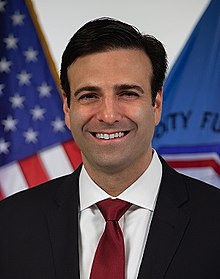

Dr. Heath Tarbert was the latest guest on the podcast of the Futures Industry Association (FIA), FIA Speaks.

The podcast is hosted by Walt Lukken, the Chief Executive Officer (CEO) of FIA.

The conversation quickly turned to coronavirus.

As a sign of the times, the podcast was done through Zoom, rather than in person, as Lukken noted.

“Let us start with the elephant on the Zoom call- every chairman and I think we’ve talked about this Heath privately has an unexpected intervening event that diverts each chairman from their agenda- and boy do you have a doozy,” Lukken noted, referring to coronavirus.

Lukken first asked how the derivatives markets, which the CFTC oversees, have held up in response to coronavirus.

“The good news is that we have a good story to tell,” Tarbert responded, “Certainly thus far. Our markets have been incredibly resilient.”

Tarbert noted that there were many differences between this crisis and the last one in 2008, “In 2008, there was a concern, particularly on that part of the derivative markets, that we did not regulate at that time, the uncleared bilateral OTC markets, that it was amplified systemic risk. Well, I can tell you without a doubt that today both our exchange traded markets and cleared markets, as well as the OTC non cleared markets, have acted as shock absorbers for systemic risk.”

Tarbert said the priorities at the CFTC changed as soon as the crisis started, “We quickly pivoted the agency’s resources to take the crisis head on and, so, we really looked at a few major objectives. First was monitoring derivatives markets and their participants so what we knew exactly what was going on. Second, we wanted to make sure that we promoted orderly and liquid markets, despite what was happening around us, and in order to do that, we responded swiftly with targeted, practical relief, and finally, we wanted to communicate consistently and transparently with all our stakeholders.”

Tarbert noted further, “Right now, things have stabilized from where they were a month ago.

Tarbert also talked about how the CFTC has changed the way it does business in response to coronavirus, primarily much more working from home.

“It has been a challenge to sort of move the agency to continuing to pursue its mission, and I would argue more than ever now, but doing so in a remote fashion. The good news is that we were able to do some testing to confirm our ability to work remote, and once we tested the system, we moved quickly to agency wide telework footing. So, basically, it’s been a seamless process and ninety-nine percent of us are working remotely.”

Tarbert stated that the CFTC has approximately seven hundred full time employees and a total of approximately one thousand people working for the CFTC, when contractors are included as well.