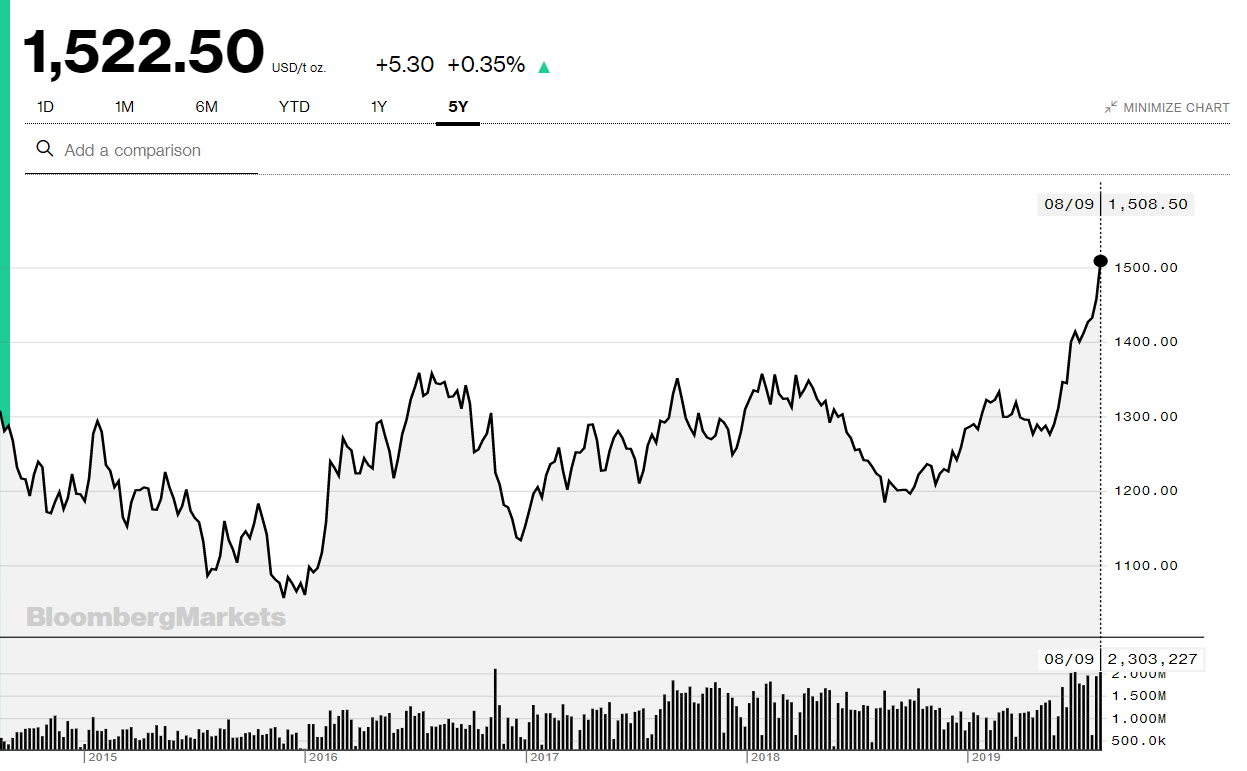

Summary: Geopolitical tensions arising from Hongkong protests and a primary election defeat of a pro-business President in Argentina boosted US treasuries. Hongkong authorities cancelled departure flights that were not checked in as protestors occupied the terminal. Argentinian voters scorned market-friendly President Mauricio Macri, handing the left-leaning opposition victory. Bond yields plunged in low volume trading. The US 10-year bond yield plunged 9 basis points to 1.65%. The Argentinian Peso sank 15%, weighing on Emerging Market currencies. Wall Street stocks sold off. Major FX was becalmed amidst the August lull, with many traders on holiday. The Dollar Index (USD/DXY) slipped 0.14% to 97.42, weighed by lower US bond yields. Japan’s Yen extended its rally against the Dollar to 105.05, it’s highest this year, settling at 105.28 at the close. The Euro rallied 0.2% to 1.1215, while Sterling gained 0.49% to 1.2075 (1.2025 yesterday). Continuing risk-off sentiment and weak Emerging Market currencies weighed on the Australian Dollar, down 0.47% to 0.6752 (0.67850). Gold prices increased by 0.99% to US$1,511.50, above the 1,500 USD level and highest this year. The DOW was down 1.43% to 25,900. (26,277. Yesterday).

- USD/JPY – The Dollar slide to 105.05, fresh lows since earlier this year when the flash crash occurred. Risk-off sentiment continued to favour the haven-sought Yen. USD/JPY rallied off the lows to close at 105.28 in New York. Volumes were low as Tokyo enjoyed a holiday yesterday.

- EUR/USD – The Euro shrugged off Italy’s political woes, climbing 0.2% against the Dollar to finish at 1.1215 from 1.1185 yesterday. Germany’s 10-year Bund yield fell one basis point to -0.59%, narrowing the rate gap with its US counterpart.

- AUD/USD – Risk-off sentiment and weaker Emerging Market currencies continued to weigh on the Aussie Battler. The Australian Dollar fell 0.47% to 0.6752 from 0.6785 yesterday. In a speech this morning at a Finance and Treasury Breakfast in Sydney RBA Assistant Governor Christopher Kent (Financial Markets) said that the RBA is not targeting unemployment, suggesting that negative rates are not necessary.

On the Lookout: With Tokyo back into the fray today, volumes should pick up. However, the influence from the Northern Hemisphere August vacation period is still in play. Economic data releases pick up today and tomorrow. Traders will continue to monitor events in Hongkong.

Earlier this morning New Zealand’s Food Price Index climbed 1.1% in July from June’s fall of -0.7%.

Australia releases its NAB Business Confidence Index (July) with Japanese Tertiary Activity following.

The Euro area starts off with Germany’s Final CPI (July) and Wholesale Price Index and its ZEW Economic Sentiment Index. The UK’s Employment report for July comes next with Average Earnings Index (3m/year), Claimant Count Change, and Unemployment rate. US Headline and Core CPI data (July) round up the day’s reports.

Trading Perspective: The fall in US treasury rates have not been matched by its counterparts in terms of extent. Which narrows the differentials and weighs on the Greenback. The 10-year US bond yield plunged 9 basis points to 1.65%. In contrast, German, UK, Japanese and Australian 10-year rates were much unchanged. The US 30-year rate fell to 2.13%, the lowest of this year.

- USD/JPY – The Yen should continue to be sought after in the current environment. Lower US 10-year rates will keep USD/JPY pressurized. However, the 105.00 psychological level held last night. With Tokyo back from it’s holiday yesterday, we can expect more two-way trade with the 105.05 overnight and yearly low to hold. Japanese corporates will be buyers on dips. The next support level can be found at 104.70. Immediate resistance lies at 105.70 and 106.10. Look to buy dips with a likely range today of 105.10-105.90.

- EUR/USD – The Euro drifted higher as the Dollar weakened against most of the major currencies. The narrowing rate gap between German and US rates should keep the Euro supported. German’s ZEW Economic Sentiment is released today. Immediate support for the Euro lies at 1.1200 followed by 1.1180. Immediate resistance can be found at 1.1230 (overnight high was 1.12306). The next resistance level is found at 1.1260. Look to buy dips in a likely 1.1200-1.1260 range today.

- AUD/USD – The Australian Dollar climbed off its lows after RBA Assistant Governor Kent suggested that negative interest rates were not necessary when he said in a speech this morning that they are not targeting unemployment. AUD/USD moved up a mere 10 pips to 0.6760 from 0.6750 before settling at 0.6750. Risk-off sentiment continues to weigh on the Aussie Battler and will likely keep a lid on the topside. Immediate resistance can be found at 0.6785 and 0.6805. Immediate support lies at 0.6740 (overnight low 0.6745) followed by 0.6710. Kent, who heads the RBA’s Financial Markets division is aware that the Australian Dollar is near long term lows on a Trade Weighted basis. While the RBA have stated their preference for a weaker currency a few years ago, today is a different story. An Aussie Dollar which is too low is not ideal for the country either. Look to buy dips with a likely range today of 0.6740-0.6810.

Happy trading all.