Summary: The RBNZ started the ball rolling and cut its Official Cash Rate by 0.5%, more than expected, to an all-time low of 1.0%. The Bank of Thailand and Bank of India cut rates, raising concerns about the weak global economy. US President Trump called on the Federal Reserve to cut interest rates more in a tweet. Global bond yields plunged then pulled back at the last hour in New York, reversing sharp falls as dealers squared up. Market volumes were lower amidst choppy trade due to the northern hemisphere summer holidays. The benchmark US 10-year bond yield made an impressive comeback to 1.73% (1.72% yesterday) after plummeting to 1.595%, late 2016 lows.

New Zealand’s Dollar, known by traders as the Kiwi, nosedived to 0.6377 from 0.6525, 3.1/2-year lows before settling at 0.6445. While the Dollar Index (USD/DXY) was little changed at 97.630, it was mixed versus it’s Rivals. The Greenback was lower against the safe-haven Yen (106.22 vs 106.45) and Swiss Franc (0.9755 vs 0.9765). The Euro ended flat at 1.1204 despite weaker German Industrial Production data. The Australian Dollar rebounded to close at 0.6760 (0.6758) after slumping to 0.6677 on the back of the Kiwi’s fall. Yesterday the Dollar gained against the Offshore Chinese Yuan (CNH) to 7.0800 (7.0555).

Wall Street stocks reversed losses to close with modest gains after an initial tumble. The S&P 500 finished at 2,882 (2,878 yesterday) after slumping to 2,824.

The RBNZ cut its Official Cash Rate by 0.5% to 1.00% from 1.50%. Most analysts forecast a 0.25% trim. RBNZ Governor Graeme Orr kept a bearish stance, stating to Parliament that “negative rates are a possibility”. Australian Home Loans slipped -0.9% in July, lower than expected. Germany’s Industrial Production fell to -1.5% in June, much worse than the -0.5% forecast. Germany’s 10-year Bund yield plunged to an all-time low at -0.6% before settling at -0.59%.

- EUR/USD – The Euro ended little changed at 1.1204 after a choppy session. The Single currency fell to an overnight low at 1.11793 on the dismal German Industrial Production report. EUR/USD jumped to a high at 1.1242 after the initial drop in US bond rates.

- USD/JPY – The Dollar plunged to 105.494, fresh 2019 lows before settling at 106.24 on the bounce back in the US 10-year yield.

- AUD/USD – The Australian Dollar had another volatile session, slumping to 0.66768, its lowest since early 2009 after the RBNZ’s move to chop rates. The Aussie then jumped in true Battler fashion on the rebound in risk assets. AUD/USD closed at 0.6760, touching an overnight high at 0.6783.

- NZD/USD – The RBNZ shot the already flightless Bird down after the interest rate chop to 0.63774, near-November 2015 lows. NZD/USD had been sitting at 0.6525 before the move. The Kiwi then rallied with risk to finish at 0.6445, down 1.3%.

On the Lookout: Traders and investors alike will keep their focus on today’s release of China’s Trade data (no scheduled time, normally in early Asian afternoon). Analysts expect China’s July Trade Surplus to narrow to a median CNY 300 billion from June’s CNY 345 billion. In US terms, a surplus of USD 41 billion from USD 50.98 billion. China’s Annual Imports are forecast to have dropped -8.3% from -7.3% in June. Exports are expected at -2.0% from -1.8%.

Japanese Bank Lending, Current Account and Trade Balance as well as Foreign Investment in Japanese stocks and Japanese investment in Foreign Bonds are release prior to the Chinese reports (9.50 am Sydney time).

Euro area sees the release of the ECB’s Economic Bulletin. US Weekly Unemployment Claims and Final Wholesale Inventories round up today’s economic reports.

Trading Perspective: The rebound in stocks and bond yields occurred in thin trading. Easing moves from the RBNZ, Bank of Thailand and Bank of India fed market concerns about the weak global economy. This saw equities and bond yields plummet before mounting a strong comeback. Currencies followed suit and the Dollar Index (USD/DXY) closed much unchanged at 97.63. Expect more volatility as the trade war between China and the US continues to escalate. Traders will also watch the PBOC and their actions today particularly at the CNY Fix. Ranges are being established, albeit wider due to the choppy trade. Which is ideal for FX traders.

- EUR/USD – The Euro ended flat at 1.1204 after trading an overnight range between 1.11793 and 1.12419. Immediate resistance lies at 1.1220 followed by 1.1250. Immediate support can be found at 1.1180 and 1.1150. Euro traders await the release of the ECB’s Economic Bulletin, which will provide insight into the ECB Board’s latest thinking on the economy and interest rates. The Economic Bulletin (previously known as the ECB Monthly Bulletin) is published two weeks after the latest Governing Council meeting. Look to trade a likely range today of 1.1190-1.1260.

- USD/JPY – The Dollar slumped to 105.494, lows not seen since the flash crash in January this year. The fall in the US 10-year yield to 1.595% weighed heavily on this currency pair. The subsequent bounce saw USD/JPY back up above 106, closing at 106.24. The Yen will continue to attract due to its haven status in the current environment. On the bid side of the Dollar, Japanese corporate (importers) buying on dips and a vigilant BOJ will provide support. Immediate support lies at 106.00 followed by 105.70. Immediate resistance can be found at 106.50 and 106.80. Look to trade in a 105.85-106.85 range. Prefer to buy dips

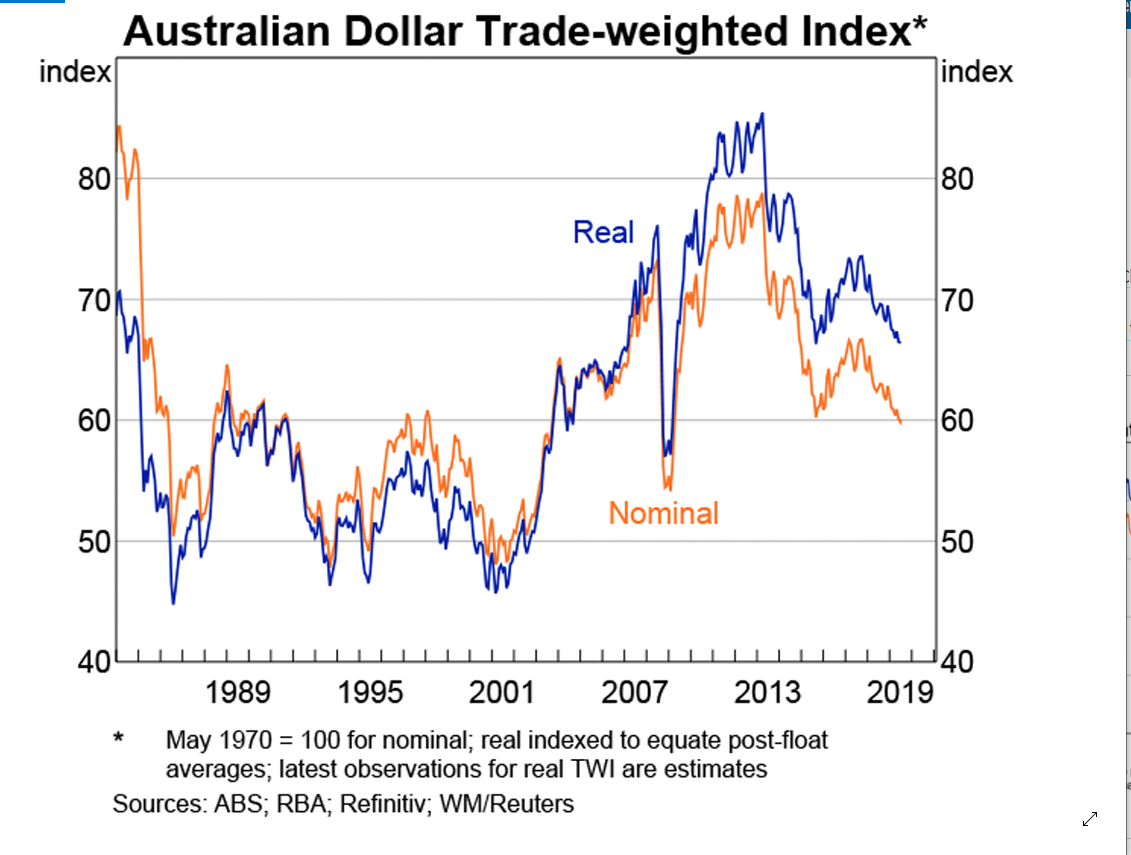

- AUD/USD – the Australian Dollar had a good bounce after plunging on the back of the Kiwi. The Australian Dollar remains oversold despite the heavy feel about it. In typical Aussie Battler fashion, the currency always feels heaviest when its at or near lows. The opposite applies when it’s bid. We highlighted two factors yesterday. That on a Trade Weighted Index, the Aussie is near decade lows as well. While the RBA has advocated a low currency, the Aussie has reached its lower limits. Speculative short Aussie bets are still at near 12-month highs (-AUD 53,442 contracts as at 30 July). Immediate support for the Aussie lies at 0.6730 and .6700. Strong support can be found at 0.6680. Immediate resistance can be found at 0.6780 followed by 0.6800. Look to buy dips in a 0.6740-0.6790 range.

Happy trading all.