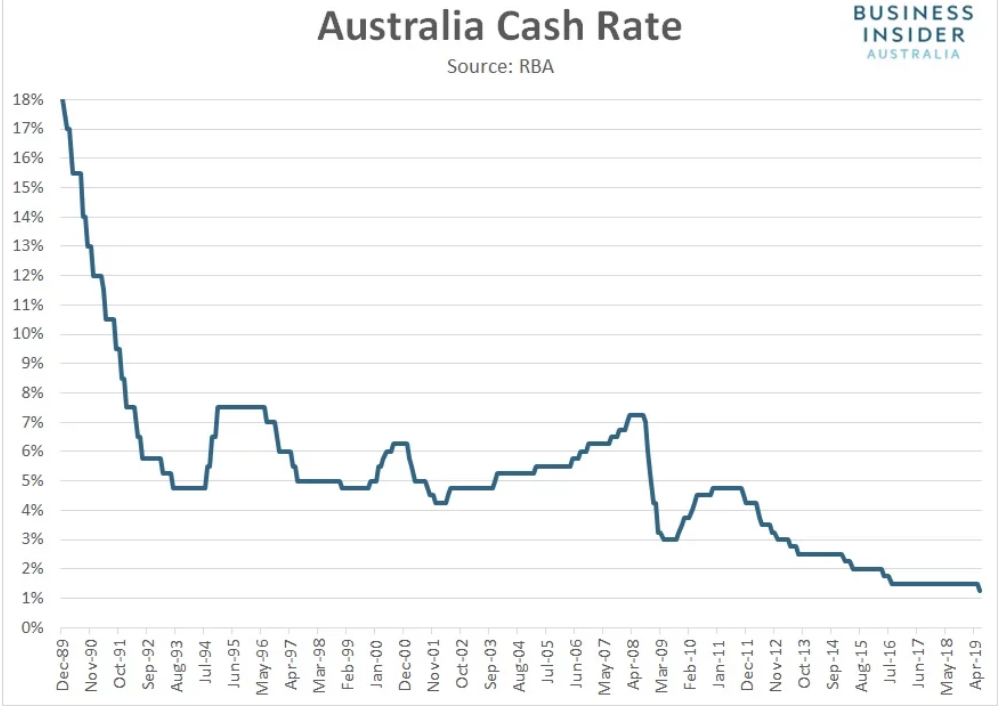

Summary: Jerome Powell restored calm to jittery markets, stating that the US Federal Reserve will respond “as appropriate.” The Fed Chair opened the door for a rate cut in the face of economic risks posed by a global trade war. The Dollar dipped following its move lower yesterday on Fed colleague James Bullard’s dovish comments. A popular measure of the Dollar’s value against a basket of 6 rival currencies, the Dollar Index (USD/DXY) ended modestly lower at 97.123 from 97.243 yesterday. The Euro was a touch higher at 1.1255 (1.1245). The Dollar steadied against the Yen to 108.15 after touching fresh 5-month lows yesterday at 107.84. Sterling rallied to close at 1.2700 (1.2667) amidst a build-up of speculative short Pound bets on Brexit uncertainty. The Australian Dollar was challenging 0.70 cents (0.6978) after the RBA cut rates to 1.25% (1.5%) becoming the first major central bank to cut in 2019. The move was widely expected with speculative Aussie short bets moving to cover.

Wall Street stocks and US bond yields bounced back. The 10-year bond yield rebounded to 2.13% from 2.06% yesterday. The DOW rallied to close at 25,360., up 1.79%.

Australia’s May Retail Sales underwhelmed. Euro area data mostly matched forecasts. Employment data improved. Headline and Core Eurozone CPI were lower. UK Construction PMI for May fell to its lowest level in almost 3 years. US Factory Orders beat forecasts in May but saw a downward revision for April.

- USD/DXY – the Dollar Index steadied to close at 97.123, 0.02% lower than yesterday. Although Powell’s comments were slightly negative, the Greenback already fell yesterday after Bullard’s dovish remarks. The bounce back in the US 10-year bond yield helped stabilise the Dollar.

- AUD/USD – the Aussie Battler dipped initially to 0.6960 from 0.6980 following the RBA’s 0.25% rate cut, which was the first cut in nearly 3 years. The cut had been fully priced into the currency, which had already been climbing against the overall weaker US Dollar. AUD/USD backed off the 0.70 cent mark to end at 0.6993.

- USD/JPY – bounced off fresh 5-month lows at 107.844 to close at 108.15 as stocks and bond yields bounced. There is also a hint of Japanese corporations purchasing US Dollars at the lows just under 108.00.

- EUR/USD – the Single currency closed little-changed at 1.1255 (1.1245), having built most of its gains yesterday.

On the Lookout: While Powell hinted at a conditional easing bias, markets have priced in at least 2 cuts from the Fed this year. The Fed Chair said that he sees the economy growing with unemployment and inflation stable. Several other officials, Evans (Chicago Fed President) and Clarida (Fed Vice-Chairman) reiterated the same message.

Trade tensions eased after US Commerce Secretary Wilbur Ross said in its latest report that the US will take steps to ensure it doesn’t get cut off from the supply of rare earth used in commercial production.

Markets now focus on Friday’s US Payrolls and other primary economic data reports.

Australian Q1 GDP (q/q and y/y) kicks off today’s reports (Sydney, 11.30 am). China’s Caixin Services PMI for May follows. The Euro area and Eurozone report their Services and Composite PMI’s. UK Services PMI, US Markit Composite and Services PMI, and US ADP Employment Change reports are also due. The ECB meets on interest rates tomorrow.

Trading Perspective: Expect the Dollar to hold around current levels supported by higher US yields. Global bond yields, by contrast were mostly flat. Speculative long USD bets were trimmed in the latest COT/CFTC report against the Euro and Yen. In the case of Sterling, the Aussie and Kiwi long USD bets (ie short currencies) were increased. This will constrain the Dollar’s topside. Expect consolidation into the upcoming data reports and Friday’s US Payrolls.

- EUR/USD – a base on the Euro has been formed around the 1.1200 area. Overnight high for the Multi-currency was 1.12774. This puts the immediate resistance at 1.1280. The next resistance level is 1.1310. Immediate support can be found at 1.1230 and 1.1200. The latest COT/CFTC report saw a mild reduction of speculative Euro short bets to -EUR 99,691 from -EUR 101,102. Look to buy dips with a likely range today of 1.1230-1.1280.

- AUD/USD – The Aussie Battler challenged 0.70039 (overnight high) before settling at 0.6993. Australia’s Q1 GDP report as well as China’s Caixin Services PMI are out today. AUD/USD has immediate resistance at 0.7000 (mild), 0.7030 and 0.7060. Immediate support can be found at 0.6960 and 0.6930. The latest COT/CFTC report saw a modest increase in net speculative Aussie bets to -AUD 66,393. RBA Governor Philip Lowe has adopted a “steady as she goes” approach to recent global trade and economic development. Australian economists, meantime, are still calling for at least one more cut this year, possibly two. Look to trade a likely range of 0.6965-0.7015. Prefer to buy dips.

- USD/JPY – After falling to 5-month lows, the Dollar has steadied against the Yen. Risk aversion fears have been calmed by Jerome Powell and his colleagues. US 10-yaer bond yields have bounced off their lows and further away from the 2.0% mark. At least for now, until Friday’s US Payrolls. Japanese corporations who need to purchase the Greenback have found a spot around the 108.00 level. USD/JPY has immediate resistance at 108.00 and 107.80. Immediate resistance can be found at 108.40 (overnight high 108.357) and 108.80. Look to trade a range today of 108.00-70. Just trade the range shag on this one.

Happy trading all.