Summary: Asian markets rocked and rolled early on. First, a Bloomberg reported that the US and China agreed to a Phase-One trade deal in principle which needed President Trump’s signature. Risk assets climbed, the offshore Chinese Yuan jumped with the Aussie and Emerging Market currencies joining in the rally. USD/CNH plunged to a July 2019 low at 6.9216 from 7.0295), settling at 6.9500. The Aussie extended its gains to 0.6938, a 3-month high. Soon, the British Pound rocketed to 1.3470 after trading in an extremely choppy 1.3050-1.3230 overnight range. UK election results showed that Boris Johnson’s party were set to win a majority in Parliament. The Euro jumped in tandem with the Pound to 1.11965 from 1.1113. Earlier the ECB maintained its ultra-easy money policy. Christine Lagarde, new ECB President, ever the politician, avoided any fireworks in her maiden press conference. The Dollar Index (USD/DXY) dropped to 96.60, down 0.50% (97.14). Wall Street stocks advanced, hitting record highs in the process. The DOW was at 28,150, up 0.8%, while the S&P 500 soared to 3,169 from 3,146 yesterday. Treasury prices dropped, and bond yields were higher. The US 10-year note yield climbed to 1.90% from 1.78%.

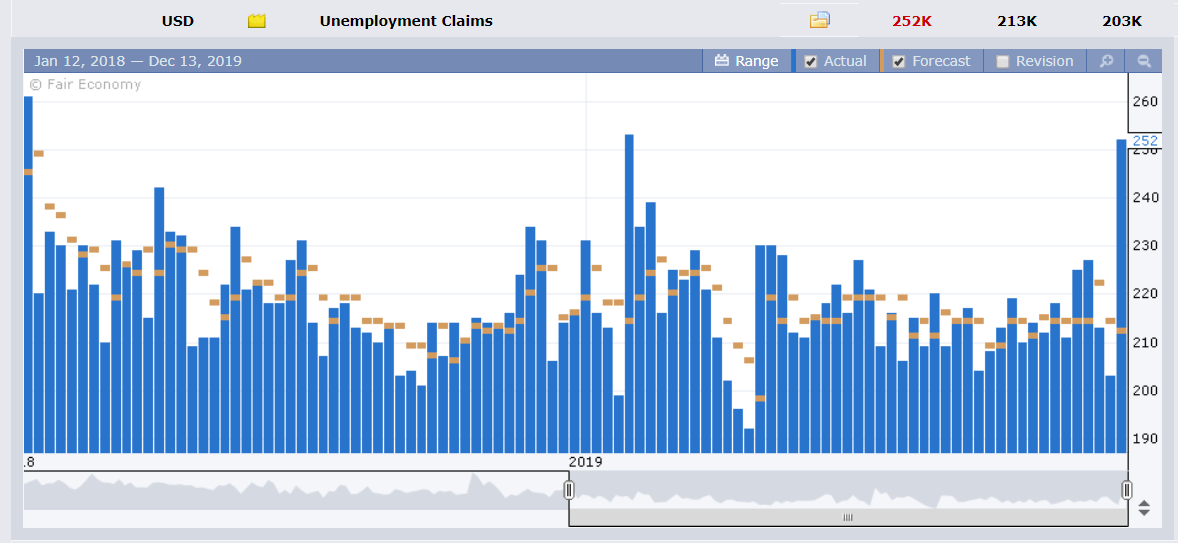

Data released yesterday saw Japanese Core Machinery Orders underwhelm, falling 6% missing expectations of a 0.7% gain. The UK RICS House Price Index dropped 12% against a forecast fall of 5%. US November PPI dipped to 0.0%, disappointing expectations of 0.2% while Core Producer Prices slumped to -0.2% against expectations of 0.2%. US Weekly Unemployment Claims jumped to 252,000, against median expectations of 213,000. The number of unemployed workers in the US claiming benefits increased to the highest number since February.

- GBP/USD – The British currency rocketed up in early Asian trade to 1.3470 as reports filtered in that UK exit polls project a large majority for Boris Johnson’s Conservative Party. Which would free the path for the British Prime Minister to push through his Brexit plan. GBP/USD had eased and was trading around 1.3125 in late New York.

- EUR/USD – The Euro opened a touch lower in early Sydney at 1.1113 before rallying to 1.1192 on Sterling’s climb. Earlier the ECB maintained its ultra-easy monetary policy. Christine Lagarde said that she is neither a hawk nor a dove, but an “owl’. Lagarde avoided any fireworks, Eurozone growth was revised slightly lower, inflation slightly higher, with the economic slowdown signalling stability.

- AUD/USD – The risk positive trade agreement news boosted the Aussie to fresh 3-month highs at 0.69387 from a late New York close at 0.6900.

- USD/CNH – The Offshore Chinese Yuan soared against the US Dollar, (USD/CNH plunged to 6.9216 from 7.0295) on the Bloomberg report on the Sino-US trade agreement. The two countries had agreed in principle to a Phase-One to avert December tariffs.

On the Lookout: Fireworks were ignited in early Asian markets with fresh headlines on trade and the UK election coming in fast and furious. Sterling was the big winner as Boris Johnson and his Conservative Party recording a big majority win in Parliament. BJ can now push through his Brexit plan. What happens after that is still not known and we should continue to see the Pound as the most volatile major currency. Volatility should ease as Asian markets get underway with the Dollar heading further south.

The rise in the US Weekly Unemployment Claims as well as the fall in Producer Prices was ignored by most of the markets. Understandable given the prominence of trade and the UK election. However, this is another nail in the coffin of the Greenback.

Today sees Japan’s Tankan Manufacturing and Non-Manufacturing Index start off the day’s reports. Germany reports its Wholesale Price Index. The UK follows with its Consumer Inflation Expectations and Consumer Board Leading Index. The US rounds up the day’s data with its Headline and Core Retail Sales.

Trading Perspective: The result of this morning’s fireworks was a stronger Pound, Euro and Australian Dollar. Much of this move was short covering in these currencies where the speculators have been short for some time now. We have probably seen the extremes for today. Expect Asia to consolidate around the break-out levels established earlier.

- GBP/USD – The Pound traded to an intraday and fresh June 2018 high at 1.3511 before easing to settle at its current 1.3460. Sterling is bid and we can expect more short covering ahead. However, the 1.3550 level should cap on the day. Immediate support can be found at 1.3410 and 1.3350 and 1.3300. GBP/USD has moved its trading range higher and we can expect a range between 1.3250 and 1.3550 form. With the overall view of a weaker US Dollar look to trade that range with the preference to buy dips now to the 1.3250 level.

- EUR/USD – The Euro got its boost from Sterling’s climb, trading to a high at 1.1200, a high not seen since August. EUR/USD has immediate resistance at 1.1200 followed by 1.1230. Immediate support can be found at 1.1160 followed by 1.1130 and 1.1100 (overnight low 1.1103). Expect the Euro to consolidate within a likely range of 1.1150-1.1200.

- AUD/USD – The Aussie rallied to 0.6939, a 3-month high following the report of a trade agreement between China and the US. AUD/USD currently trades around 0.6935 and has found a bid. The overall weaker US Dollar and positive risk tone will keep the Aussie buoyed after being in the doldrums of late. Immediate resistance lies at 0.6940 followed by 0.6970. Immediate support lies at 0.6900 and 0.6870. Look for consolidation with a likely range today of 0.6900/50.

- USD/JPY – The Dollar traded higher against the Yen to 109.58 in the current environment. Higher US 10-year bond yields also contributes to a bid USD/JPY. There is immediate resistance at 109.60 followed by 109.90. Immediate support can be found at 109.20 (this morning’s opening as 109. 32). The next support level lies at 108.80. The speculative short JPY bets should keep a lid on the Dollar. Look for a likely range today of 109.10-109.60. Prefer to sell rallies.

The fireworks have begun. Happy days! Happy Friday, and top weekend to all.