Summary: “Oh, what’s going on, what’s going on?” Marvin Gaye’s 1970 lyrics entered my head as I logged into my trading platform. The S&P 500 had slumped over 2% following yesterday’s furious rally only to bounce back and finish up 1.2%. Literally in the blink of an eye, Fast and furious 2. Trading volumes stayed low. The S&P 500 volumes were a reported 11% below the 30-day average. Computers and Algos have taken over in stock trading which defy human explanation. Wall Street’s initial fall came after a Reuters reported that President Trump was considering an executive order to ban US firms from using equipment built by Chinese firms Huawei and ZTE.

The Dollar Index (USD/DXY) closed 0.5% lower, mainly on the Euro which rallied 0.7%. USD/JPY was little-changed at 111.04, rebounding off lows seen when stocks slumped earlier.

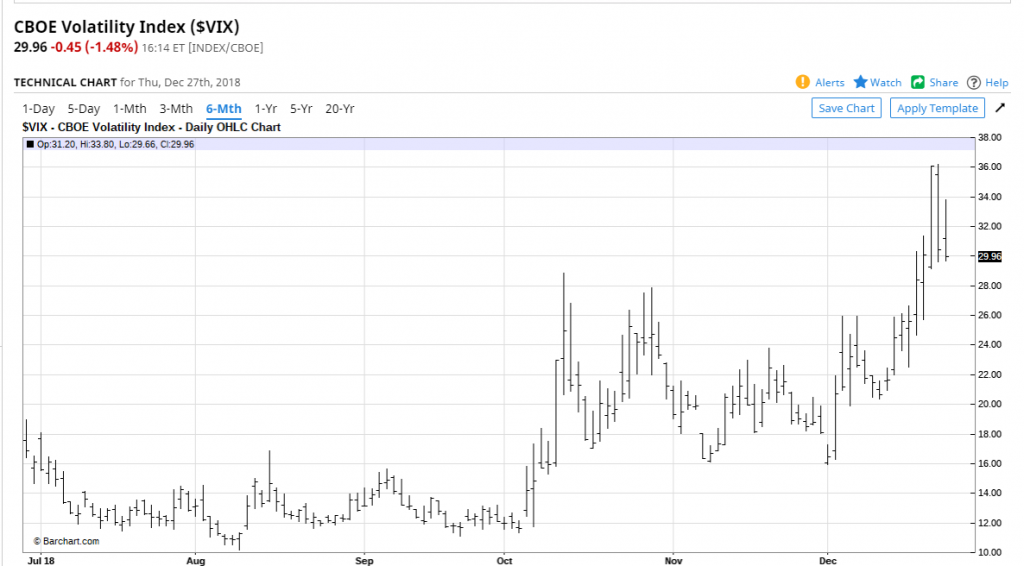

The VIX Index remained elevated, rising back to 34 before dropping to finish around the 30.00 mark.

The yield on the benchmark US 10-year bond slipped 2 basis points to 2.78%.

- EUR/USD – The Single Currency outperformed, rallying 0.7% against the Greenback. Overnight high traded was 1.14542. ECB policymakers have maintained their confidence that the Euro-Zone will weather the slowdown. The recovery of the lows and current market positioning leave the Euro poised for a more sustainable recovery.

- USD/JPY – Safe haven Yen saw the Dollar drop to a low of 110.456 before rallying back above 111.00 as stocks recovered. Japanese 10-year JGB yields were unchanged. A slew of Japanese economic data is due today

- AUD/USD – The Aussie’s attempt to climb on the overall USD weakness failed and the antipodean ended down 0.6% at 0.7028 (0.7060 yesterday). AUD/USD traded to a low of 0.70166, lows not seen since January 2016.

- VIX Index (CBOE Volatility Index). The VIX climbed back to 33.80 following the drop to 30.23 before closing at 29.96, down 1.48%. It remains elevated near the 30 mark. Expect more volatile days ahead. “My my, hey, hey, volatility is here to stay”.

On the Lookout: Amidst the uncertainty, economic data released yesterday saw the US Conference Board’s Consumer Confidence Index declined in December, printing at 128.1 against forecasts of 133.0 and a previous 135.7. Today’s data sees Japanese Preliminary Industrial Production, Retail Sales, Unemployment Rate and Tokyo Core CPI. Germany reports its Preliminary CPI. US Goods Trade Balance and Chicago PMI round up the data.

Trading Perspective: The drop in US yields will keep a lid on the US Dollar. Two-Year US Treasury yields fell 4 basis points to 2.57%. Market positioning also favours a weaker Greenback. The last full Commitment of Traders CFTC report saw speculative US Dollar long bets were maintained against the Major currencies. With trading volumes low, and trading rooms thin into next week, any sizeable orders could see some exaggerated moves.

- EUR/USD – The Euro topped out at 1.1454 which is today’s immediate resistance. Short term support can be found at 1.1420 and then 1.1400. The overnight low was 1.1351 and that level should hold if the Single currency is to see further gains.

- USD/JPY – The Yen continues to be the choice of safe-haven currency and any further dramatic falls in stocks will see the Dollar lower. The fall in US yields will also keep a cap on USD/JPY. The overnight high traded was 111.34. Immediate resistance lies at the 111.30/40 level followed by 111.80 and 112.00. Immediate support can be found at 110.50 and then 110.20. A break of 110.20 would see the 110.00 level tested, leaving the Dollar exposed to 109.60. With market positioning currently short JPY bets, look to sell USD/JPY rallies.

- AUD /USD – The Aussie continues to trade heavy in the current environment. A test of 0.7000 is possible. However, given that the speculators are short of Aussie, we should see some good support at those levels and a bounce is likely. For today, AUD/USD has immediate support at 0.7015 and the 0.7000. A break of 0.7000 would see 0.6960. On the topside, resistance lies at 0.7050 and then 0.7080. With US yields coming lower, the widening differential between US and Aussie rates has come to a halt. Which is supportive of the currency.

Happy trading all.