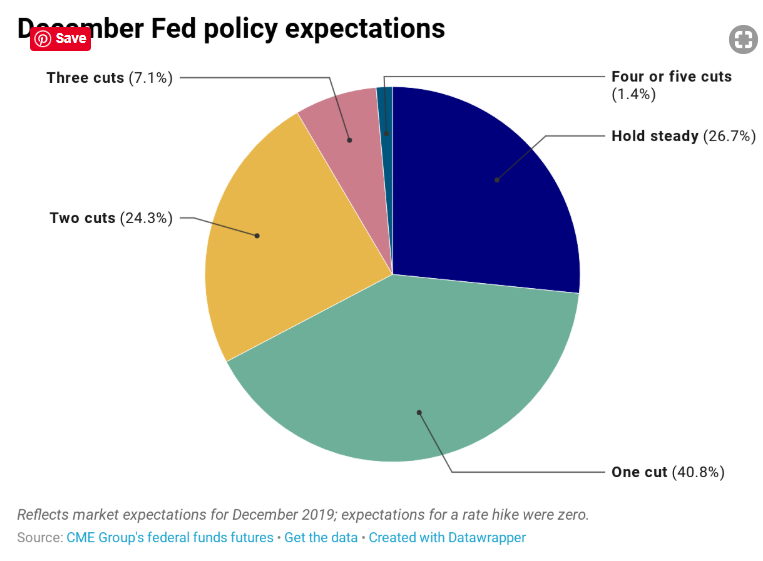

Summary: US treasury yields collapsed, extending May’s steep declines after US President Trump’s new tariff threats on Mexican exports drove a flight-to-safety. The benchmark US 10-Year bond yield collapsed 9 basis points to 2.12%. Two-year US yields plummeted to 1.92% from 2.06%, a whopping 14 basis points. Trump also threatened to end an arrangement that allows Indian exports of almost 2,000 products tax free. The US President threatened to impose an initial tariff of 5% on all Mexican goods, lifting them higher unless the flow of illegal immigrants across the border ceased. Haven demand boosted the Yen 0.98% against the US Dollar to 108.32 and lifted the Swiss Franc 0.64% to 1.0010 from 1.0080. The Dollar Index (USD/DXY) which stayed close to 2-year highs last week, slumped 0.54% to 97.60 from 98.17 on Friday. The Euro rallied 0.24% to 1.1168 while the Australian Dollar rose to 0.6935 (0.6911). Sterling finished with mild gains against the overall weaker Greenback to 1.2630. The Mexican Peso plummeted 2.5% against the Dollar. The collapse in US yields steadily weakened the Greenback against other EM Currencies. USD/TRY slumped 1.34% (5.8400) while USD/ZAR dropped 1.14% to 14.58. Market expectations of a Fed rate cut in 2019 due to a much weaker economy than anticipated from the trade war continued to grow.

The DOW slid 1.5% to close at 24,798 (25,190). The S&P 500 finished at 2,752 (2,790), 1.35% lower.

- USD/JPY – The Dollar gave way to the previous 109.00 support area which has held since February. Late Friday, markets melted on risk-off following Trump’s Mexican tariff threat. USD/JPY plummeted to 108.277 overnight lows before settling at 108.32 at New York’s close. The collapse in the US 10-year yield also weighed heavily on this currency pair.

- EUR/USD – The Euro lifted to 1.1170 after having held strong support levels at 1.1100 since late April. Overnight low for the Single Currency was 1.11252. Germany’s 10-year bond yield finished 2 basis points lower at 0.88% in contrast to the drop in its US counterpart.

- AUD/USD – Despite widespread expectation that the RBA will cut its cash rate from 1.5% this week for the first time in 3 years, the Aussie held on to 0.69 cents. AUD/USD closed at 0.6935 (0.6911 Friday), up 0.37%.

- USD/DXY – The Dollar Index dropped 0.54% to 97.60 after US bond yields capitulated. Markets are beginning to reassess the impact of Trump’s trade wars on the Dollar, and the US economy. The Fed is now more likely than ever to cut rates in 2019. The worm is turning for the Greenback.

On the Lookout: The week begins with today’s data-dump that could add further volatility to the currencies. Tomorrow’s (Tuesday) highlight is the RBA policy meeting, where the Australian central bank is widely expected to but the cash rate from 1.5% to 1.25%. Fed Reserve Chair Jerome Powell speaks at an event hosted by the Chicago Federal Reserve on Tuesday evening (Sydney time). Australia’s Q1 GDP report will be Wednesday’s highlight. The European Central Bank monetary policy meeting and rate statement is Thursday. Friday sees the US May Non-Farms Employment report which markets will watch closely.

Today’s data sees Australian AIG Manufacturing Index, Company Operating Profits and ANZ Job Ads, mostly secondary data. Japan releases its Capital Spending, and Final Manufacturing PMI reports this morning. Asia’s big number will come from Chinese Caixin Manufacturing PMI (May).

Euro-area and Eurozone Final Manufacturing PMI’s start off Europe’s data reports. UK Manufacturing PMI rounds up European reports. Canada reports its Manufacturing PMI. US Final and ISM Manufacturing PMI’s as well as Construction Spending finish the today’s data releases.

Trading Perspective: Friday’s Dollar drop could be a turning point for the Greenback. The collapse in US yields will erode support for the currency. Without yield support, the Dollar will struggle. The trade war will eventually make its way to the US economy and the Fed will have no recourse but to cut interest rates. Lastly the market’s positioning is still long of US Dollar bets. The latest COT/CFTC report (week ended 28 May) saw net total speculative USD longs trimmed to +USD 92,400 contracts from +USD 100,800. Net Euro short bets were pared. GBP short bets increased while JPY and AUD shorts were little changed.

- USD/JPY – The Dollar should see Japan Inc to the rescue with the 108.00 level now their new buying support level. In January 2019 following the flash crash, USD/JPY held and stabilised around the 108.00 area before climbing on overall Dollar strength. On the day, USD/JPY has immediate support at 108.20 (overnight low 108.277) followed by 108.00. Immediate resistance can be found at 108.70 followed by 109.00. Expect some verbal support from Japanese officials should the Dollar slide further. Look to trade a likely range of 108.20-108.80 today. Prefer to buy dips at current levels.

- EUR/USD – The Euro held the supports near the lower 1.1100 area well and should be poised for a topside test of 1.1200. The latest COT/CFTC report was net speculative EUR short bets trimmed to -EUR 92,400 contracts (week ended 28 May) from -EUR 100,800. Total net shorts are still at multi-year highs. EUR/USD has immediate support at 1.1150 and 1.1125. Immediate resistance can be found at 1.1200 followed by 1.1230. Look to buy dips with a likely range of 1.1150-1.1250 today. Prefer to buy dips.

- AUD/USD – The Aussie Battler has held above 0.6900 cents after testing the 0.6860 level last week. Expectations of an RBA rate cut tomorrow have not taken away any support from the Aussie. The latest COT/CFTC report saw net speculative Aussie short bets at 66,400 from the previous week’s -AUD 66,100. Market positioning remains short, and the risk is higher once the RBA trim rates tomorrow. The overall weaker US Dollar and lower US yields have emerged as big supports for the Australian Dollar. Immediate resistance lies at 0.6950 (overnight high 0.6944) followed by 0.6980 and 0.7010. Immediate support can be found at 0.6910 followed by 0.6890. Look to buy dips with a likely range today of 0.6915-75. Prefer to buy dips.

Have a good week ahead, happy trading all.