on its inflation numbers with Headline August CPI, Annual Trimmed CPI, August Core CPI data. The US Existing Home Sales report rounds up the day’s data. The FOMC’s latest meeting minutes are released in the North American evening (early Sydney Thursday 4 am). Which will give traders a clearer guide of future Fed interest rate policy.

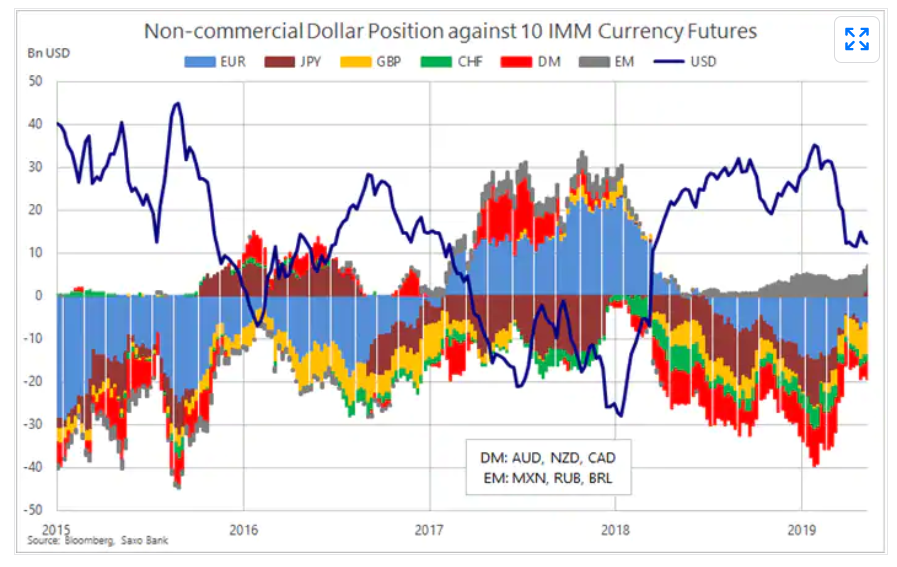

Trading Perspective: Ahead of the FOMC’s release of its meeting minutes and Jackson Hole, Wyoming global central bank symposium, expect the recent trading ranges to hold. We highlighted that net speculative US Dollar longs were very much unchanged. However speculative shorts in Sterling and the Australian Dollar continued to build, which may see further short-covering support. Against the Yen, it is a totally different ball game. Among the majors, the Yen is the only currency where speculators are net long the currency (ie short US Dollars).

President Trump’s attacks on the Fed and some of his solutions, ie cutting taxes on payrolls will erode support for the US Dollar. It is no secret now that he prefers a weaker Dollar. Watch the bond yields, they are trading like currencies and will give us a guide.

- EUR/USD – The Euro rallied on the back of the generally weaker US Dollar. The latest drama in the Italian political scene leaves the shared currency vulnerable. EUR/USD closed at 1.1100 after trading to an overnight and near 2-year low at 1.10656. The overnight high traded was 1.11066 which leaves the immediate resistance at 1.1110. The next resistance level lies at 1.1130. Immediate support can be found at 1.1080 and 1.1060. A clean break of 1.1060 could see 1.1027, early August and two-year lows. The latest COT report saw a small increase in net speculative Euro shorts to -EUR46,649 contracts. Which is about 45% off the biggest shorts recorded in a year. Expect a likely trading range today of 1.1060-1.1110.

- USD/JPY – The Dollar retreated against the Yen weighed by lower US bond yields and a rise in risk aversion. USD/JPY closed at 106.22 from 106.62 yesterday. Immediate support for today can be found at 106.10 followed by 105.80. Immediate resistance can be found at 106.70 and 107.00. The latest COT report saw net speculative long JPY bets increase by +JPY 14,181 bets to total +JPY 24,742 the biggest total since November 2016. This is a danger sign to getting too short of US Dollars near the 105.00 area. We also know that the Japanese authorities will be vigilant at those levels as well. Meantime we have not broken out of the 105-107 range. Look to trade a likely range today of 106.00-106.70. Prefer to buy dips.

- AUD/USD – The Australian Dollar dipped to an overnight low at 0.67546 ahead of the RBA meeting minutes release yesterday. Following the result where the Australian central bank signalled a steady as she goes policy, the Battler slowly grinded higher against the generally weaker Greenback. AUD/USD traded to an overnight high at 0.6495. Immediate resistance remains at 0.6800 followed by 0.6830. Immediate support can be found at 0.6755 followed by 0.6730. The latest COT report saw speculative Aussie shorts increase to -AUD 62,912 bets from the previous week’s -AUD 55,511. Look to trade a likely 0.6760-0.6810 range today, prefer to buy dips.

- GBP/USD – Sterling had a brief rally to 1.2180 after Merkel’s positive comments on the EU’s preparedness to think about practical solutions to the Irish backstop which is key to a Brexit agreement. This was short-lived and the Pound slipped back to 1.2160 in early Asia. GBP/USD has immediate resistance at 1.2180 followed by 1.2210. Immediate support can be found at 1.2130 followed by 1.2100. The latest COT report saw speculative short GBP bets trimmed to -GBP 95,820 contracts from the previous week’s -GBP 102,702. This is still a large number of shorts, and the risk is for a further short squeeze. Look to trade a likely range today of 1.2110-1.2180. Prefer to buy dips.

Happy trading all.