Asian stocks start the week lower today as investors await the first interest rate cut in a decade from the Fed, and U.S. trade negotiators will likely visit China next week for their first face-to-face talk with Chinese officials since the G20 meeting. The Nikkei225 ended 0.37 percent lower at 21,577; the Hang Seng finished 1.20 percent lower at 28,056. The Shanghai Composite ended 0.14 percent lower to 2,940, while in Singapore the FTSE Straits Times index finished 0,63 percent lower to 3,343. Australian equities trading lower, The ASX 200 is trading near record highs as the ASX200 is gaining 0.14% to 6803.5.

European equities started mixed the day, DAX30 is adding 0.06 percent to 12,426, CAC40 is 0.08 percent lower at 5,605 while the FTSE MIB in Milan is trading 0.20 percent lower at 21,794. The London Stock Exchange is 1,07% percent higher to 7,629.

In commodities markets, crude oil trades 0.11 percent lower at $56.11 as traders turn cautious on recent tensions in the Middle East. Brent oil is trading 0.33% lower at $63,16 per barrel despite major oil producers have agreed to cut output. Gold is trading higher at 1,420, keeping the bullish momentum as the price holds above all the major daily moving averages. On the upside, strong resistance will be met at 1,452.90 high.

In cryptocurrencies, Bitcoin (BTCUSD) continues lower today and trades at 9,594, hitting the daily low at 9,085 and the daily high at 9,706. Bitcoin breached the 50-day moving average, and now the momentum is bearish for the short term, the previous two times it managed to rebound from that point. Immediate support for BTC stands now at $9,085 today’s low while next support stands at 9,000. On the upside, strong resistance now stands at 13,138 recent high and then at 13,500 round figure. Ethereum (ETHUSD) gives up 5 dollars and trades at 210 with capitalization now to 22.7 billion. On the upside, the immediate resistance stands at 317 Friday’s high while the support stands at 200 round figure, Litecoin (LTCUSD) also trades lower at 90.15. The crypto market cap now stands above $266.5 billion.

On the Lookout: In the US forex calendar, we have the Dallas Fed manufacturing outlook, level of general business activity for July which will be released at 14:30GMT, the forecasts are for a figure of -5.1 while the previous reading was -12.1.

Earlier today, Japan Retail Trade (year over year) came in at 0.5%, beating forecasts of 0.2% in June. Retail Trade s.a (month over month) registered at 0%, below expectations (0.8%) in June and Large Retailers’ Sales registered at -0.5% topping expectations of -0.7% in June.

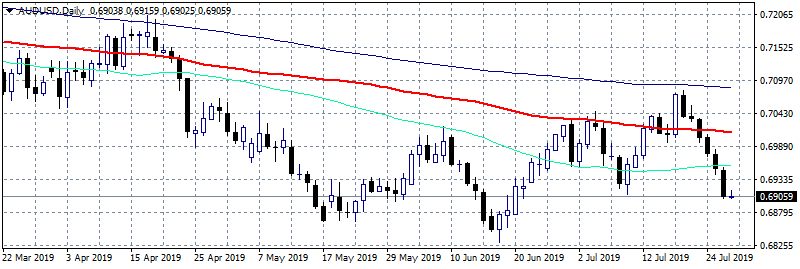

Trading Perspective: In forex markets, USD continues higher 0.16 percent at 98.07, the Aussie dollar trades 0.13 percent lower at 0.6905, while Kiwi also trades lower at 0.6625.

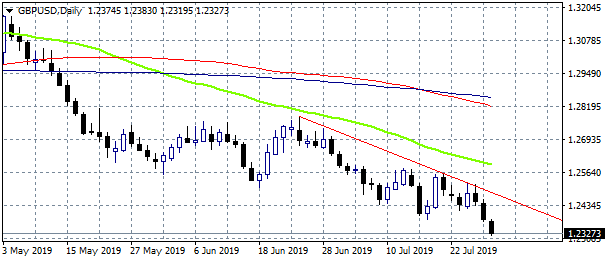

GBPUSD is trading 0.37% lower at 1.2335 making fresh 28 months low. Major support now stands at 1.2325 today’s low which if broken might accelerate the slide further towards 1.2108 the low from March 1st, 2017. On the upside, immediate resistance now stands at 1.2596 the 50-day moving average while more offers will emerge at 1.2831, the 100-day moving average.

In Pound futures markets open interest increased by 7,100 contracts while volume decreased by 20,000 futures contracts.

EURUSD gives up 0.01 percent to 1.1120, facing the strong support at 1.1101 the yearly low, which if the pair manages to close below will open the way to 1.1050. On the upside, immediate resistance stands at 1.1200 round figure.

Euro futures markets open interest increased by 9,000 contracts while volume decreased by 122,600 futures contracts.

USDJPY is trading 0.04% lower at 108.64 having hit the daily low at 108.41 and the daily high at 108.68. USDJPY pair will find support around 107.50 round figure and then at 107.00. On the upside, immediate resistance for the pair now stands at 108.98 the recent high and then at 110.04 the 100-day moving average.

In Yen futures markets open interest increased by 700 contracts while volume decreased by 38,800 futures contracts.

USDCAD is trading 0.10 higher at 1.3178 and continues the rebound from the lows around 1.30 amid USD strength, and the retreat in crude oil prices, Canada’s main export item seems to have added further weakness in the Canadian Dollar (CAD). The pair will find immediate support at 1.3017 the YTD low while extra support stands at 1.30 round figure. On the upside, immediate resistance now stands at the 1.32 zone before an attempt to 1.3450 recent high from 31st May.