Summary: The US Dollar maintained its bid tone, edging higher against its rivals, boosted by higher bond yields. Jerome Powell’s comments on “transitory” factors dragging on inflation saw US rate cut bets pared by interest rate futures traders. The 10-year US bond yield climbed 4 basis points to 2.54%. Markets also anticipated a strong Payrolls report for April following Wednesday’s better-than-expected ADP private jobs number. The Euro bore the brunt of Dollar strength, slipping 0.28% to 1.1175. Euro area data were mostly in line with expectations.

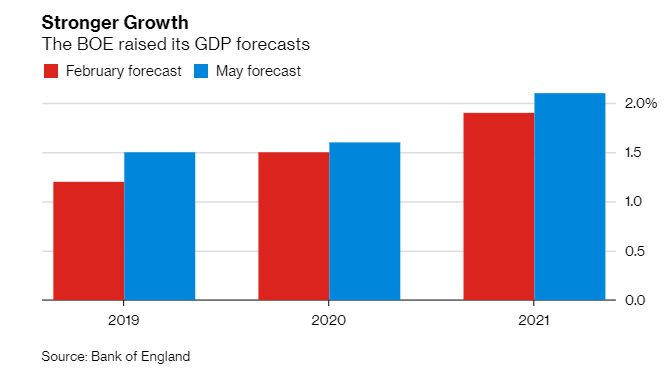

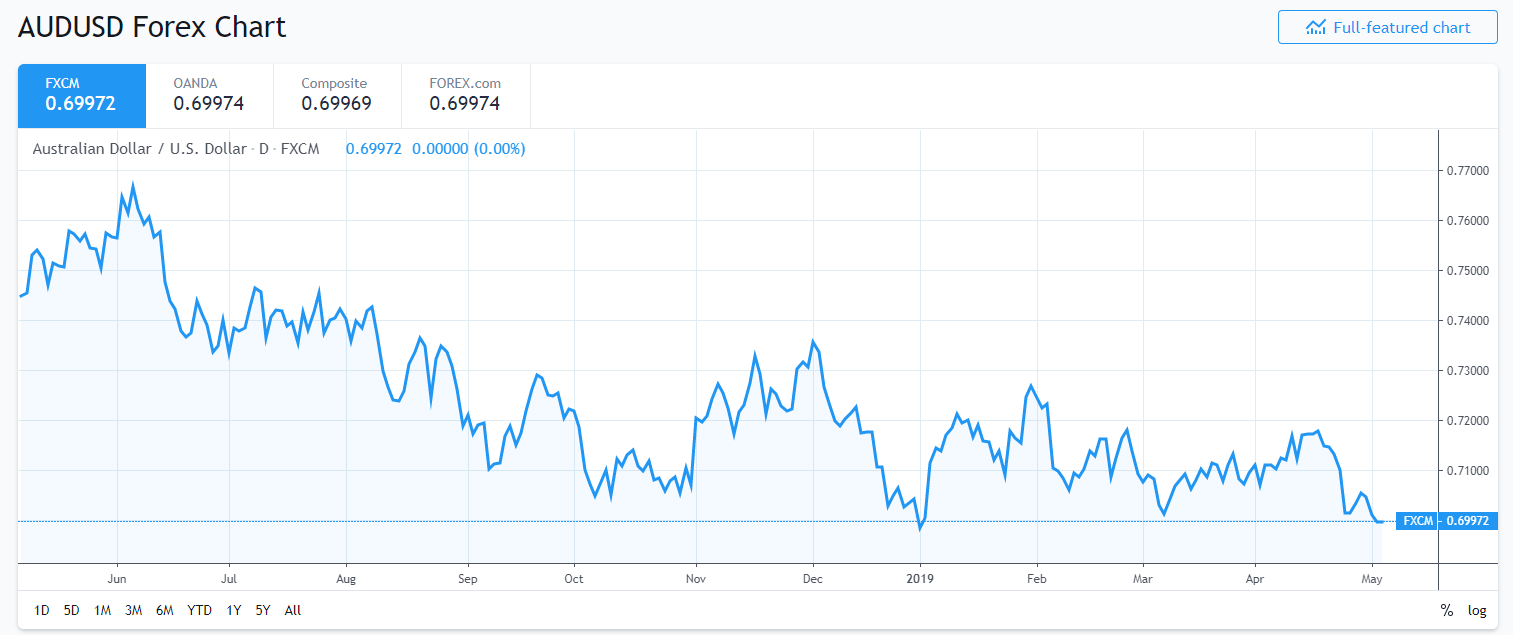

Sterling eased to 1.3035 (1.3050) after the Bank of England kept rates on hold and lifted growth forecasts but warned that Brexit continued to cloud policy. The Australian Dollar edged lower to close around the 0.70 cent level.

Economic releases yesterday saw US Factory Orders rise 1.9% in April beating forecasts of 1.0%. Weekly Unemployment Claims in April matched March’s 230,000 against an expected 220,000.

- EUR/USD – The Single Currency fell to immediate support at 1.11706 overnight lows, settling at 1.1175. Euro area Manufacturing PMI’s saw better-than-expected results in France, Italy and Spain, while Germany’s was flat. German 10-year Bund yields climbed 2 basis points to 0.03%.

- GBP/USD – Sterling slipped despite the Bank of England suggesting the next likely move in interest rates was higher although they would remain on hold for now. The overall stronger Dollar weighed on the Pound which ended down 0.23% at1.3035.

- AUD/USD – The Aussie fell back to its support level and closed at 0.7000 cents on the broadly stronger Greenback. Australia’s 10-year bond yield was unchanged at 1.78% which contrasted with the 4-basis point climb of its US counterpart.

On the Lookout: It’s all about the Payrolls. Markets are anticipating a strong report. Median forecasts from analysts centre around a Non-Farms Employment gain of 190,000 from March’s +196,000. The Unemployment rate is expected to remain at 3.8%. Average Hourly Earnings (Wages) are forecast up at 3.3% annually, or 0.3% for April (0.1% March). The risk is for a weaker number which is possible given the rise in Unemployment claims and layoffs.

Australia will start off the day with its report on Building Approvals for April. Following March’s gain of 19.1%, forecasts are for a fall of 12.5% in April. A fall of over 12.5% will pressurize the Aussie.

Traders will also look out for Eurozone Annual Flash Headline and Core CPI reports, both of which are forecasted to have gained over the previous number.

China and Japan are off today which would make for less liquid trading.

Trading Perspective: The markets are bulled-up on the Dollar post-FOMC and in anticipation of a strong Payrolls number. US NFP will have to be stronger-than-forecast to push bond yields and US Dollar higher. Anything weaker risks disappointment. Market positioning is also long USD bets at multi-year highs.

- EUR/USD – The Single currency closed just above immediate support at 1.1170. The overnight traded was 1.12189. While the Euro is under 1.1200 there is a chance for a test lower at the next support level of 1.1160. Strong support lies at 1.1140. Immediate resistance can be found at 1.1200 and 1.1220. Look for consolidation ahead of the Eurozone CPI and US Payrolls reports later. Likely range 1.1160-1.1210. Prefer to buy dips.

- AUD/USD – The Aussie Battler fell to 0.69949 under the weight of the overall stronger Greenback. Immediate support can be found at 0.6960 followed by 0.6940. Immediate resistance lies at 0.7030 and 0.7060. Australian Building Approvals will be the first number to affect the currency. Anything less than the forecast of -12.5% will support the Australian Dollar. Market positioning in the Aussie is short. The latest COT/CFTC report saw a modest increase in speculative Aussie short bets to -AUD 50,400 contracts from -AUD 49,600. Likely range 0.6975-0.7025. Prefer to buy dips

- GBP/USD – Despite the 0.23% drop to 1.3035, Sterling kept its head above 1.3000. The BOE is the only central bank that has a hawkish bias among the Fed, ECB, BOJ, BOC, RBA, and RBNZ. However, Brexit remains a big risk. GBP/USD has immediate support at 1.3000 followed by 1.2960. Immediate resistance can be found at 1.3060 and 1.3080 (overnight high traded 1.30803). The next move in Sterling will depend on the US Dollar. Look for a likely range of 1.3000-1.3100. Look to trade the range.

- USD/JPY – was little-changed at 111.50 (1.1142 yesterday). USD/JPY traded to an overnight low of 111.35 which is where immediate support lies. The next support level is at 111.10. Immediate resistance can be found at 111.70 (overnight high 111.665) and 112.00. Total net speculative short JPY bets increased to -JPY 94,400 from -JPY 87,100. Which is the second biggest total currency short against the US Dollar next to the Euro. Likely range today 111.30-111.80. Prefer to sell rallies.

Happy Payrolls Friday and trading all.