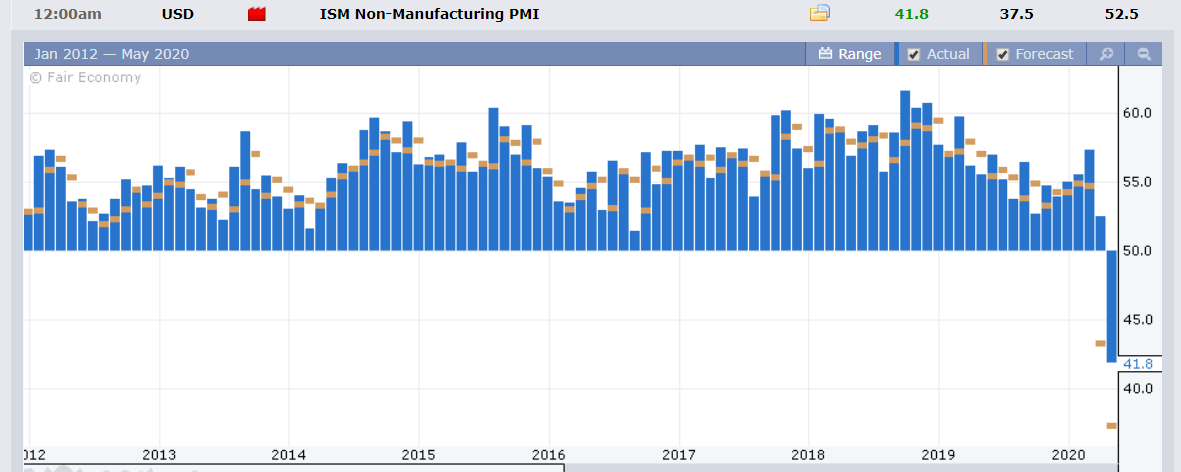

Summary: The Euro slumped 0.61% to 1.0837 (1.0902) after Germany’s Constitutional Court ruled that the Bundesbank should stop buying government bonds if the ECB cannot prove that the purchases are needed. This propelled the Dollar Index (USD/DXY), a gauge of the Greenback’s value against a basket of foreign currencies, in which the Euro takes 60% of the weight, up 0.37% to 99.848 (99.54). The Australian Dollar lifted 0.15% to 0.6435 (0.6423) after the RBA kept its interest rates and policy unchanged. While the move was widely expected, policymakers did not signal an immediate need for additional easing. Against the Canadian Loonie, the US Dollar dipped to 1.4053 (1.4095) after oil prices rallied. WTI (West Texas Intermediate) up 22.3% (US$26.25). Sterling closed little changed at 1.2437 (1.2440). Trading was light due to the Japanese and Chinese Golden Week holidays. USD/JPY finished at 106.54 (106.72 yesterday). US bond yields climbed. The benchmark 10-year treasury rate was at 0.63% (0.61% yesterday). Germany’s 10-year Bund yield finished at -0.57% from -0.59%. Wall Street stocks slipped off their highs, still ending in positive territory. The DOW was 0.13%% higher in late New York at 23,867 (23,734) while the S&P 500 added 1.05% to 2,866 (2,836). Investor optimism rose as some US states ease restrictions to spark their economies. US Service Sector activity (ISM Non-Manufacturing PMI) bettered market forecasts of 38 with a 41.8 print, down from the previous 52.5. Other data released yesterday saw Eurozone PPI fall to -1.5%, lower than expectations of -1.2% and a previous -0.7%. The US Trade deficit rose to -USD 44.4 billion from -39.9 billion, underwhelming expectations of -USD 41.0 billion.

On the Lookout: It’s all about the data ahead which culminates in Friday’s US Payrolls report. Earlier today, New Zealand released its Q1 Employment report, which rose to 0.7%, beating expectations of -0.2%. New Zealand’s Unemployment rate dipped to 4.2%, beating forecasts at 4.4%. The Kiwi which closed at 0.6055, popped to 0.6070 before dropping to 0.6060 on the report. The data covered the period before New Zealand went into its lockdown.

Other data scheduled for release today begin with Australia’s Retail Sales for April which could move the currency. Retail Sales are forecast to slump to -10% from March’s -1.4%.

Euro area reports see Germany’s Factory Orders. Services PMI’s from Italy, Spain, France, Germany, and the Eurozone follow. The Eurozone also releases its Retail Sales (April). The European Union releases its Economic Forecast which will keenly be focussed on. The UK reports on its Construction PMI. The final report for today is the US ADP Non-Farm Employment Change. Expectations in the Private Employment sector are forecast by economists to drop to -20,000K versus the previous month’s -27K. Again, more prospects for fireworks following the release of this number.

Trading Perspective: While trading conditions remained thin due to the Japanese and Chinese holidays, there were some volatile moves within the ranges that were established yesterday. Today the US Dollar faces a test with the release of the upcoming data. While the correlation between the US Dollar and equity markets is positive now, much of that is the result of thin markets. This could change on a sixpence. Market positioning has also been a factor. We highlighted yesterday that while net speculative Euro long bets were trimmed, the total was still near 2018 highs. Against the Australian Dollar, speculative short Aussie bets saw a slight increase. Expect these factors to continue to be an influence in FX.

AUD/USD – Mildly Higher, Pivot at 0.6400, Spotlight on Retail Sales

The Australian Dollar continued its outperformance after the RBA kept its cash rate target unchanged and did not signal an immediate need for additional easing. The RBA releases its official economic forecast on Friday. The Aussie finished with modest gains to 0.6435 from 0.6423 yesterday. Overnight the AUD/USD pair traded in a 0.64168 to 0.64759 range. The Battler held above its pivot point between 0.6387 and 0.6400.

AUD/USD has immediate resistance today at 0.6450 followed by 0.6480 and 0.6500. Immediate support can be found at 0.6420 followed by 0.6400 and 0.6385.

Today the spotlight is on Australia’s March Retail Sales, which are expected to remain at 8.2%, unchanged from the previous 8.2%. Sales could have increased in anticipation of the lockdown then. Any upside surprises should be limited to 0.6500 cents.

Yesterday the Australian Business Insider reported an ABS report suggested that nearly 1 million Australians lost their job between 14 March to 18 April. The RBA expects the Unemployment Rate to peak at 10% in the coming months. This will prevent any sustained Aussie gains. For today look for a likely range trade between 0.6350-0.6500. Be prepared to trade either extreme.

EUR/USD – Stays Heavy, only a Weak USD Can Lift It, 1.08 Pivot

The Euro suffered the most, underperforming in FX weighed by Germany’s constitutional ruling which criticised the European Central Bank in its long-standing bond-buying program. The ruling does not affect the separate EUR 750 billion PEPP (Pandemic Emergency Purchase Program) launched in March to combat the coronavirus crisis. EUR/USD slumped 0.61% to 1.0837 in late New York after hitting an overnight low at 1.08259.

The other factor weighing on the Euro is the current level of speculative market positioning. We reported yesterday that speculative long Euro bets totalled +EUR 79,681 contracts from +EUR 87,218 the previous week. The latest Commitment of Traders report was for the week ended April 28. While this was an actual reduction of Euro longs, the net total is still near 2018 highs.

EUR/USD has strong support at its pivot point between 1.0790 and 1.0800. Immediate support for today lies at 1.0820. Immediate resistance can be found at 1.0880 followed by 1.0910. The Euro remains heavy and only a big move lower for the US Dollar can lift the shared currency. Which in today’s market, is very possible. Am neutral at current levels and look to trade a likely range today of 1.0820-1.0930.

USD/CAD – Bounce in Oil Prevents Gains Above 1.4100, 1.40 Pivot

The Dollar eased against the Canadian Loonie to finish 0.25% lower to 1.4050 from 1.41095 yesterday. Rising crude Oil prices boosted the commodity-sensitive Loonie. West Texas Intermediate (WTI) oil soared 22.3% to US$26.25 (US$22.55). The easing of Covid-19 restrictions has fuelled much of oil’s recent rebound rally.

On Friday Canada reports its Payrolls data which is expected to see up to 5 million Canadians out of work from the previous month’s 1 million Jobless. Canada’s Unemployment rate is expected to soar to 20% from 7.8%. On Sunday, Canada appointed a new Governor, Tiff Macklem, who said that he cries out for bold, unprecedented responses to the economic crisis fuelled by Covid-19.

USD/CAD has immediate support at 1.4025 followed by 1.4000 (the pivot point is at 1.40). The next support level can be found at 1.3970. Immediate resistance can be found at 1.4100 followed by 1.4130. Look for a likely trading range today of 1.4020-1.4120. Prefer to buy USD/CAD dips toward 1.40 today.