by Giles Coghlan, Chief Market Analyst, HYCM

Precious metals are having a difficult time in an environment of dollar strength and rising rates. Gold has held up relatively well, especially when priced in euros, yen, or sterling. But it’s when you look at silver that you really get a sense of how bearish sentiment has gotten.

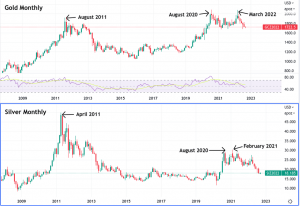

The recent sell-off in silver has broken all support levels that the precious metal established since the pandemic, taking it down to the levels it was trading at before the COVID-19 crash. Meanwhile, at the time of writing, gold is still clinging to a support level it established last March and is edging closer to its 200-week moving average.

A way to look at silver vs gold

Like small-cap stocks versus blue chips, or altcoins versus bitcoin, silver tends to be more volatile than gold. It runs further during bull markets but also experiences greater drawdowns when the trend turns. The post-2008 bull market in precious metals saw gold appreciating by around 180% from trough to peak. In the case of silver, it appreciated by almost 500% over the same period. This is why silver is so enticing to a certain type of investor, it offers the diversification of a precious metal, with the potential upside of an asset further out on the risk spectrum.

When the tide turns, though, the losses are also greater for silver holders. In the bear market that followed the 2011 peak, gold dropped by around 45%, while silver dropped by over 70%. The riskier nature of silver as compared to gold also makes it a useful barometer of the general sentiment around precious metals. This is because silver traders require a higher degree of assurance in the underlying trend due to the volatility of the asset they’re trading.

Another interesting point to be aware of is that silver has historically led gold when it comes to turning points. In 2011, it peaked in April, while gold peaked in September. In August of 2020, it peaked a day before gold, then came back to re-test (and even momentarily break) that level in February of 2021. By the time gold attempted to retest its own August 2020 all-time high, more than a year later in March of 2022, silver was already 15% off its own highs.

Is the bottom in?

With the above in mind, it appears that silver traders are pricing in further downside for precious metals in general. And since gold is only down around 18% from its peak, if this were to be a full multi-year bear market, one would expect that further downside is in store.

There are also some very real headwinds that may be preventing a bounce from these levels. Dollar strength is, of course, looming over the prospects of all dollar-denominated assets, and the recent resumption of the DXY’s upward march is problematic for both gold and silver, but also for assets like crypto, which are even more oversold at the moment.

The two market fears that generally bode well for precious metals (inflation and recession) have also been in the headlines for a long time now. In other words, they aren’t news to anyone, so investors have had time to adjust to them and position themselves accordingly.

Then, you also have the prospect of higher rates for longer. The Federal Reserve is doing its very best to convince everyone that it will be unflinching in its efforts; ‘forceful’ was a word Powell used repeatedly at Jackson Hole.

Markets dislike uncertainty

All of the above place a very firm lid on the potential upside for precious metals at the moment, if it weren’t for the general level of uncertainty. Markets dislike uncertainty more than bad news because bad news is a known reality that can be priced in. In an uncertain environment, nothing is stable because anything could happen.

At this moment in time, there is a great deal of uncertainty regarding the path forward for the global economy, as well as a variety of competing narratives. So, as bearish as the technicals appear, and as difficult the path forward in terms of a macro environment that favours precious metals, things could ultimately turn on a penny as they have done in other asset markets quite regularly since the pandemic.

This is also why the general level of noise is growing. Stock pickers and crypto traders are scouting for bottoms in their respective markets. Currency traders are looking for the dollar to peak and the euro to bottom, and precious metals traders are looking for it to be their asset’s turn to break to new highs. Not everyone can be right at the same time.

If you want to learn more about how to invest in gold and silver, and what opportunities will arise leading into year-end, then please attend HYCM’s seminar, Investing in FX, Stocks & Gold in a High Inflation Era, on the 29th of September at the Shangri-La hotel in Dubai. More information will be available soon on the HYCM website.

Note: Cryptocurrencies are not available for trading under HYCM (Europe) Ltd and HYCM Capital Markets (UK) Limited.

About: HYCM is the global brand name of HYCM Capital Markets (UK) Limited, HYCM (Europe) Ltd, HYCM Capital Markets (DIFC) Ltd, HYCM Ltd and HYCM Limited, all individual entities under HYCM Capital Markets Group, a global corporation operating in Asia, Europe, and the Middle East.

High-Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

*Any opinions made in this material are personal to the author and do not reflect the opinions of HYCM. This material is considered a marketing communication and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. HYCM does not take into account your personal investment objectives or financial situation. HYCM makes no representation and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or other information supplied by an employee of HYCM, a third party, or otherwise. Without the approval of HYCM, reproduction or redistribution of this information isn’t permitted.