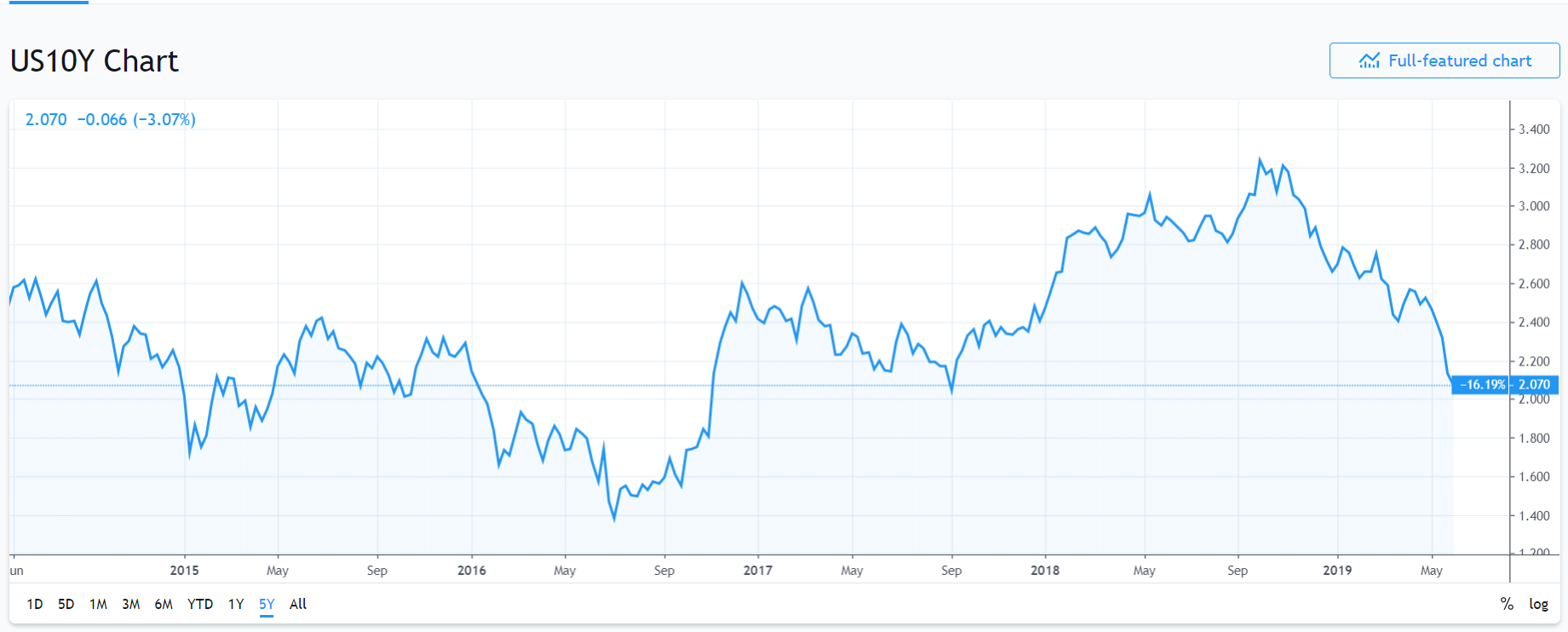

Summary: The Dollar weakened for the second day running weighed by comments from St. Louis Fed Reserve Head and FOMC member James Bullard. Bullard, a noted dove, said that “an interest rate cut may be warranted soon.” US ISM Manufacturing Activity slowed in May to its weakest level since October 2016 as the trade war with China raised concerns among factory managers. The benchmark US 10-year bond yield extended its drop to 2.07% from 2.12%. Two-year yields plummeted to 1.83% from 1.92%. A popular measure of the Dollar’s value against six major currencies (USD/DXY) was 0.40% lower to 97.216 (97.60). The Euro settled higher near 3-week highs at 1.1244, up 0.7% from 1.1170. USD/JPY slipped to 108.08 (108.32) while Sterling rose to 1.2667 (1.2630) on the broad-based Dollar fall. The Australian Dollar rallied to 0.6975 (0.6935) on short covering as the RBA is widely expected to cut interest rates by 0.25% later today.

Wall Street stocks steadied. The DOW finished at 24,897 (24,800) while the S&P 500 was little changed at 2,754.

China’s Caixin Manufacturing PMI in May matched April’s, slightly better than forecasts. German and Eurozone Final Manufacturing PMI’s matched forecasts. Factory output in the UK underwhelmed expectations.

- EUR/USD – The Euro rallied to an overnight high of 1.1262 before settling at 1.1246, up 0.75% from 1.1170 yesterday. Increasing expectations of a Fed rate cut lifted the Euro to 3-week highs. Euro area manufacturing PMI’s mostly matched forecasts.

- USD/JPY – eased further to close at 108.07 in New York after trading to 107.882 overnight and January 2019 lows. The extended fall in US bond yields and risk aversion continue to support the Japanese currency.

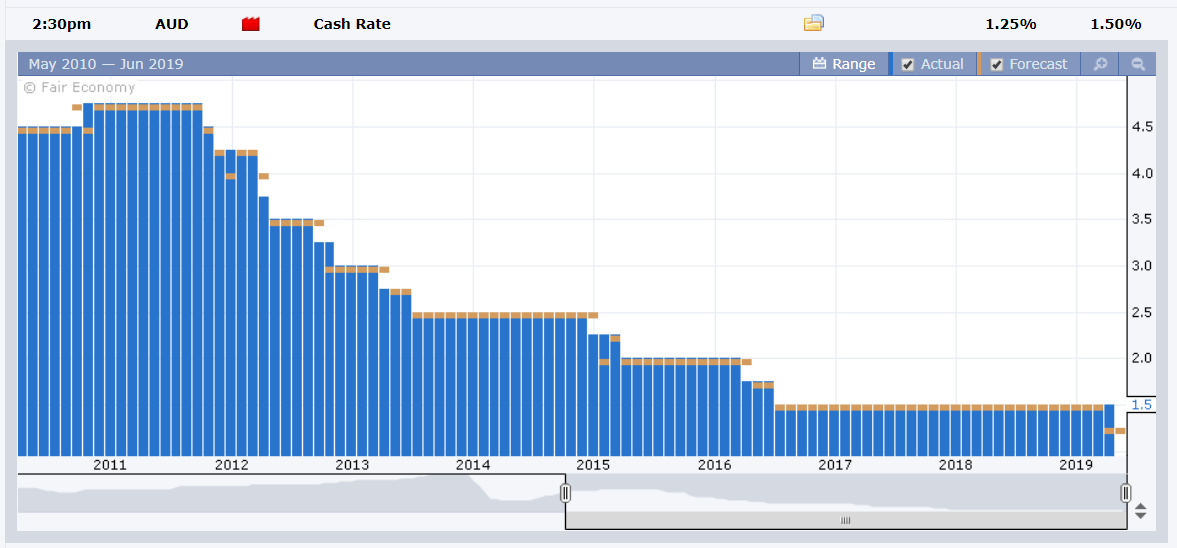

- AUD/USD – The Aussie Battler continued to grind higher boosted by short-covering into today’s RBA rate decision. Before that Australian Retail Sales in May are forecast to have declined from April. An RBA rate cut of 0.25% is already in the currency. Traders will focus on the RBA rate statement where guidance is key as to future rate moves.

On the Lookout: Today’s events are key to the next short term move for the Dollar and currencies. Volatility has picked-up as US yields accelerate to the downside. Federal Reserve Chair Jerome Powell speaks in Chicago (11.55 pm Sydney) on Federal Reserve policy, tools and communication strategy at an event hosted by the Chicago Federal Reserve Bank. Powell’s speech could be pivotal on the outlook for US interest rates, and the Dollar.

Before that, Australia starts off with May Retail Sales and Current Account. The RBA interest rate decision follows with the cash rate widely expected to be trimmed to 1.25% from 1.5%. The RBA’s policy statement follows. Later in the evening (7.30 pm Sydney) RBA Governor Philip Lowe speaks at an RBA Board dinner in Sydney. Audience questions are expected.

European reports start with Spanish Unemployment Change, Italy’s Unemployment Rate as well as Eurozone Flash Headline and Core CPI data. Eurozone Unemployment Rate rounds up todays data reports.

Trading View: Expect the Dollar to consolidate its losses today ahead of Jerome Powell’s key speech in Chicago. Bullard’s remarks weighed on the Dollar, already on the decline due to falling US bond yields. However, Bullard is a known dove on interest rates. Tonight, apart from Jerome Powell, New York Fed Reserve President and FOMC member John Williams speaks in New York.

- EUR/USD – The Multi-currency traded to an overnight and 3-week high at 1.1262 before easing to 1.1245 at the New York close. The Euro has immediate resistance at 1.1260 which should hold on the day. The next resistance level lies at 1.1280 and 1.1310. Immediate support can be found at 1.1220, which was the previous resistance. The next support level at 1.1180 should be strong. Expect consolidation within a 1.1220-70 with the preference to buy dips as market positioning is still short of Euro bets.

- USD/JPY – The Dollar ended lower against the Japanese currency although the Dollar’s fall was cushioned as stocks steadied. The US ten-year yield fell another 5 basis points to 2.07%. This should limit the topside to immediate resistance at 108.40. The next resistance level can be found at 108.80. Immediate support lies at 107.85/90 (overnight low 107.88) followed by 107.70. The next support level is at 107.30. Expect Japanese importer buying to present itself again today around the 107.80/90 region. Which will keep a base to this currency pair in the short term. Look to trade a likely range of 107.90-108.90.

- AUD/USD – The Aussie rallied on the back of the generally weaker US Dollar and short-covering ahead of today’s RBA interest rate decision. The Australian central bank is widely expected to cut its Cash Rate for the first time in 3 years by 0.25% to 1.25%. Traders will focus on the Rate Statement for key guidance as to future rate moves. Should the RBA leave rates unchanged, expect a spike to 0.7020 first up until the Statement, and guidance is released. Should the RBA’s guidance reveal more cuts ahead, the Aussie will drift lower to initial supports at 0.6880. If the RBA lowers rates but is not committed to future rate cuts, the currency, already oversold, could spike as high as 0.7080/0.7100 before settling. Immediate resistance lies at 0.7000 and 0.7040. There is good support at 0.6930 followed by 0.6900. Prepare for some fireworks in the Battler today. The Aussie market is short so look to buy on dips.