Ladies and Gentlemen,

Good evening to everybody. Many thanks to Riksbanken and NABE for the invitation to give a dinner talk at your symposium. I have been asked to focus my remarks on the European side of things by looking at the economic outlook and monetary policy in Europe. I will do so, and it is a great honour and pleasure to discuss these matters with you today.

Let me begin by highlighting our joint Nordic and American societal heritage, which is fundamentally linked to economic liberalism and the market economy. This is the basis for us ‘growing together’, as the conference title starts, which I, frankly, much prefer to ‘growing apart’.

Our joint legacy can be illustrated by a person who is relatively unknown outside the Nordic countries, but who played an important role in paving the way for economic and also social liberalism. I am referring to a chaplain from western Finland, Anders Chydenius, who was politically active during the second half of the 18th century. He lived at the time when Finland was an organic part of Sweden. He still holds an important place in our common Swedish-Finnish history. Chydenius spent a short period of his long life as a Member of Parliament (or ‘Diet’) here in Stockholm.

The parliamentary work and writings of Chydenius during the years 1765 and 1766 left a permanent imprint on society in Sweden and Finland. Among other things, he wrote about the importance of the stable value of money, an issue very dear to us central bankers, and warned about the deflationary consequences of a forced massive revaluation of the then Swedish currency, on which he was right, but for which he was in fact expelled from the Diet – there were limits to the freedom of speech then!

Chydenius also wrote about ‘the wealth of the people’ a decade before Adam Smith published his milestone ‘The Wealth of Nations’1. Making productive activity and the stock of labour the basis of a nation’s wealth, Chydenius took a distance from the mercantilists and instead emphasized the gains of commerce and free trade. This was immensely important for the catching-up process in the 19th century, first by Sweden and later byFinland, and their subsequent growth and prosperity.

As an example, at that time Finland had only three towns with staple rights that allowed the townspeople to export produce on their own ships directly to foreign ports. This ‘Bothnian Trade Prohibition’ meant that Finnish west-coast merchants and those of Swedish Norrland were forced to transport and sell their produce in Stockholm before shipping abroad. The decades-long struggle ended in 1765, as staple rights were granted to four towns in Ostrobothnia and two in Norrland, largely thanks to the work of Chydenius. This was essential for the rapid growth of those regions. And it is no wonder that free trade became a core part of the Nordic DNA.

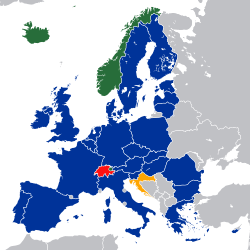

A more recent example of the Nordic path of development relates to labour rights, an issue driven also by Chydenius. We have major achievements in the free movement of labour, which today is one of the freedoms guaranteed by the European Union. The Common Nordic Labour Market was formed already in 1954 by Denmark, Norway, Finland and Sweden. The catalyst for the arrangement was post-war reconstruction.

Today it is not only people who move across the borders, but also companies and businesses. Almost all countries participate in the world economy. Isolation is not possible anymore without great losses in citizens’ living standards. At the same time, perceived negative side-effects of globalisation have stimulated a large-scale movement against it, and, in fact, against modernity. Protectionism, however, is not an answer.

We in the Nordic countries tend to believe that the benefits of globalization can be realized in full only with a sustainable and inclusive growth agenda at the national level. The Nordic model is based on the combination of entrepreneurial dynamism and free trade with strong safety nets, universal health care and free education. We like it – and we don’t call it socialism, but welfare society, or the social market economy.

While an inclusive national agenda is necessary, many critical challenges are global, and hence our pressing economic and political challenges can be properly addressed only through effective international cooperation.

This symposium explores both common and diverse trends shaping the United States’ and European economies. It is worth underlining that the impact of Euro-Atlantic cooperation since the Second World War has been enormous and positive in all walks of life. Current developments, described by the organizers as ‘growing together while growing apart‘, could have equally far reaching consequences for US and European businesses and citizens, but to the reverse direction. It is essential to maintain our current global institutions, but at the same time to reform them to face new challenges. While the IMF has been able to adapt itself successfully in the post-crisis era, it is the World Trade Organisation that is in the greatest need of reform today. As has been rightly said by EU Commissioner Cecilia Malmström, we should make the WTO reform a cornerstone of the next transatlantic project. I very much endorse this.

International cooperation, and policy coordination, also played a critical role in firefighting the global financial crisis. From the start of the crisis, an intensive co-operation emerged between central banks to safeguard the functioning of the global financial system after the collapse of Lehman.

As global markets started to collapse, the demand for liquidity by the banks increased, not only in domestic currency, but also in foreign currency, most of all in US dollars. Suddenly, the demand for dollars exceeded the supply on the wholesale market. Subsequently, the swaps between the Fed and the ECB began in December 2007. The ECB borrowed dollars from the Fed, which took euros in exchange. By October 2008, the Fed had decided on swaps with the ECB, Bank of England and the Swiss and Japanese central banks to provide as many dollars as needed, thus fulfilling its role as the lender of last resort in dollars. Importantly, the central banks had the necessary insight and determination to back words with deeds.

Ladies and Gentlemen,

After tough times and difficult decisions, Europe was able to overcome the rock-bottom of the debt crisis by the end of 2012. During the euro area recovery since 2013, over 10 million net new jobs have been created. Unemployment has fallen from its peak of over 12 per cent to below 8 per cent. The banking sector is now more resilient: capital buffers have been doubled, non-performing loans reduced considerably, and lending to households and enterprises increased. The ECB’s accommodative monetary policy has been very important in supporting the recovery.

During the first months of 2019, global economic activity slowed down, which has been felt also in the euro area. Prevailing uncertainty, which stems from the US-China trade tensions, slowdown of growth in China and Europe’s internal problems, has weakened the outlook for the economy.

Growth forecasts for this year have globally been revised downwards. Incoming data, however, is moving sideways. Some very recent indicators hint at stabilization – I am referring to last week’s growth figures for the United States that were rather strong, and to this week’s Eurostat flash estimate that the Eurozone GDP growth in the first quarter of this year accelerated to 0.4 percent, up from 0.2 in the last quarter of 2018.

This is good news, of course. But in my view we should not jump the gun after the first green shoots and change the course. In policy-making, it is often better to be safe than sorry. This goes certainly for monetary policy.

As a consequence of the slowdown, (almost) all major central banks needed to put monetary policy normalisation on hold and instead maintain an accommodative policy stance. This holds true for the ECB as well.

The ECB Governing Council is maintaining an ample degree of monetary accommodation through our forward guidance on the key ECB interest rates, reinvestments of a sizable stock of acquired assets, and the new series of targeted long-term refinancing operations.

Moreover, as President Mario Draghi has said, the Governing Council stands ready to adjust all of its instruments, as appropriate, so that inflation converges with our aim of below but close to 2% in a sustained manner. It is worth noting that our inflation aim does not imply a ceiling at 2%, since inflation can deviate from our target in both directions.

Before concluding, let me say a word on the longer term. The ECB – much like other central banks – operates in an environment where long run trends, such as population aging and lower long-term interest rates, as well as concerns about inequality and climate change can have important societal effects. The central banking community needs to understand better the implications of these structural changes for growth, employment and inflation dynamics, so as to deliver more effectively on their mandate.

That’s why it is important to assess systematically how these transformations affect our longer-term monetary policy strategy. Many central banks are reviewing their monetary policy strategy and some do it regularly. For instance, the Bank of Canada and Riksbanken have done so recently, and the Federal Reserve System has just launched one.

The Fed review was announced to be wide-ranging, without prejudging where it will lead. The Federal Reserve Board has outlined questions for the review that focus on the symmetry of its inflation objective, the adequacy of its policy tools and the enhancement of communication.2 If I have understood it correctly, the strategy review is best seen as an important research program, but also as an inclusive dialogue with the academia and the civil society, important for legitimacy.

Every central bank must operate under its own mandate. The mandate defines the scope of the strategy review. I have also been advocating for a review of the European Central Bank’s monetary policy strategy. The last time Eurosystem has done a comprehensive strategy review was 15 years ago in 2003. That was before the financial crises and low inflation, before our forward guidance and the large-scale asset purchases.

My motivation for a review stems from the previously mentioned structural changes, which seem to have lowered the long term real natural rate of interest. The natural rate of interest is one of the key concepts for understanding monetary policy. Its modern usage in fact dates back to the Swedish economist Knut Wicksell, who in 1898 defined it as the interest rate that is compatible with a stable price level – a still valid definition.

Why is a low natural rate of interest a problem? Because it increases the risk of monetary policy hitting the zero lower bound, making monetary policy ineffective. This in turn would prevent the necessary easing of monetary policy stance, as well as eventually lead into permanently too low inflation expectations compared to our definition of price stability.

I wish that the outcome of a strategy review, if and when launched, will lead to more effective and timely monetary policy that fulfills our primary objective of price stability – and, “without prejudice to the objective of price stability”, supports “the general economic policies in the Union, with a view of contributing to the achievement of the objectives of the Union”, which include, inter alia, “full employment” and “balanced economic growth”.

Ladies and Gentlemen, Dear Friends,

On a final note, let me come back to our common heritage of liberty and Anders Chydenius. His era was still characterized by mercantilism and clericalism, yet, Chydenius wrote about and fought for the freedom of speech and the press, for the freedom of religion and labour, and for the freedom of trade and industry. Democracy, equality and respect for human rights were, for him, the only way towards progress and the pursuit of happiness for the entire society. That was ten years before Patrick Henry and the Declaration of Independence of the Thirteen Colonies.

Those Enlightenment values, which still underpin our economic and political models on both sides of the Atlantic, are now being challenged both politically and socially, from inside and outside. Politically, a populist and nationalist agenda appears tempting to many people. Socially, the values of tolerance, liberalism and inclusion are increasingly under threat.

To my mind, it is a common challenge for both of us, as Americans and Europeans, to defend the values of liberty and democracy, and the rule of law and rules-based world order. On this side of the pond, we realize the urgency of this effort, especially now as the role of Europe as the standard-bearer for liberal democracy has become even more crucial.

As the international system is built not only on rules and institutions, but also on trust and confidence, current policy uncertainty and the erosion of international cooperation are damaging to everyone. We need bolder joint efforts to steer the global economy towards a more sustainable future.

In Europe we want to keep the flame of global multilateralism alive. I hope our American friends will rejoin us and stay on board.

Many thanks for your attention, and enjoy the evening and Stockholm.