Summary: Sterling was pounded to fresh 6-month lows (1.2624) before settling to close 0.41% lower at 1.2662 in New York. A Sky News report that British PM Theresa May would resign soon which would pave the way for frontrunner Boris Johnson, a Eurosceptic to succeed. Expectations of a no-deal Brexit rose. Elsewhere, the FOMC revealed that the Federal Reserve’s current patient approach to monetary policy could remain in place for “some time”.

The Dollar Index (USD/DXY), a popular measure of the Greenback’s value against a basket of foreign currencies, closed little-changed at 98.106 from 98.02 yesterday. The Euro traded in a tight 31-pip range, closing at 1.1155 from 1.1162 yesterday ahead of today’s start of Europe’s Parliamentary elections. The Dollar slipped against the Yen (110.32 from 110.50) and Swiss Franc (1.0098 from 1.0112) as trade tensions between China and the US stewed. The Aussie steadied at 0.6882 while the Kiwi closed a tad lower to 0.6497 (0.6502) despite upbeat Sales data. USD/CAD rallied to 1.3432 from 1.3405. While Canada’s retail sales outperformed, Brent Crude Oil slumped 1.86% to US$ 70.00 (US4 71.33). Stocks and bond yields slipped. Wall Street stocks were 0.3% lower. The benchmark US 10-year bond yield fell 5 basis points to 2.38%. Other global yields eased.

Japan’s Core Machinery Orders for April beat forecasts. New Zealand’ Retail Sales climbed 0.7% last month, beating forecasts of 0.6%. The UK’s Annual CPI in April was up 2.1% against a forecast rise of 2.2%. Canada’s Headline and Core Sales both beat forecasts.

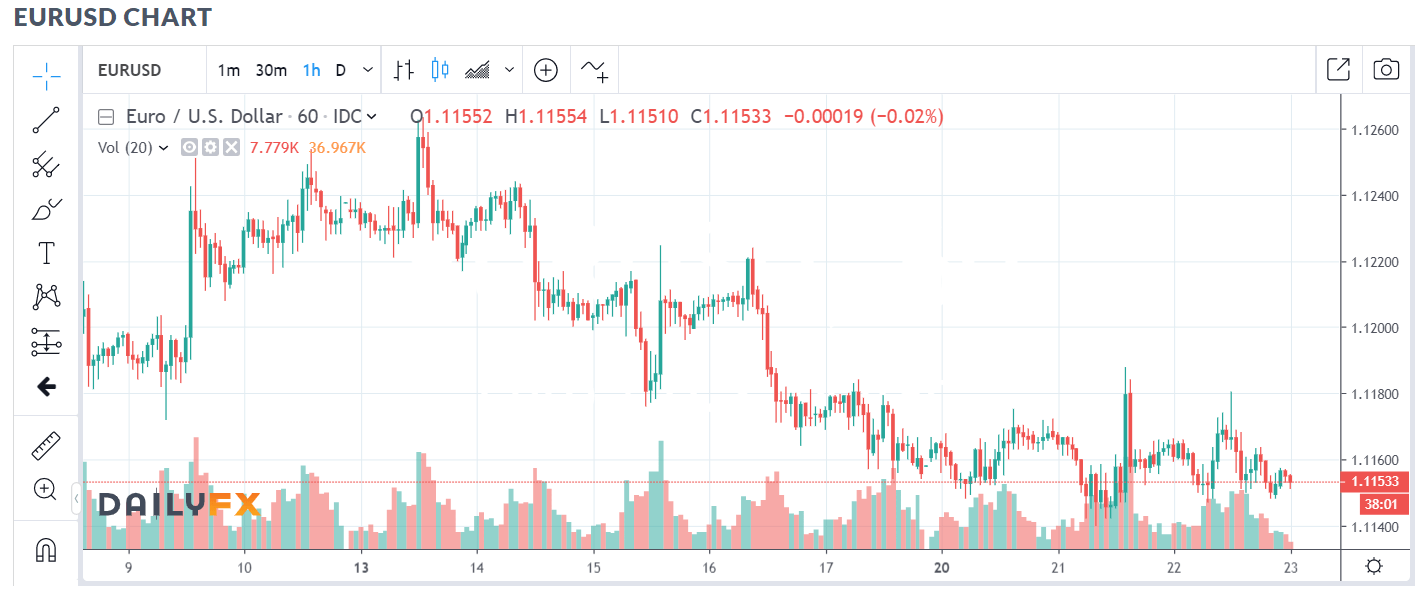

- EUR/USD – the Euro closed at 1.1153 from 1.1163 in low volume trade ahead of today’s European Parliamentary elections. The Single currency traded in a relatively tight range between 1.1149 and 1.1180. Market sentiment remains bearish while positioning is short.

- GBP/USD – slip-sliding away. Sterling looks ripe for further pounding with more whipsaws expected. Ongoing Brexit woes will keep the British currency heavy. With current market positioning near square, the British currency remains susceptible to further volatility that will be triggered by headlines.

- AUD/USD – The Australian Dollar is constrained by the ongoing trade conflict, an expected RBA rate cut against the surprise election victory of Scott Morrison and a short market. The Aussie Battler steadied at 0.6882 (0.6887 yesterday).

On the Lookout: While the Fed has decided to keep their monetary policy gear on neutral for “some time”, US bond yields slid further. The US 10-year yield closed at 2.38%, one basis point above 2019 lows. Australia’s 10-year bond yield dropped 5 basis points to 1.58%while UK 10-year yields fell 7 basis points. Germany’s 10-year Bund yield was down 2 basis points. Japanese yields were flat.

The European elections begin this afternoon with 28 European countries vying for seats in the 751-member European Parliament. While the risk lies for a rise in a Nationalist Euro-sceptic movement, which most expect will see a lower Euro, is not that clear-cut. Final election results are not expected until Sunday (evening here in Asia).

Today sees many Manufacturing and Services PMI’s from around the globe. Australia, Japan, France, Germany, Eurozone, and the US give their latest updates. Germany reports on its Final Q1 GDP and IFO Business Climate. The ECB Financial Stability Review and its latest Monetary Policy Meeting accounts are due for release as well. US Weekly Jobless Claims and New Home Sales round up a busy events schedule. China-US trade tensions continue to simmer. While the US eased trade restrictions on Huawei, no significant breakthrough is likely.

Trading Perspective: Without yield support, the Dollar faces topside headwinds. Market sentiment remains bullish on the Dollar. It is still the best of the worst given the simmering trade wars. The Fed has confirmed its not going to move in any direction on interest rates for “some time”. Market positioning is still long US Dollars despite a large buy back of JPY shorts.

- EUR/USD – The Euro is ripe for a big move which most expect to be lower. While any election is a risk due to a possible rise in a nationalist Euro-sceptic movement, it is no guarantee that it’s currency will move lower. BK Asset Management Kathy Lien, a veteran analyst, observes that in the case of the US and Australia, the currencies rallied. Spot on. The market remains short of Euro bets at multi-year highs. Euro area PMI’s and the ECB’s latest monetary meeting accounts are due today. Immediate support for the Euro lies at 1.1140 and 1.1120. Immediate resistance can be found at 1.1180 followed by 1.1210. Look for a likely range today of 1.1145-1.1195. Prefer to buy dips.

- GBP/USD – The Pound remains susceptible to another flash-crash given the latest developments in the Brexit drama. PM May is looking at the exit which could occur anytime soon. The pressure for her to resign is strong. While her replacement remains uncertain, the chances of a no-deal Brexit grows. Speculators have steered clear of the Pound where market positioning is almost flat. The risk remains for another flash-crash given the history of this currency. Immediate support can be found at 1.2620 and 1.2580. Immediate resistance lies at 1.2700 and 1.2730. Look for a likely range today of 1.2580-1.2720. Tin helmets on, the Pound is going for a wild ride.

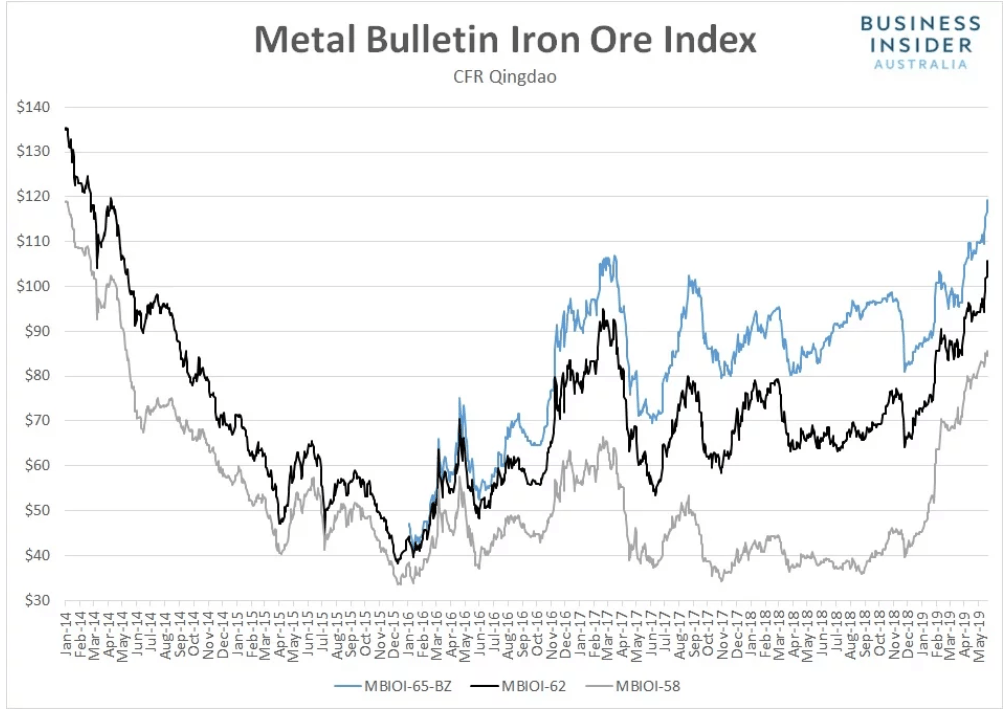

- AUD/USD – The Australian Dollar has stabilised after its impressive post-election spike. The Aussie Battler has immediate support at 0.6870 followed by 0.6850. Immediate resistance can be found at 0.6900 and 0.6930. Australian Business Insider reported that Iron Ore prices continued to surge due to supply disruptions and strong Chinese steel production. Aussie net short bets increased in the latest COT/CFTC report. Look to trade a likely range today of 0.6870-0.6920. Prefer to buy dips.

Happy trading all.