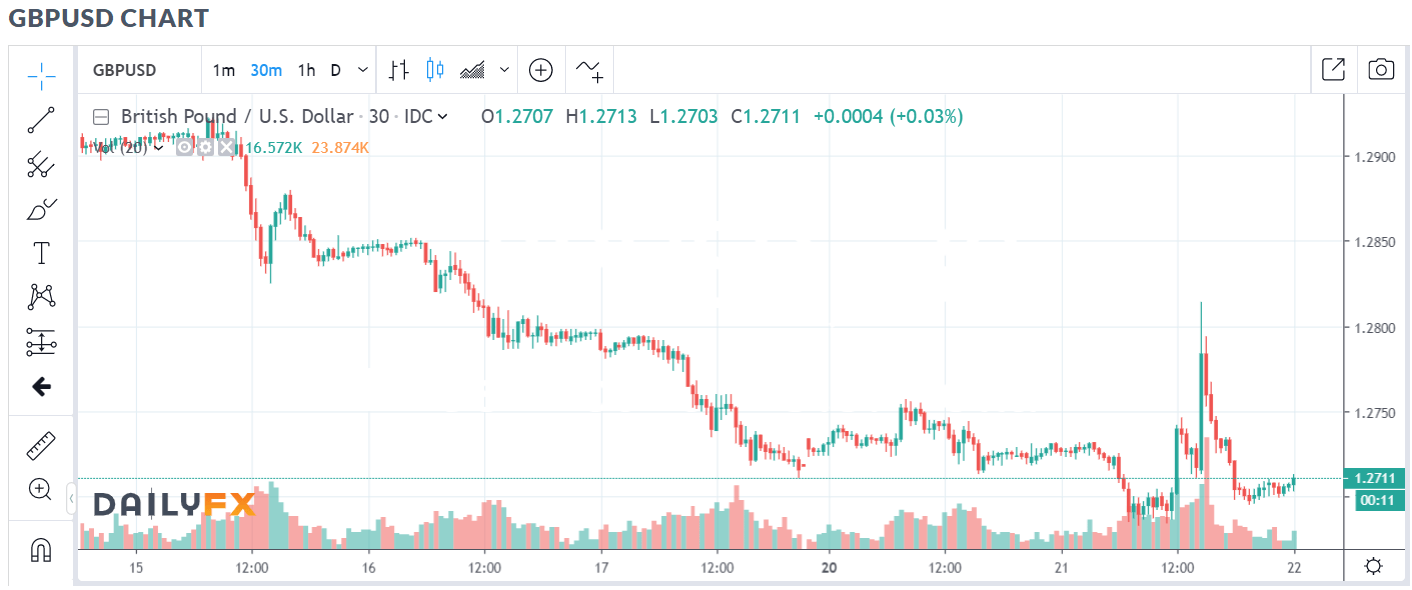

Summary: Sterling whipsawed as Theresa May prepared to roll the dice one last time and get Parliament to endorse her “new deal” for Brexit. The British Pound initially soared to 1.28139 from 1.2730 immediately after the May announcement before slumping back to 1.2715. May’s Brexit deal has already been rejected three times by UK lawmakers. Risk appetite returned after the US Commerce department temporarily eased restrictions on China’s Huawei Technologies Co Ltd. The US Dollar rose against the Yen and Swiss Franc. The Euro and most EM currencies were modestly lower against the Greenback. The Australian Dollar slumped 0.56% to near pre-election levels (0.6888) after RBA minutes revealed it was “considering” cutting rates.

Bond yields and equities rallied. The DOW finished up 0.55% at 25,870. (25,728). The S&P 500 rose 0.59% to 2,865. The yield on the US 10-year bond climbed one basis point to 2.43%.

US Existing Home Sales missed forecasts in April with a total 5.19 million against a forecast of 5.35 million. Which had no effect on the currency markets.

- GBP/USD – The British currency finished at 1.2703 after whipsawing between 1.26853 and 1.28139. Theresa May’s “new” Brexit deal offered the chance to vote on a second referendum to try and break the deadlock. Sterling soared to 1.28139 high before quickly reversing to 1.2715 as it became apparent that Parliament would not pass May’s deal.

- EUR/USD – The Euro remained constrained in a tight range ahead of the European Parliamentary elections which start tomorrow. EUR/USD closed at 1.1165, little-changed after trading between 1.1142 and 1.1188.

- AUD/USD – the Australian Dollar fell back to 0.6885 from 0.6908 yesterday after the RBA meeting minutes were released. The Australian central bank revealed it will “consider” cutting rates as inflation is weak. Most analysts expect the RBA to cut rates by 0.25% at its next meeting in June.

- USD/JPY – the Dollar rallied to close at 110.50 (110.05), up 0.36% on risk appetite returned and stocks rose.

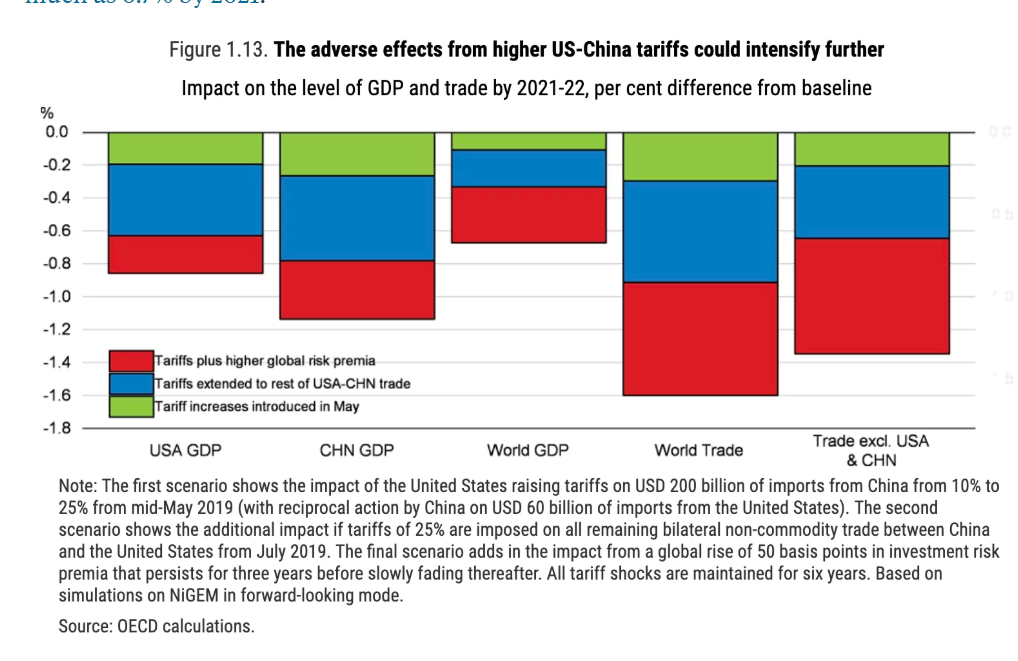

On the Lookout: Markets will continue to monitor developments on the trade war between China and the US. The Australian Business Insider highlighted an OECD forecast that saw an escalation of Trump’s trade war potentially wiping US$600 billion from the global economy. The US economy stands to lose more than the rest of the world if 25% tariffs are imposed on all remaining bilateral trade with China and this remains in place for 6 years.

The South China Morning Post reported that President Xi-Jin Ping is preparing China for a protracted trade war with the US.

The FOMC releases the minutes of its last meeting (April 30-May 1) early tomorrow morning (4 am Sydney). Markets will look for further clarifications as to the Fed’s thinking on the economy and, particularly, inflation.

New Zealand’s Retail Sales report, released at the time of this writing, rose 0.7% against a forecast of 0.6%. The New Zealand Dollar did not budge from its NY close of 0.6508 at the news report.

This morning St Louis Fed President James Bullard speaks to the Foreign Correspondents Club in Hongkong on the US Economic Outlook and Monetary Policy amidst questions. Worth watching out for.

Other data releases today see Japanese Core Machinery Orders, and Trade Balance for April. Australia reports on its MI Leading Index (April) and Q1 Construction Work Done (expected to rise to +0.1% from the previous quarter’s -1.3%). UK Headline and Core CPI, PPI Input, and Public Sector Net Borrowing reports follow. Canada rounds up today’s report with its Headline and Core Retail Sales.

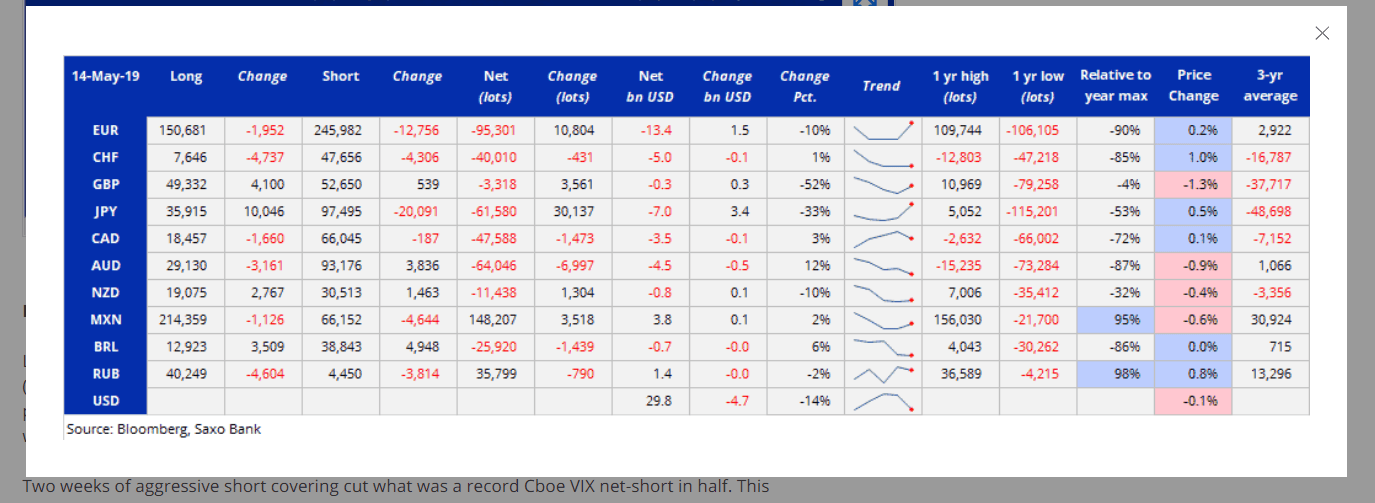

Trading Perspective: The latest Commitment of Traders/CFCT report from Saxo Bank saw speculators (mostly hedge funds) cut their net total bullish US Dollar bets by a massive $4.7 billion. A chunk of that came against the resurgent, haven darling Japanese Yen. The escalation of the trade war between the US and China also saw Euro short bets cut by its largest since January. On the other side of the spectrum, speculators increased their Aussie Dollar short bets on a combination of the trade war and a predicted Labour election victory. Net total US longs still totalled a massive US$ 29.8 billion against 9 IMM currencies in the latest week ended May 15.

- EUR/USD – The Euro should continue to trade within its recent 1.1140-1.1240 range until the outcome of the EU Parliamentary elections. The COT/CFTC report saw net speculative Euro short bets cut to -EUR 95,301 contracts (week ended May 15) from -EUR 106,105. While the reduction was the largest since January, the short Euro net position is still at multi-year highs. Immediate support lies at 1.1140/50 while immediate resistance can be found at 1.1190/1.1200. Look for a likely range today of 1.1150-1.1210. Prefer to buy dips

- AUD/USD – The Australian slid back down to basically where it started before the surprise election win by the Liberal National Party. The RBA said it is “considering” cutting rates at its next meeting (June) and that inflation is weak while boosting wage growth is glacial. Saxo Bank highlighted that speculative Aussie short bets were increased by their biggest since November last year to total -AUD 64,046 contracts from the previous -AUD 57,049. AUD/USD has immediate support at 0.6865 followed by 0.6840. Immediate resistance can be found at 0.6910 and 0.6930. Look to buy dips with a likely range today of 0.6875-0.6925.

- GBP/USD – Sterling remains the most volatile among the majors, which is not likely to change. The latest COT/CFTC report saw net speculative GBP short bets trimmed in the latest week ended May 15 to -GBP 3,318 contracts from -GBP 6,879. The net position in Sterling is near square which is where most traders would prefer to be on the British currency. GBP/USD has immediate resistance at 1.2725 and 1.2785. Immediate support can be found at 1.2685 (overnight low) followed by 1.2650.

- USD/JPY – The Dollar rallied against the Yen boosted by the recent 3 day climb in US 10-year bond yields and the return of risk. The latest COT/CFTC report saw an aggressive cut of JPY short bets as the haven Yen rallied amidst the deteriorating trade war. Net speculative JPY shorts (week ended May 15) fell to -JPY 61,580 contracts from -JPY 91,717 the previous week. That’s a massive haircut of over 30,000 contracts! Still net speculative JPY bets remain on the short side. USD/JPY has immediate resistance at 110.60/70 (overnight high was 110.67). The next resistance level is found at 111.00. Immediate support lies at 110.25 and 110.00. Look to sell rallies with a likely range of 110.00-70 today.

Happy trading all.