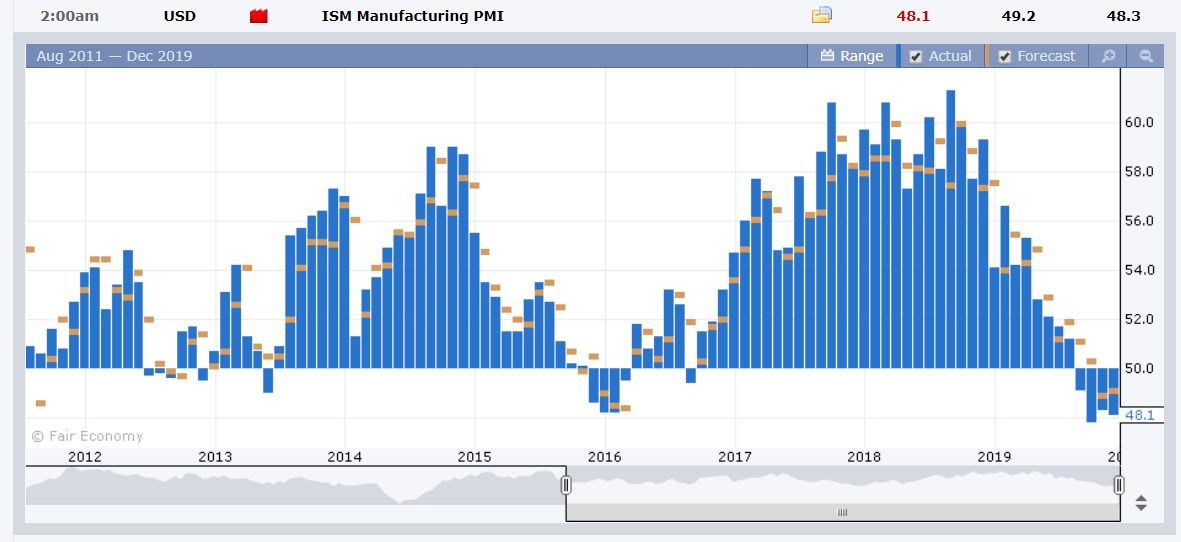

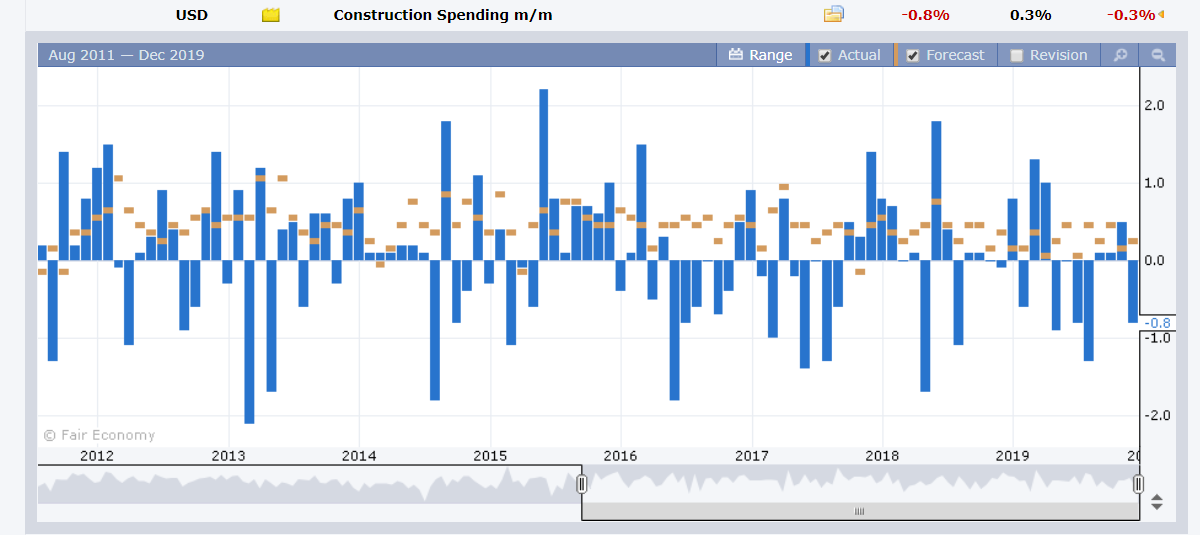

Summary: Dismal US Manufacturing PMI and Construction Spending after a string of recent upbeat data sank the Dollar against its Major Rivals. The Institute of Supply Management (ISM) reported that US factory output in November sank to 48.1, well below forecasts of 49.2 and the lowest level since 2012. In a separate report, the US Commerce Department said November Construction Spending unexpectedly fell 0.8%, against expectations of a 0.3% rise. In contrast, Chinese, Euro area and UK manufacturing PMI’s showed signs of recovery, mostly beating expectations. President Trump blamed the manufacturing fall to a strong US Dollar and called for the Fed to lower interest rates. The Dollar Index (USD/DXY), a popular measure of the Greenback’s value against a basket of major currencies, dropped 0.45% to 97.884 (98.271). New Zealand’s Kiwi outperformed, soaring 1.4% to 0.6507 (0.6425) while its bigger cousin, the Aussie jumped 0.96% to 0.6820 (0.6757). The Euro rallied to 1.1076 from 1.1022, gaining 0.6%. The Dollar slumped 0.5% against the Yen to 108.98 (109.48) after trading to a 5-month high at 109.73 overnight. Markets switched to risk-off mode after US President Trump announced immediate tariffs on base metal imports from South America. China said it would not allow the US military to visit Hongkong and announced sanctions against some non-government US companies for encouraging protestors. Wall Street stocks slumped while Treasuries fell, yields rose. The DOW fell 0.75% to 27,780. (28,072) while S&P 500 lost 0.7 % to 3,115 (3,145). The US 10-year bond yield climbed 4 basis points to 1.82%. Germany’s 10-year Bund yield was up 8 basis points to -0.28%.

Data released yesterday saw Australia’s November Building Approvals fall 8.1% against expectations of a 1.0% fall. China’s Caixin Manufacturing Index climbed to 51.8 against forecasts of 51.5. Japan’s Final Manufacturing PMI beat forecasts at 48.9 against 48.6. The Eurozone Manufacturing PMI climbed to 46.9, beating forecasts of 46.6. The UK’s Manufacturing PMI rose to 48.9 from 48.3 in October. Spanish, German, French and Italian Manufacturing PMI’s all marginally beat expectations.

- EUR/USD – The Euro rallied 0.6% to 1.1076 (1.1022) after staying in the doldrums around the 1.10 area for over a week. The shared currency was boosted by improving Euro area manufacturing PMI’s and a broad-based weaker US Dollar.

- AUD/USD – The Aussie rose in tandem with the strengthening Kiwi and weaker Greenback. The Battler jumped to an overnight high at 0.6823, before settling at 0.6820 in late New York trade. The RBA is not expected to reduce its Official Cash rate (0.75%) when it meets today, however markets will be focussed on the RBA statement.

- USD/JPY – The Dollar reversed all its recent gains versus the Yen and then some, falling 0.5% to 108.95 from 109.47 yesterday. USD/JPY rose to a 5-month and overnight high at 109.728 on the market’s risk-on stance and positive US Dollar sentiment. Dismal US factory output data and global trading anxieties weighed on the Greenback.

- USD/DXY – the Dollar Index slipped 0.45% to 97.824 from 98.271 yesterday. The Dollar’s fall was broad based. USD/DXY hit an overnight high at 98.376 before reversing.

On the Lookout: Today’s big event is the RBA interest rate policy meeting, rate announcement and statement (2.30 pm Sydney time). The Australian central bank is expected to keep its Official Cash Rate at 0.75%, and all-time low. Before that Australia reports it’s Q3 Current Account data. The UK reports its BRC Retail Sales Monitor. European data start with Switzerland’s November CPI report. Spanish Unemployment Change follows. Eurozone PPI (November) and UK Construction PMI round up Europe’s reports. The US reports its Ward Total Vehicle Sales to finish the day’s reports.

Trading Perspective: Once again, it’s the US manufacturing output that sank the Dollar and is its kryptonite. The reading of November’s factory output was well below forecasts and is the 4th straight monthly contraction. The employment component fell to 46.6 from 47.7, the 4th consecutive month of declining employment in the sector. This will keep the Greenback under pressure and a reversal of its uptrend is underway. President Trump blamed the manufacturing fall to a strong Dollar. While this may fall on deaf ears, in some ways Trump’s observance is correct.

Overnight global bond yields rose. The US 10-year yield finished at 1.82%, while the 2-year rate fell to 1.60% (1.61%) with the 2to10-year yield curve steepening. Global rivals saw their bond yields climb higher than that of the US. Germany’s 10-yaer Bund yield was up 8 basis points. The UK 10-year Gilt rate climbed 5 basis points to 0.74%. Australia’s 10-year bond yield rose 6 basis points to 1.09%. Japan’s 10-year JG yield climbed 3 basis points to -0.06%.

With the global yield differentials narrowing with the of the US and a speculative market that is long US Dollar, the Greenback risks further losses and reversal.

- EUR/USD – the Shared currency rallied on the back of the overall weaker US Dollar, and better Euro area manufacturing output data. EUR/USD closed at 1.1075 after hitting an overnight and two-week high at 1.10907. Immediate resistance for the Euro lies at 1.1100 followed by 1.1130. Immediate support can be found at 1.1050 and 1.1030. After some consolidation at current levels, expect the Euro to challenge higher with a likely range today of 1.1060-1.1110. Market positioning is currently short Euro bets. Prefer to buy dips.

- USD/JPY – Slip-sliding away, the Dollar slumped 0.5% against the Yen to 108.98 from 109.45 yesterday. The narrowing of the 10-year yield differential and market’s risk-off mode has pressurised the USD/JPY lower. Overnight low for the USD/JPY was at 108.925. Immediate support lies at 108.85 followed by 108.55. Immediate resistance can be found at 109.20 followed by 109.50. Look for consolidation today between 108.85-109.35. Prefer to sell rallies.

- AUD/USD – The Australian Dollar jumped to 0.6823 overnight and 9-day high before easing to settle at 0.6819. The overall weaker US Dollar will buoy the Aussie Battler. While the market’s risk-off mode keeps a lid on the Aussie, expect the currency to remain supported on dips with speculative market Aussie shorts totalling the biggest since mid-October. Immediate resistance for the Aussie lies at 0.6830 followed by 0.6860. Immediate support can be found at 0.6790 followed by 0.6760 (overnight low 0.67616). Look for consolidation today with a likely range of 0.6785-0.6855. Prefer to buy dips.

Happy trading all.