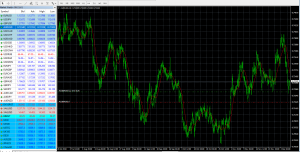

Summary: The benchmark US 10-year bond yield extended its epic drop by another 4 basis points to 2.87% from 2.91% yesterday. Barely a week ago, the 10-year yield was sitting at 3.05%. Futures traders now put the odds Fed rate hike this month to 60% from almost-certain. The US Dollar finished lower against the Yen, Euro and Sterling.

Risk appetite took another hit on news of the arrest of CFO of Chinese tech giant Huawei. Fears rose of a flare-up in US-China trade relations. The DOW fell 1.93%, leading Wall Street stocks lower.

- USD/JPY – reversed initial gains to finish 0.34% lower to 112.50 (113.18 yesterday). The Dollar sank to a low of 112.23 overnight before rallying at the close. This currency pair is traditionally the most sensitive to moves in the US 10-year yield and looks headed further south. Japan’s 10-year JGB yield was down one basis point to 0.05%.

- AUD/USD – against the trend, the Aussie fell against the US Dollar and other majors after the weak Q3 GDP report on Wednesday. The news of the arrest of Huawei’s CFO has put markets on risk-off mode which does not bode well for the antipodean currency. AUD/USD finished at 0.7322, down 0.57% from 0.7268 yesterday. AUD/USD slumped to an overnight low of 0.7191. With an overall weaker US Dollar, the Aussie should find support near 0.7200.

- EUR/USD – held the low of 1.1321 well, bouncing to an overnight high of 1.1413 before slipping to 1.1380 at the New York close. German November Factory Orders beat expectations, rising 0.3% against a forecast -0.4%.

- US 10-Year Bond Yield – after holding at 2.91%, the benchmark 10-year yield slid to a low of 2.83% before settling at 2.87% at the New York close. In early Sydney the yield has stabilised at 2.89%. Barely a week ago, the yield was at 3.05%, which is an epic drop of almost 20 basis points. The loss of yield support from the US Dollar will keep it under pressure.

On the Lookout: Traders go into Friday’s Payrolls day with a risk-off stance. The US-China trade dispute is escalating and weighing on investors. Bank of Japan Governor Haruhiko Kuroda said economic risks from abroad could be severe. Lastly, it’s all about the yields. The move in bond yields highlight concern that the global growth picture is not as robust as it seems. Global growth has slowed. It comes at a time that central banks are scaling back stimulus. What a difference a few days make!

Today economic data sees Japanese Household Spending and Leading Economic Indicators. Euro-area data at German and French Industrial Production for November, UK reports on Halifax House Price Index. Canada’s Employment data precede the US Non-Farms Payrolls for November. The median forecast is for a gain of 195,000 Jobs from October’s 250,000. Wages will be closely watched with traders looking for an increase of 0.3% from 0.2%.

Trading Perspective:

- USD/JPY – the combination of a lower US 10-year bond yield and risk-off mode will continue to weigh on this currency pair. There is immediate resistance at 112.80 and 113.20. Support comes in at 112.45 followed by 112.20. A break of 112.20 could see us back down to 111.50. Don’t forget that the speculative market is short JPY which will limit the USD/JPY topside.

- AUD/USD – The Aussie looks soft at the outset and a risk-off stance by the markets could see initial selling pressure to the overnight lows of 0.7195/0.7200. Immediate resistance can be found at 0.7250, followed by 0.7270. A bad US Payrolls number will continue to pressurise the US Dollar. This will provide the Aussie support and we can look for a further topside test of 0.73-0.74 cents. The yield on Australia’s 10-year bond fell 5 basis points to 2.45%.

- EUR/USD – the multi-currency maintains its trading range between 1.1320 and 1.1420 and its difficult to see that break just yet. The Euro looks poised for a break-out soon and the risk is for higher, given the backdrop in the markets. It all boils down to the US Payrolls tonight provided there are no further surprises on the US—China trade front. With the speculative EURO market short, prefer to buy dips to 1.1300. The epic drop in US bond yields tell us that a Dollar correction move lower is coming. And the Euro could be a main beneficiary.

- US Ten-Year Bond Yield – Unless the US NFP data is much weaker than forecast later today, the 10-year yield should find good support at 2.80-2.85%. The low last night was 2.83% and we have come a long way down in a very short span of time. Any rally to the 2.95% should be contained. For now, it looks likely that we will consolidate between 2.85 and 2.95%.