Summary: The Dollar ran out of steam following a robust US Jobs report after Jerome Powell said the Fed would take a more “patient” approach to monetary policy. Powell’s more dovish tone combined with a better-than-expected US Payrolls gain of 312,000 (vs 179,000 f/c) saw stocks, the Aussie and Emerging Market currencies soar. Sterling, battered on Thursday, rallied further, up 0.6% against the Dollar. EUR/USD was little-changed at 1.1395. Earlier in the day, China moved to address its weakening economy and eased bank’s cash reserve ratios by 1%.

US Treasury yields bounced off their lows, leading its global peers higher. The US 10-year bond yield finished at 2.67%, up 11 basis points (2.56% Friday).

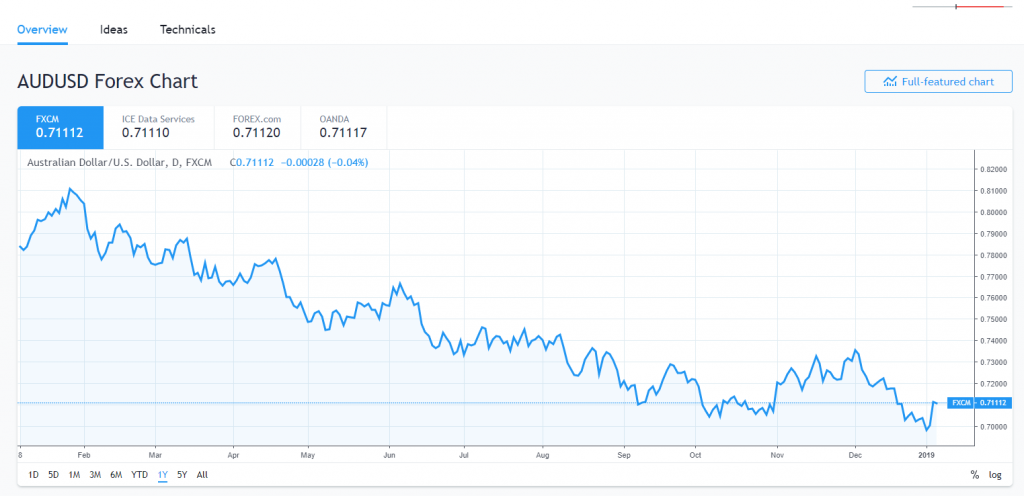

- AUD/USD – The Battler soared liked a flying kangaroo to close in New York at 0.7118 (0.7007 Friday), up 1.4%. The Aussie which has been battered due to the slowdown in China’s economy and the market’s risk off sentiment came back with a vengeance. The week ahead should see more stability in the Australian Battler.

- USD/JPY – The Haven Yen fell out of favour and the Dollar rallied 0.56% following Thursday’s “flash crash”. USD/JPY finished in New York at 108.52 from 107.80 at the Friday’s opening. The rebound in the US 10-year yield to 2.67% was a strong support for this currency pair and will continue to be in the days ahead. By contrast Japan’s 10-year JGB yield lost 4 basis points to -0.05%.

- USD/DXY – The Dollar Index finished with mild losses to 19.199 from 96.334 Friday after climbing to a high of 96.612 on the stellar US Payrolls report. Jerome Powell suggested the Fed may pause in it’s monetary policy tightening path.

- US 10-Year Bond Yield – Treasury yields continued their own wild ride with this benchmark yield jumping off its lows from 2.56% to 2.67% at the close. Financial market conditions and Fed policy will continue to be a big driver for bond yields.

On the Lookout: Markets are back full-force from the holidays and the week ahead is a busy one in terms of events and data on myclap.com. Today and tomorrow (Jan 7 and 8) see the trade talks between China and the US which are held in Beijing. The US partial government shutdown goes into its third week as Washington works for a deal between the Democrats and Republicans. Fed speak including Jerome Powell are scheduled toward the end of the week.

As for economic data, today sees Japanese Markit Services PMI and China’s Foreign Exchange Reserves. European data sees German Factory Orders and Retail Sales (December) as well as Euro-Zone Retail Sales. North America sees Canada’s Ivey PMI and US ISM Non-Manufacturing for December. Later in the week we see the US Trade Balance, as well as Headline and Core CPI.

Trading Perspective: Some semblance of stability returned to the markets with the robust US Jobs data calming investor nerves. Recession fears may have been overblown as we are reminded of the resilience of the US economy. US ISM Non-manufacturing data will give us further evidence of on how the economy is doing. Risk and Emerging market currencies saw the biggest gain in the FX space. The Russian Rouble, Turkish Lira, and South African Rand all rallied by over 2%.

The markets positioning would have seen a few adjustments last week. We look at that when the latest Commitment of Traders report from the CFTC is released tomorrow.

- AUD/USD – trading under the 0.7000 psychological level did not stay there long. The currency’s dip to 0.67393 lows on Thursday was the result of the “flash crash” in the AUD/JPY cross. The Aussie is looking more resilient now in the current environment of a more resilient US economy and more flexible US Fed on monetary policy. While the US 10-year bond yield climbed 11 basis points, Aussie 10-year yields rallied 6 basis points. Base metals rebounded led by Copper’s 3.17% rally. Zinc and Aluminium prices also soared. The NY based CRB Index climbed 1.06%. The Aussie traded to an overnight high of 0.71245, which remains immediate resistance. AUD/USD has immediate support at 0.7080 and then 0.7050. While its premature to call a base on the Aussie, anything around the 0.70 cent level remains an excellent purchase.

- USD/JPY – The Dollar finished at 108.52, from 107.80 Friday. The overnight high traded was 108.88 which was also Thursday night’s high. The 108.90 remains immediate resistance followed by 109.20. Immediate support can be found at 108.20 followed by 107.80. Look for a more balanced trade today between 107.80-108.80. While there was no urgency for verbal intervention by Japanese officials on Friday, the fall in Japan’s 10-year yield to -0.05% is surprising. This will keep the USD/JPY supported around the mid-107/s.

- US 10-Year Bond Yield – the 10-year treasury had a wild ride on Friday with that 11-basis point bounce from the lows of 2.56%. The benchmark US yield slumped from 3.20% in mid-November. The bounce to 2.67% following the US Jobs report and Powell’s speech suggest that a base around 2.60% may be forming. Immediate resistance can be found at 2.70% and 2.75%. The 10-year should consolidate this week with all the events and data releases.

Have a good and happy trading week ahead all.