1. Introductory remarks

The Chair confirmed that the November 2019 SLC minutes were published on the Bank of England website.

2. Update from the International Securities Lending Association (ISLA)

The Chair invited the ISLA representative to provide an update on recent ISLA developments

ISLA updated on the size and composition of the securities lending market. The value of the global securities lending market (on loan) is estimated at just over €2 trillion. EU lenders represent one third of the global total, with bonds representing 55% of loans and equities 42%. There is in excess of €17 trillion of securities available in lending programmes globally, and the lending of government bonds now represent 45% of securities on loan globally.

Over 75% (circa €11 trillion) of supply comes from institutional investors. Mutual/retail funds represent 48% of lendable assets, but only 16% of the total securities on-loan. Sovereign insurers (including sovereign wealth funds) represent 6% of lendable assets, but 12% of the total securities on-loan.

ISLA noted that there has been a migration from cash to non-cash collateral. Non-cash collateral represents over 65% of all transactions globally. There has also been a decrease of corporate bonds as non-cash collateral. Non cash collateral represents over 65% of all transactions globally and as high as 90% in European Government bond lending.

ISLA set out the current drivers of the securities lending market.

First, there has been a drift towards passive asset management. For example, Fidelity has launched a zero fee trackers funds in the summer on 2018.

Second, the Environmental, Social and Governance (ESG) agenda is gaining momentum, with governance being a key component in the UK market regarding lending to vote and recalling. This brings about the question of whether lending can sit comfortably alongside a good corporate governance structure.

Third, there has been a focus on cost dynamics within the asset management industry, as securities lending can add to fund performance or reduce cost base.

Fourth, the implementation of mandatory transparency with Securities Financing Transactions Regulation (SFTR) has meant that investors have institutional confidence to revisit securities lending.

3. Update on the Securities Financing Transactions Regulation (SFTR)

The Chair provided a brief update on recent SFTR developments, noting that Level 2 reporting is now finalised and entered into force on 11 April. ESMA has held a consultation on draft guidelines.

ISLA noted that they have a group working on a unified response to the consultation on behalf its members, and that they have been having an open dialogue with ESMA. ISLA have also been producing best practice around data fields and life cycle events.

Members noted that the final ESMA Q&As are not expected until the end of the year, which creates a challenge as participants cannot build systems functionalities until they know what they’re building to.

Members noted that individual firms have been trying to interpret the RTS. There have been consistent conversations around data and the interpretation of fields, as firms try to ensure that all participants are using the same vocabulary and understanding the timing and sequencing of reporting. One bank noted the importance of client education on communication and fees especially for those that are out of scope (e.g. US clients).

SFTR implementation hurdles include agreeing models with the counterparty, receiving the data, and also building systems to incorporate data points that are alien to securities lending, such as timestamps on trades.

Members suggested around 25% of collateral is ineligible under SFTR because they do not have LEIs. ISLA believes that LEIs should be optional for collateral.

Members raised the point on control and management of data provided through SFTR, as vendors might find it interesting due to its high quality. Members agreed to discuss the commercialisation of SFTR data at a future SLC meeting.

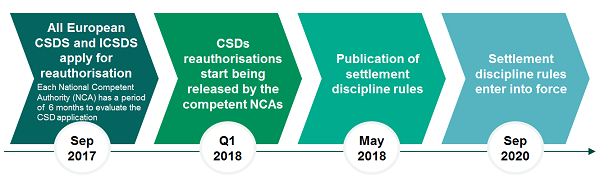

4. Update on the Central Securities Depositories Regulation (CSDR)

The chair provided a brief update on CSDR developments.

The European Repo and Collateral Council (ERCC) recently noted a concern with central counterparties (CCPs) and buy-in provisions due to a lack of harmonisation between the CCPs. The European Securities and Markets Authority (ESMA) is investigating and is also proposing a best practice for the non-cleared market. ESMA is looking at a proposal from industry in simple flexible multi-international CSD mechanisms, and the International Capital Market Association (ICMA) has asked them to lead this effort.

The industry is working with Linklaters on Article 25, and members noted that any firm choosing to settle transactions in Europe will be required to comply with it. It was noted that this could have a negative impact on the amount of securities lending undertaken within the EU.

4.a. Settlement fails

Gilt fails have decreased in numbers and value over the last financial year. If gilts are being lent against equity baskets, they tend to fail slightly more than standard repo.

The CCP view is that settlement fails have stabilised dramatically from January this year. For example, the average fail rate at a large UK CCP last year was 2.5% from a peak of 4% in October. The current fail rate was said to be lower at 1.5-2%.

The main driver for this is that CCPs have strengthened their escalation process (as fails are more likely in cleared trades than in the bilateral market).

One large bank noted that they have seen negligible fails in UK in repo and in outright cash gilts.

5. Update on pledge/the Global Master Securities Lending Agreement (GMSLA)

The Committee had discussed pledge structures at its previous meetings, as some institutions are operating pledge-type structures. Firms in this space are looking and actively moving to the market standard together with their own annex.

Some members are seeing a gradual shift away from bespoke arrangements into the global master agreement.

ISLA noted that there are elements to the pledge structure that are not yet finished. When the pledge discussion was ongoing 3-4 years ago, markets were operating with higher leverage and there was a higher use of balance sheet and risk-weighted assets (RWA). Now, participants are creating as many tools in their arsenal as possible which can be deployed when and if needed.

The Committee also noted also the broader discussion on routes to market (central clearing, peer-to-peer) instead of just pledge or title transfer. This was set out as a possible better way of taking the pledge discussion forward.

Members also noted that there has been a shift in dynamics from just looking at the price of the transaction to the embedded cost structure of running a securities lending organisation. Only large players are now able to move into this market as it is a volumes-business, with some members noting the associated concentration risk.

Clifford Chance provided an update on the use of pledge structures in Securities Lending markets and GMSLA documentation. In summary, they noted that there is still more scope for the market as a whole to understand GMSLA, which is making the take-up slower.

6. Best execution in Securities Lending markets

Members raised the question of how best execution is defined in securities lending markets. In particular, it was noted that there are difficulties in comparing across clients as there are variables, such as collateral type, that could influence returns. Therefore best execution should be interpreted in relation to the client mandate. One member noted that client and lenders’ incentives are aligned as lenders take a percentage of revenue.

One member also raised the question of how to demonstrate best execution. ISLA mentioned the Performance Management working group which is having ongoing

discussions with data providers to look into the data and how to best achieve a fair representation of performance. It was also noted that the Money Market Code also covers best execution in spirit of treating clients fairly. Members agreed to revisit this issue at the next meeting.

7. Diversity and inclusion in Securities Lending markets

The discussion focused particularly on gender diversity in Securities Lending markets. Members also noted that although there is a better gender ratio at junior levels, there is a lack of women in senior positions in securities lending, and in the Committee itself.

Members noted that there have been changes into how their firms recruit into talent pools and that there have been efforts to create a more flexible workplace. One bank, for example, has started using a scanning tool in their job ads to prevent unconscious gender bias. Another raised the importance of linking performance in the workplace to the extent that employees promote diversity and inclusion. This can be achieved, for example, by having diversity and inclusion competencies as part of performance management.

Members agreed that there should be a focus on development and retention as well as recruitment.

Members agreed that gender diversity in securities lending markets should continue to be addressed by the Committee and agreed to return to this topic regularly.

8. Forward agenda items

The Committee agreed that the Impact of Environmental, Social and Corporate Governance on Securities Lending markets; Alternative routes to market (peer-to-peer, pledge, client clearing); and SFTR/CSDR should be included in the Committee’s forward agenda.