Summary: FX markets settled following yesterday’s “flash crash” on two Yen crosses during the hand-over time from New York to Sydney. The Japanese holiday exacerbated an already thin, illiquid period. Trading experience told us that this was the result of cross Yen stop-losses passed into early Asia from North America. Traders refer to this time period as the “twilight zone”. This resulted in an 8% free–fall in the AUD/JPY cross in less than 10 minutes. Reports confirmed that there was a Turkish Lira/Yen cross stop as well. I remember the last time something similar like this occurred, I was still trading at one of the large trading banks. It was during handover time on a Japanese holiday, and the event that triggered such a move was the Tohoku tsunami in March 2011. The USD/JPY hit a low of 75.50 from around 85.00.

Stocks extended their slump following Apple’s sales warning which was what triggered the FX move early yesterday. The Dow slid 2%, the S&P 500 dropped 1.7%. Treasuries rose. The US 10-year bond yield fell 9 basis points to 2.56%. The Dollar slid against it’s Rivals. EUR/USD rose 071% to 1.1392. The Dollar Index (USD/DXY) slipped 0.34% to 96.334 (96.955 yesterday).

- USD/JPY – The “flash crash”, the results of stops and algorithm programs saw a free-fall in the Dollar to 104.646 from 109.15 in around 7 minutes. USD/JPY rallied back through 107.50 to around 108.00 before settling at 107.50. The bounce took the Dollar to an overnight high of 108.88. The Yen has been rallying into the last part of December and early January as the Japanese currency played catch-up with the risk-off market profile. With Tokyo back today, we should see more liquidity and two-way interests.

- AUD/USD – The Aussie, the proxy for China and the most liquid Asian currencies has been bashed lower after the trade conflict between the US and China worsened. From a high of 0.74 cents, the Aussie opened yesterday at 0.6995 lows not seen since 2016. The “flash crash” saw AUD/USD plummet to 0.67393 from 0.6990 as AUD/JPY stops were triggered in illiquid conditions. The Battler rallied back to close in New York at 0.7007 on the generally weaker US Dollar.

- US 10-year Bond Yield – fell to 2.56% from 2.65% yesterday as investors took an even bleaker view of the global economy following Apple’s almost 10% slide. According to a Bloomberg report, bond traders are now pricing in a Fed rate cut in April 2020. The 2-year treasury yield fell 12 basis points to 2.38%. Jerome Powell speaks early tomorrow morning at an American economic meeting which features a panel discussion with ex-Fed heads, Ben Bernanke and Janet Yellen. Interesting.

On the Lookout: With Tokyo back today, Japanese officials will not like the fact both the Nikkei stock market and the USD/JPY have slumped. Expect them to talk down the currency. Today sees the heaviest economic data calendar highlighted by the US Payrolls numbers for December. Japanese Final Manufacturing PMI for December kicks off the data followed by Chinese Caixin Services PMI data in Asia. Europe follows with Euro area and Euro Zone Final Services PMI as well as Euro Zone December Flash Headline and Core Annual CPI. The UK reports on its Services PMI, Net Lending to Individuals (consumer credit), and Nationwide House Price Index. Finally, North America sees Canadian Employment Change and Unemployment rate. US Payrolls follows with a forecast of 179,000 Jobs created from November’s 155,000. Last night US ADP Private Jobs rose to 271,000 from a forecast of 179,000. This was offset however by a large downward correction in November’s number to 157,000 from 179,000. For tonight’s number look for the corrections to previous US payrolls. The Jobless rate is expected to remain at 3.7% while Weekly Wages are forecast to climb to 0.3% from 0.2%.

Trading Perspective: The Dollar Index (USD/DXY) slipped to 96.334 from 96.955 yesterday. Considering the move in the US 10-year yield, this is pretty a pretty strong performance for the Greenback. The doom and gloom of a global economic slowdown being led by China and now affecting the US may be overdone in the short term. A good Payrolls number could see a bounce in US yields and thus the Dollar. With better liquidity, we should see more two-way trading in all currencies.

- USD/JPY – The confidence factor in this currency pair has been damaged by the recent moves despite the overnight bounce. Japanese officials will be aware of this. Expect “Japan Inc” to talk up the economy, the Dollar and stocks. Japan comes from a 4-day holiday. The USD/JPY was trading at 110.50 then. Today we can expect Japanese importers to find current levels attractive. This should support the downside in the short term. The recent USD/JPY range for most of this year has been between 107-114 since March. Immediate resistance now lies at 108.50 and then 109.00. Immediate support lies at 107.50 and 107.10. Look for a likely trading range today of 107.30-108.30.

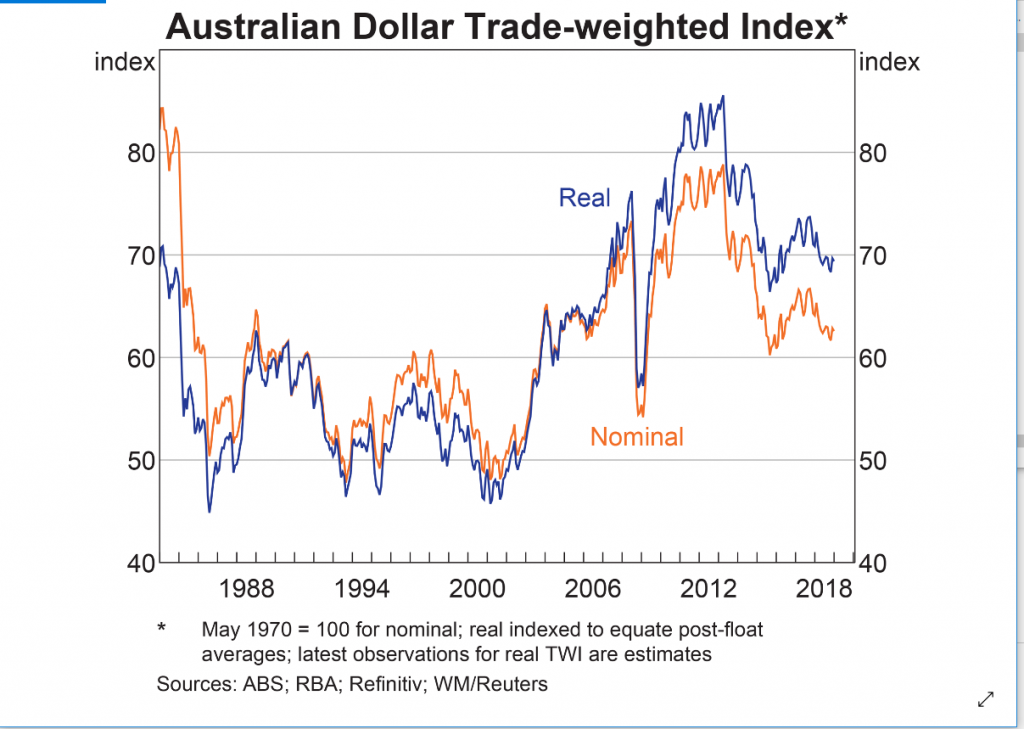

2. AUD/USD – The Aussie managed to climb and close just above 70 cents, only just. While the tone is weak, the Battler can always turn on a sixpence. With so much focus now on China, we can expect Chinese officials to add liquidity to their markets in the coming days. The Aussie fell on the crosses as well with the AUD TWI (Trade Weighted Index) down at 59.7, the first time it is under 60.00 since January 2016. The Aussie should stabilise around current levels. Immediate support lies at 0.6960 followed by 0.6925. Immediate resistance can be found at 0.7020 and 0.7050. Look to buy dips, the Battler is ready to rumble and rally. While the Japanese retail clients may be long of Aussie Yen bets, the speculative COT traders are still short of Aussie bets.

3. EUR/USD – The Euro rallied back to an overnight high of 1.1411 overnight following its 1.1340 close. Overnight high traded was 1.1411. Immediate resistance lies at 1.1420 for today. The next resistance level is at 1.1450. Immediate support lies at 1.1360 followed by 1.1330. We should continue to see a range between 1.1300-1.1500 in the coming days. The 1.1500 held well and we would need to see a clean break of that for a more sustained upward move.

Happy Friday and trading.