Asian markets were under selling pressure today following a sell-off on Wall Street overnight sparked by ongoing worries about a breakdown of trade talks between China and the US.

The Nikkei225 opened with a gap lower today and lost 1.46 percent to 21,602, and the Hang Seng benchmark in Hong Kong finished 0.93 percent lower at 29,091. The Shanghai Composite lost 0.64 percent to 2,906, while in Singapore, the FTSE Straits Times index finished 0.97 percent lower at 3,280. Australian stocks bounced off intraday lows, mainly thanks to a bigger than expected lift in imports. The ASX200 ended the session down 26 points or 0.4% to 6,269.

European session started mixed as traders are cautious ahead of US-China trade talks tomorrow, the DAX30 is 0.31 percent higher to 12,129 and CAC40 is 0.14 percent higher at 5,402 while the FTSE MIB in Milan is underperforming and trading 0.10 percent lower at 21,196. The London Stock Exchange gives up 0.14 percent to 7,248.

In commodities markets, crude oil recovers 0.75 percent after US session sell-off and as of writing, the black gold is trading at 61.85 after Trump’s threats to China and geopolitical tensions as the US dispatched bombers and an aircraft carrier to the Middle East over the weekend over concerns that Iranian proxy forces were preparing to possibly attack U.S. forces in the region. Brent oil is trading at $70,19 per barrel. Gold trades 0.24 percent higher at 1288 level as the rebound from Friday lows continues. XAUUSD technical picture starts to improve, and now the support stands at 200-day moving average down to $1251, which if broken can accelerate the downward move to 1200 as sellers will take full control. Strong resistance stands at 1293 and the 100-day moving average, and then the $1300 round figure.

In cryptocurrencies market, bitcoin (BTCUSD) whose market capitalization accounts for more than half of all other cryptocurrencies consolidates at yesterday high above the 5,800 mark enhancing the bullish outlook. The daily low for BTC was at 5,643 and the daily high at 5,896. BTCUSD’s immediate support stands at the 50-hour moving average at 5,684 while the next strong support stands at the $5,515 level the 100-hour moving average and then at the 5000 round figure. On the upside, strong resistance stands at 5956 the recent high before challenging the 6,000 mark. Ethereum (ETHUSD) is flat at 175 holding well above the 50-day moving average at 138, and facing the immediate resistance at 185, the 200-day moving average, while Litecoin (LTCUSD) trades 2 dollars lower at 73.09. The crypto market cap holds above $172.0B.

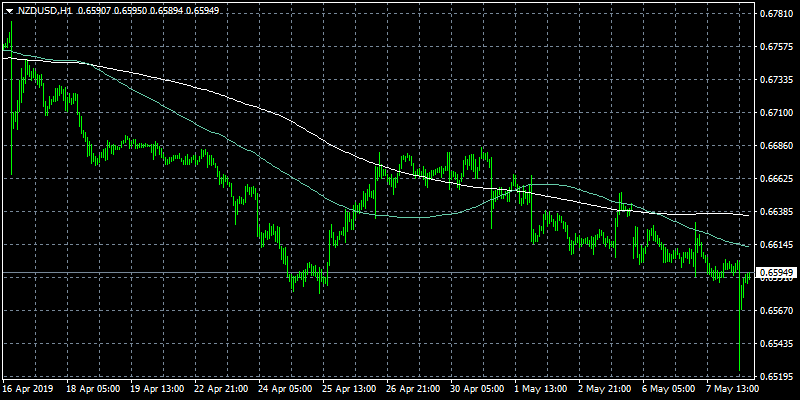

On the Lookout: The Reserve Bank of New Zealand (RBNZ) cut by 25 basis points its Official Cash Rate (OCR) to a new record low of 1.5% amid a weaker economic situation.

Yesterday the Reserve Bank of Australia (RBA) left its Official Cash Rate (OCR) unchanged at 1.50%, where it’s been since August 2016. Board members said they will be “paying close attention to developments in the labour market at its upcoming meetings. Australia’s trade surplus dropped 4% in March, to a seasonally adjusted $4.95 billion (consensus $4.49 billion). The Australian retail sales also beat economist’s expectations.

The ECB President Draghi’s speech will be closely eyed at 11:30GMT for fresh hints on the monetary policy outlook.

In the North Atlantic economic calendar, we have the Canadian housing starts which will be reported at 12:15GMT and the US EIA crude stocks data will be released at 14:30GMT.

Trading Perspective: In forex markets, the US dollar index is flat to 97.15 close to daily lows as traders digest the developments in US-Sine trade war. A stronger US dollar will likely increase the US trade deficit, adding the risk that Trump administration continues to target those nations with a significant trade surplus with the US (China – Germany – Europe). The Aussie dollar trades lower at 0.7020 as RBA kept interest rates unchanged. Kiwi crushed to 0.6524 after RBNZ cut interest rates by 25 basis points and started a slow recovery up to 0.6590.

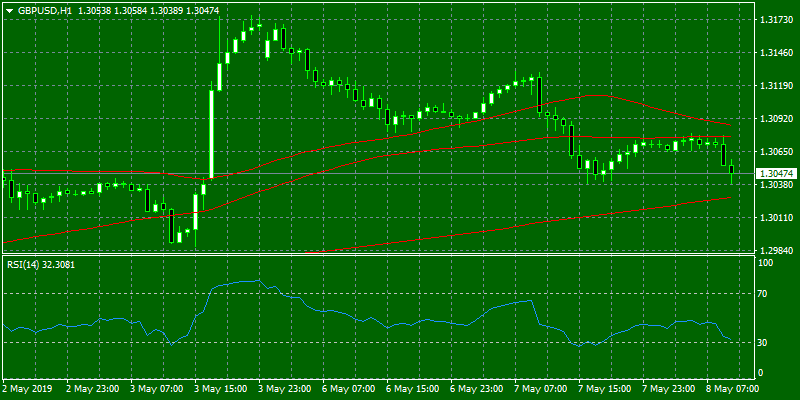

GBPUSD plunged yesterday at 1.3050 amid Brexit uncertainty and today consolidates around mid 1.30 hitting the daily high at 1.3079 and the low at 1.3048. On the downside, major support will be found at 1.2967 where the 200 and 100-day moving averages cross and then at 1.2830, the support line from February. On the upside, immediate resistance stands at 1.3104, the 50-day moving average.

In Pound futures markets, the open interest shrunk for the second session in a row on Tuesday, this time by almost 1.5K contracts. The Volume rose by around 34.2K contracts, partially reversing the previous drop.

EURUSD trades for one more day above and below the 1.1210 figure after the dovish stance from Fed last week. The pair made the Asian high at 1.1212 and the low at 1.1187. Immediate support can be found at 1.1180 the 200-hour moving average while more solid support can be found at the yearly low at 1.1115. On the upside, the immediate resistance stands at 1.1236, the bottom of the horizontal resistance line from the three-month trading range, while more offers will emerge at 1.1268 at the 50-day moving average.

In the euro futures market, open interest increased by 1.8K contracts on Tuesday while volume went up by more than 56K contracts.

USDJPY during the Asian session dropped below the 110 level shortly and rebound above as traders turn their eyes to safe-haven assets amid renewed China-USA trade. Today the pair hit the low at 109.89 and the high at 110.17. The pair will find support at 109.89 the Asian session low. On the upside, immediate resistance for the pair stands at 110.61, the 100-day moving average, and then at 111.33, the 50-day moving average.

In Yen futures, the open interest decreased by nearly 2.6K contracts on Monday from Friday’s final 202,185 contracts. The volume rose for the second straight session, this time by around 34.3K contracts.

USDCAD adds 30 pips today at 1.3461 as stronger prices in crude oil, Canada’s main export item, seems to have added further weakness in the Canadian Dollar (CAD). The pair will find immediate support at the 100-day moving average around 1.3335 while extra support stands at 1.3300 round figure. On the upside, immediate resistance stands at 1.3493 the Asian session high while a break above can escalate the rebound towards the 1.35 round figure.