Summary: Sterling reversed recent gains made at the expense of a weaker Dollar and no negative Brexit headlines. With the British Parliament set to vote on Theresa May’s Brexit plan next week (15 Jan), traders adjusted their positions. May must win the vote for any chance of an approval of the deal with the European Union by the March deadline. A modestly stronger US Dollar also weighed on the Pound, down 0.53% to 1.2715 (1.2765). The Euro slipped off its highs of 1.1485 to 1.1445 after German Industrial Production fell unexpectedly last month. It was the third decline in factory growth as soggy data continued to emerge from Europe.

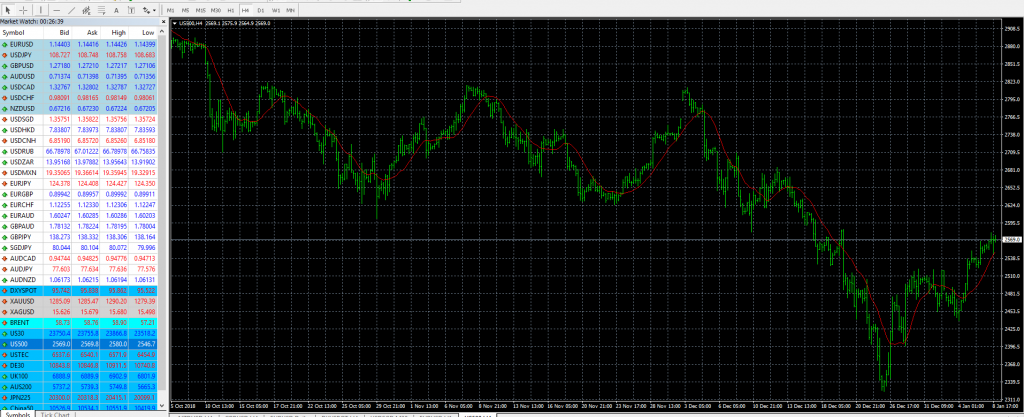

Stocks extended their gains as optimism on Sino-US trade talks continued into the second day. The DOW posted a gain of 0.86% while the S&P 500 was up 0.75%.

Global yields continued to rise with the US 10-year bond up 3 basis points to 2.72%. Japan’s 10-year JGB yield rose to 0.00% from -0.03%.

- EUR/USD – The Single currency once again failed to break above 1.1500, with 1.14846 the overnight high traded. The weaker-than-forecast German factory output data weighed on the Euro, which finished 0.33% lower. Weakness in the Euro and British Pound enabled the US Dollar to gain modestly versus it’s Rivals. However, the prospect of no further Fed rate hikes limited the Greenback’s gains.

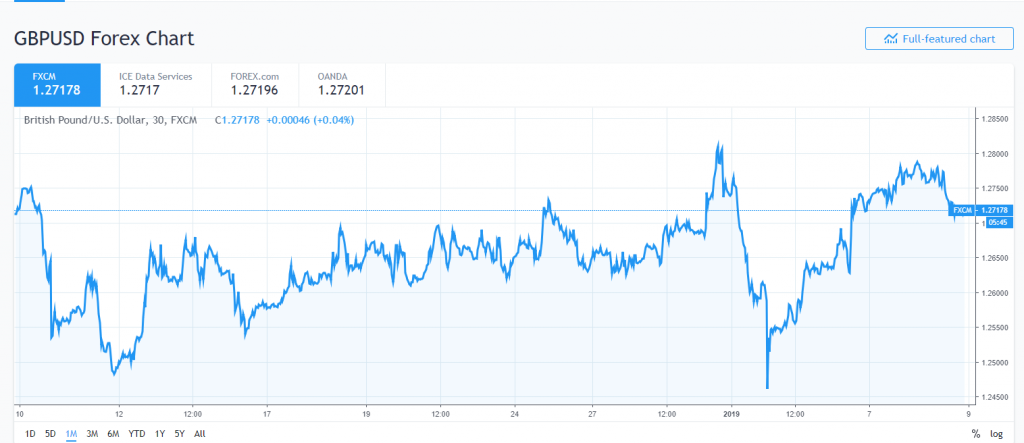

- GBP/USD – The British Pound was one of the stronger gainers at the expense of the Dollar’s fall after Fed Chair Jerome Powell’s more dovish speech. Sterling reached 1.27969, near two- week highs before slipping to end 0.53% lower (1.2715). The Pound has been relatively stable although fears of a hard Brexit will weigh and see more volatility.

- US S&P 500 – Wall Street stocks extended gains made yesterday as optimism on the ongoing China-US trade talks outweighed negative sentiment in the financial sector. The S&P 500 gained 0.75% to 2572 from 2550 yesterday and 2530 Monday. Overnight high traded was 2580 where immediate resistance lies. The ongoing partial US government shutdown will limit any gains. President Trump is scheduled to speak on it later today and focus on the budget standoff due to his border wall funding.

On the Lookout: As markets consolidate in Asia first-up the busy week’s events will start to pick up today, coming in fast and furious. US President Trump speech on the border security and the government shutdown later today (1pm Sydney time). Before that Australia releases it’s Building Approvals for November, which are expected to improve from the previous month’s drop of 1.5%.

Germany’s Trade Balance will be closely scrutinised with Exports expected to fall 0.3% from a gain of 0.7% in October. BOE Governor Mark Carney is speaking about the future of money in a Bank of England conference.

The Bank of Canada has its policy meeting later today. The meeting is interesting as some are expecting them to hike the overnight rate to 2% from 1.75%. The Rate statement and Press Conference will be closely followed should a surprise emerge.

Fed speak starts with speeches from FOMC members Bostic (Atlanta President), Evans (Chicago President) and Rosengren (Boston President).

Last, but not least, is the release of the FOMC December meeting minutes (6 am Thursday Sydney time).

Trading Perspective: With the week’s heavy events and data yet to emerge, markets will be content to consolidate at current levels. The Dollar generated support from the weaker Euro and Pound as well as higher bond yields. Meantime, the prospect of no further Fed rate hikes will keep the Dollar’s topside limited. Traders will look into the minutes of the last Fed policy rate meeting in December to get any clues to the FOMC’s thinking then on interest rates and the US economy. Fed speak from FOMC members Bostic, Evans, and Rosengren will also be monitored. The Dollar’s rebound was to be expected after it’s steep decline following Jerome Powell’s speech which many considered dovish. Expect some good two-way trade in a potentially choppy session.

- EUR/USD – The Euro failed on the topside to break above 1.1500 once again. The pressure is now to the downside with 1.1420 immediate support. The next level of support comes in at 1.1380. The topside of 1.1485-1.1500 will be difficult to break but the prospect of a more dovish Fed should see the medium-term bulls emerge in the Euro in the high 1.13’s/low 1.14’s.

- GBP/USD – The British currency will remain captive to Brexit which may not necessarily mean automatic downside. But Sterling will stay volatile with many chances to trade either side of the currency. Choose your levels carefully and look out for market positioning. GBP/USD has immediate support at 1.2700 followed by 1.2660. The resistance at 1.2760 should cap any Sterling gains today. A generally weaker US Dollar may give the Pound the needed boost to squeeze out more shorts.

- AUD/USD – The Aussie was little-changed finishing at 0.7140 (0.7144 yesterday). The Australian Dollar has had a decent bounce of it’s lows after last week’s flash crash. AUD/USD traded to a high of 0.71493 where immediate resistance lies. We should see some consolidation with a likely range of 0.7085-0.7155 today. The outlook for a generally weaker US Dollar should see the Aussie continue to maintain it’s gains and grind higher in true Battler fashion.

- US S&P 500 – This Wall Street Share Index finished up 0.75% at 2575, just below the 2580 immediate resistance level. Expect the resistance at 2580 and 2600 (strong) to hold any gains with a pull-back most likely. The immediate support at 2535 should hold, with upcoming events (trade talks, Trump’s speech on US government shutdown, FOMC meeting minutes) holding the key to future moves.

Happy trading all.