Asian stocks finished lower today as comments from Chinese Foreign Minister Geng Shuang stated that US President Donald Trump is misleading people when it comes to trade deals, which dampened the mood. The Nikkei225 ended 0.31 percent lower at 21,469, the Hang Seng finished 0.28 percent lower at 28,539. The Shanghai Composite ended 0.12 percent lower to 2,934, while in Singapore the FTSE Straits Times index finished 0.07 percent lower to 3,358.

Australian equities snapped a three-day losing streak, with the ASX 200 up 0.49 percent to 6673.3 after the Australia Westpac Leading Index, month over month, declined to -0.1% in June from the previous reading of -0.08%. The Westpac Leading Index, month over month, came in at -0.08% for June. RBA Board minutes released yesterday for the July meeting. The central bank cut interest rates for the second straight month by 25bps to support the job market. In the minutes, the RBA Board admitted it would take ‘some time’ to erode spare capacity in the labor market.

European equities started the day slightly mixed, DAX30 is flat to 12,429, CAC40 is 0.01 percent lower at 5,613 while the FTSE MIB in Milan is trading 0.09 percent higher at 22,225. The London Stock Exchange is 0.15 percent lower to 7,565 amid non-deal Brexit worries.

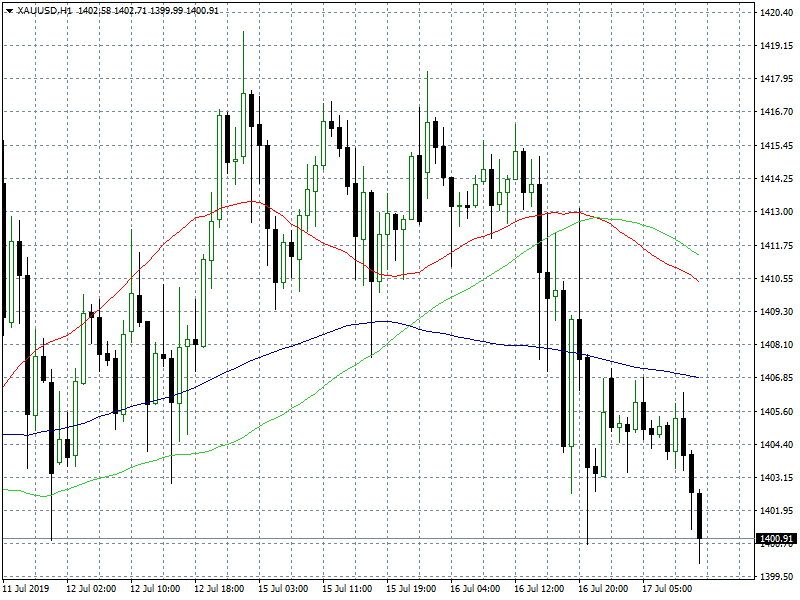

In commodities markets, crude oil trades 0.15 percent higher at $57.70 as traders turn cautious on recent highs. Brent oil trades 3.20% higher at $64,37 per barrel despite major oil producers have agreed to cut output. Gold trades lower at 1,403 keeping the bullish momentum as the price holds above all the major daily moving averages. On the upside, strong resistance will be met at 1,427 the daily high and then at 1,437 recent high.

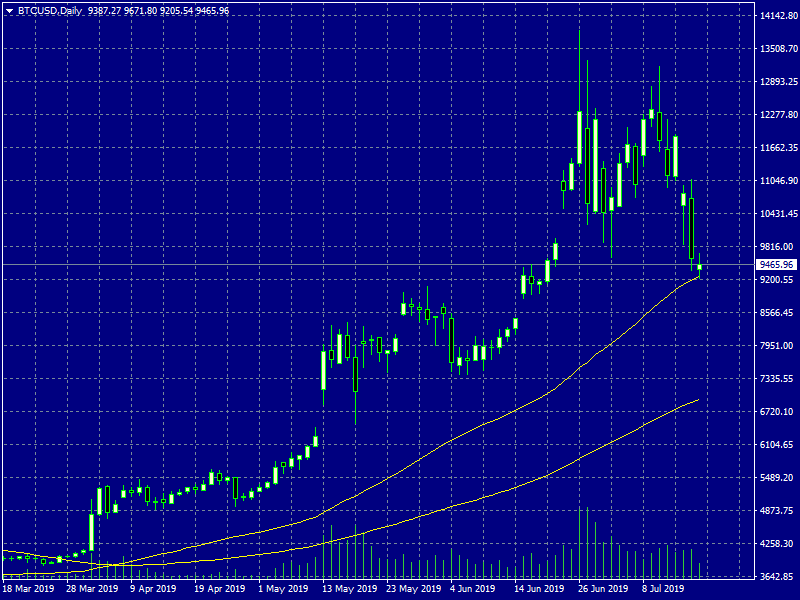

In cryptocurrencies market, after comments from President Trump that he doesn’t like bitcoin and other cryptocurrencies last Friday, bitcoin (BTCUSD) continues its trip south to 9,456, hitting the daily low at 9,205 and the daily high at 9,671. Immediate support for BTC stands now at $9,205 today’s low while next support stands at 9000. On the upside, strong resistance now stands at 13,138 the high from Friday and then at 13,500 round figure. Ethereum (ETHUSD) gives up over 20 dollars and trades at 201 with capitalization now to 21.6 billion, on the upside the immediate resistance stands at 317 Friday’s high while the support stands at 200 the 100-day moving average, Litecoin (LTCUSD) also trades lower down 10 dollars at 79.72. The crypto market cap now stands above $256.3 billion.

On the Lookout: The Fitch Ratings agency affirmed Japan’s Long-Term Foreign-Currency Issuer Default Rating at ‘A’ with a stable outlook. The Australia Westpac Leading Index, month over month, declined to -0.1% in June from the previous reading of -0.08%. The Westpac Leading Index, month over month, came in at -0.08% for June.

The International Monetary Fund, cut its 2019 economic growth forecast for Singapore to 2% from 2.3% as global trade war escalates. IMF expects Singapore’s economic growth to stabilize around 2.5% over the medium term.

In the US trading session, we have the US MBA mortgage applications for the week ended on 12 July. The weekly US housing data measures the difference in the number of applications for mortgages backed by the MBA during that week. Traders follow the MBA mortgage applications as they can get an idea of the housing sector sentiment. Oil traders will look for EIA Crude Oil Stocks Change at 14:30GMT, while the Fed Beige Book is due at 18:00.

Trading Perspective: In forex markets, USD trades 0.03 percent lower at 97.34, the Aussie dollar trades lower at 0.7007, while Kiwi trades higher at 0.6724.

GBPUSD consolidates around 1.24 area after yesterday was under selling pressure despite the better wages data. Major support now stands at 1.2381 today’s low which if broken might accelerate the slide further towards 1.23 round figure. On the upside, immediate resistance now stands at 1.2662, the 50-day moving average, while more offers will emerge at 1.2888, the 200-day moving average.

Sterling futures markets open interest increased by 3,415 contracts while volume increased by 55,500 contracts.

EURUSD trades at weekly low around 1.1210 and eyes the 1.12 mark which if the pair manages to close below will open the way to yearly low. On the upside, immediate resistance for the pair stands at 1.1238 the 50-day moving average while extra resistance will be met at 1.1283 the high from Monday.

Euro futures markets open interest increased by 8,300 contracts while volume increased by 46,500 contracts.

USDJPY is trading 0.01 percent lower at 108.23 having hit the daily low at 108.10 and the daily high at 108.32. USDJPY pair will find support around 108 round figure and then at 107.50. On the upside, immediate resistance for the pair now stands at 108.98 the recent high and then at 110.04 the 100-day moving average.

USDCAD finally manages to rebound from the lows around 1.30 close to yearly low above 1.3054 amid broadly USD strength, and the retreat in crude oil prices, Canada’s main export item seems to have added further weakness in the Canadian Dollar (CAD). The pair will find immediate support at 1.3017 the YTD low while extra support stands at 1.30 round figure. On the upside, immediate resistance now stands at the 1.32 zone before an attempt to 1.3450 recent high from 31st May.