Summary: The New Zealand and Australian Dollars outperformed in FX, as the antipodeans lead the fight against Covid-19 with their ability to control the spread. Both countries will be easing restrictions are set to gradually restart their economies in the weeks to come. The Kiwi (NZD/USD) surged 1.39% to 0.6010 (0.5955) while the Aussie (AUD/USD) was up 1.11% in late New York trade to 0.6372 (0.6322). Australian Prime Minister Scott Morrison declared that with the current rate of decline, Covid 19 could be eliminated from the country. Against the Canadian Loonie, the US Dollar eased 0.79% to 1.4075 (1.4150) as oil prices extended their recovery. While the Loonie was boosted by the climb in Oil, the economic outlook in Canada is still dour. Worse than expected Euro area and Eurozone PMI’s weighed on the Euro, which slipped further against the Greenback to 1.0775 (1.0820). The European Union EC leaders meeting ended without an agreement which also put the shared currency on slippery ground. Sterling finished little changed at 1.2345 from 1.2335 yesterday. The USD/JPY pair dipped to 107.65 (107.75). Wall Street stocks declined after a data leak showed that trials from a virus drug (Gilead) had no benefit among coronavirus patients. The Dow closed at 23,487 (23,490) while the S&P 500 was last at 2,793 (2,800). Data released yesterday saw global Manufacturing and Services PMI’s decline sharply, most missing forecasts. The Eurozone’s Flash Manufacturing PMI fell to 33.6 from 44.5 the previous month, and worse than the median estimate of 38.7. Germany’s Manufacturing PMI dropped to 34.4 from 45.4, underwhelming forecasts at 39.0. Germany’s GFK Consumer Climate plunged to -23.4, against forecasts of -1.9, and a downward revision of the previous month’s 2.3 (2.7). The number of American workers filing for Unemployment benefits in the latest week numbered 4.427 million, and while an improvement from the previous week’s revised 5.237 million (5.245 million), still brought the 5-week total of jobless in the US to 26.45 million.

On the Lookout: The leak that resulted from a mistakenly uploaded report on the World Health Organisation’s website which reported that the hopeful Gilead drug Remdesivir failed to have any benefit for coronavirus patients in China hit risk sentiment at the end of the New York trading day. The spotlight now points to the economies which can restart earliest. Which will lessen the need for stimulus and enable interest rates in those countries to stabilise, even edge higher. For now, Oceania leads the race.

Markets will focus on the economic data today and the coming weeks. Today’s data releases start with Japan’s National Core CPI (annual) report, SPPI (Services Producer Price Index, a leading indicator of consumer inflation) and All Industries Activity for April. Two primary economic reports out of Europe are the UK’s Retail Sales and Germany’s IFO Business Climate for April. The US report their Headline and Core Durable Goods Orders and the University of Michigan Consumer Sentiment and Inflation Expectations Survey. Next week the BOJ, ECB and FED FOMC hold their policy meetings.

Trading Perspective: Expect the Euro to remain the underperformer in FX with the commodity currencies maintaining a bid. The failure of European leaders to agree on the size and shape of a much-needed rescue package is providing uncertainty and will continue to weigh on the shared currency. Meantime, the economic data out of the US still paint a grim picture.

The Dollar will continue to trade mixed against its rivals. Look for opportunities at either end of the recent established ranges and get your levels established. Expect further volatility which provide one with opportunities.

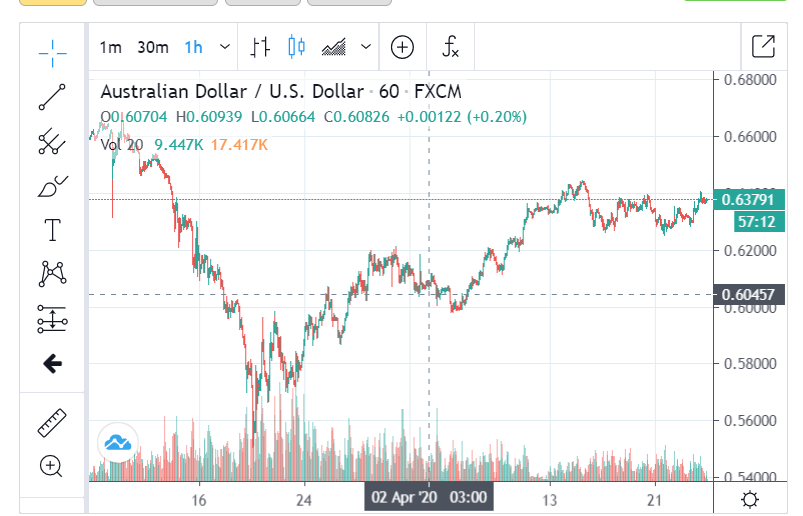

AUD/USD – Grinding Higher on Covid-19 Success, 0.6450 Next

The Australian Dollar continued its recovery following Australia’s effectiveness in controlling Covid-19 with the economy ready to restart gradually. The Aussie is best positioned to gain from any sustained US Dollar weakness. Positive risk sentiment will continue to buoy the Aussie Battler. The Australian government will slowly ease restrictions on education and key health services next week. Children will be allowed to return to schools on May 11.

AUD/USD traded to an overnight and fresh weekly high at 0.64063 before easing to settle at 0.6372 in late New York. The overnight low traded for the Aussie was 0.62827. In the short term, a retest of the 0.6450 immediate resistance level is on the cards. A sustained break of 0.6450 will see 0.6500 and eventually 0.6600 tested. Immediate support can be found at 0.6280 followed by 0.6230. Look to trade the range today which is likely 0.6320-0.6450 first up.

EUR/USD – Lows Holding Up, 1.0750-1.0850, Sell Rallies

The Euro declined anew after the release of worse than expected Euro area and Eurozone Manufacturing and Services PMI’s. The European Union failed to agree on a much-needed rescue package which creates uncertainty. Currencies hate uncertainty. German Chancellor Angela Merkel signalled that she is open to a large financial support package worth EUR 2 trillion but wants to see how it would be used before committing. French President Emmanuel Macron wants funds to be transferred to the hardest hit regions and not just loans. Reuters reported Macron said that “disagreements over the size and the shape of the rescue package persisted.”

EUR/USD slid to 1.07560 before climbing to settle at 1.0777, a loss of 0.30% (1.0820 yesterday). EUR/USD has immediate resistance at 1.0830 followed by 1.0880. Immediate support can be found at 1.0750 and 1.0720. The next direction for the Euro will depend on where the US Dollar heads. Meantime the lack of an agreement among European leaders on a rescue package which is urgently needed will weigh on the shared currency. Look for a likely trade of 1.0750-1.0850. Prefer to sell into strength.

USD/JPY – Eases Further, BOJ Meeting Next Week, 107.00-108.50

The US Dollar eased modestly against the Yen to finish in late New York at 107.65 (107.75 yesterday). Earlier in the New York trading day, a report from Japan’s Nikkei that the Bank of Japan will discuss scrapping its cap on government bond purchases at its policy meeting next week (27 April) saw USD/JPY spike to 108.042 overnight highs.

The release of weak US data weighed on this currency pair. The number of Americans who claimed Unemployment benefits reached 4.427 million bringing the 5-week total to 26.45 million. Which effectively cancels out all the new jobs created over the past 10 years. USD/JPY slipped to 107.347 before climbing to settle at 107.65.

USD/JPY has immediate resistance at 108.00 followed by 108.50. The big resistance level is at 109.00. Immediate support can be found at 107.40 and 107.10. Look for a likely range today of 107.40-108.40. Prefer to buy dips.