Summary: The Euro lifted 0.6% to 1.1071 (1.1005) following upbeat German and Eurozone investor confidence readings. US treasury yields dropped on the eve of the Federal Reserve monetary policy meeting where policymakers are expected to deliver a 0.25% rate cut. The Dollar Index (USD/DXY), a measure of its value against 5 major currencies, dipped 0.4% to 98.231 (98.652). Sterling rallied back to 1.2498 (1.2425) as speculators continued to cover their shorts. The Dollar was little changed against the Yen at 108.12 (108.15). Oil prices slipped 7.3% to US$ 63.15 after Saudi Arabia said it had fully restored oil production. The Australian Dollar closed flat at 0.6865 after slipping to 0.6830 the RBA left the door open for further rate cuts, its latest meeting minutes revealed.

The benchmark US 10-year bond yield fell 5 basis points to 1.80%. Two-year US bond rates closed at 1.72% from 1.76%. Wall Street stocks were up 0.1% on the oil price drop as the Saudi output restoration calmed fears.

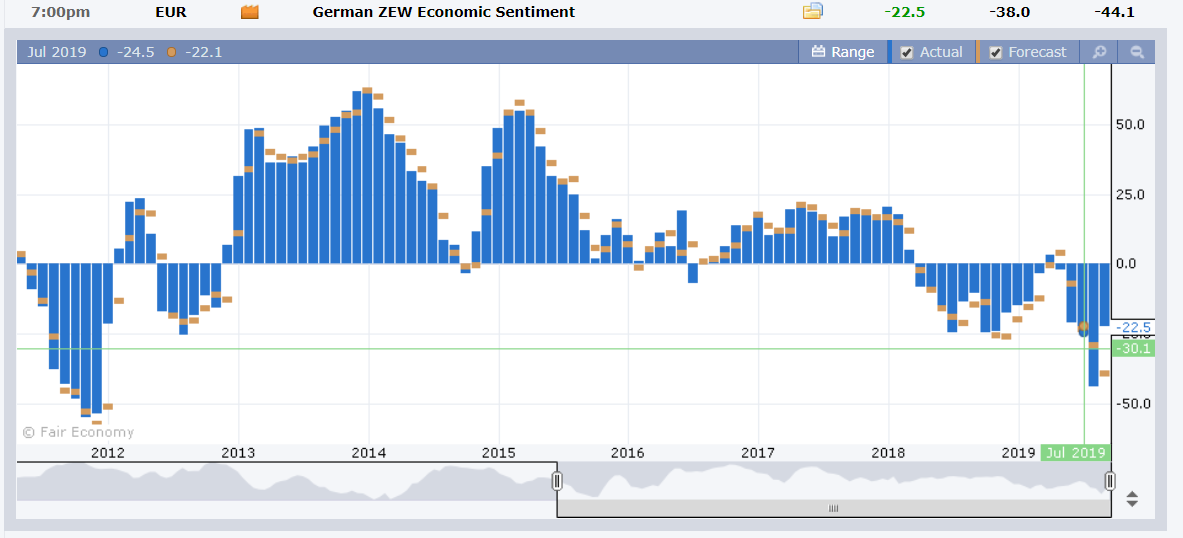

Germany’s ZEW Economic Sentiment Index improved to -22.5 in September from August’s -44.1, beating forecasts at -38.0. The Eurozone ZEW Economic Sentiment lifted to -22.4 from -43.6. Canada’s Manufacturing Sales fell to -1.3% missing expectations of -0.3%. US Industrial Production rose to 0.6%, beating expectations of 0.2% and a previous reading of -0.2%.

- EUR/USD – The shared currency bounced off the 1.1000 support level boosted by the upbeat German and Eurozone investor confidence. EUR/USD hit an overnight high at 1.10746, closing a touch lower at 1.1070.

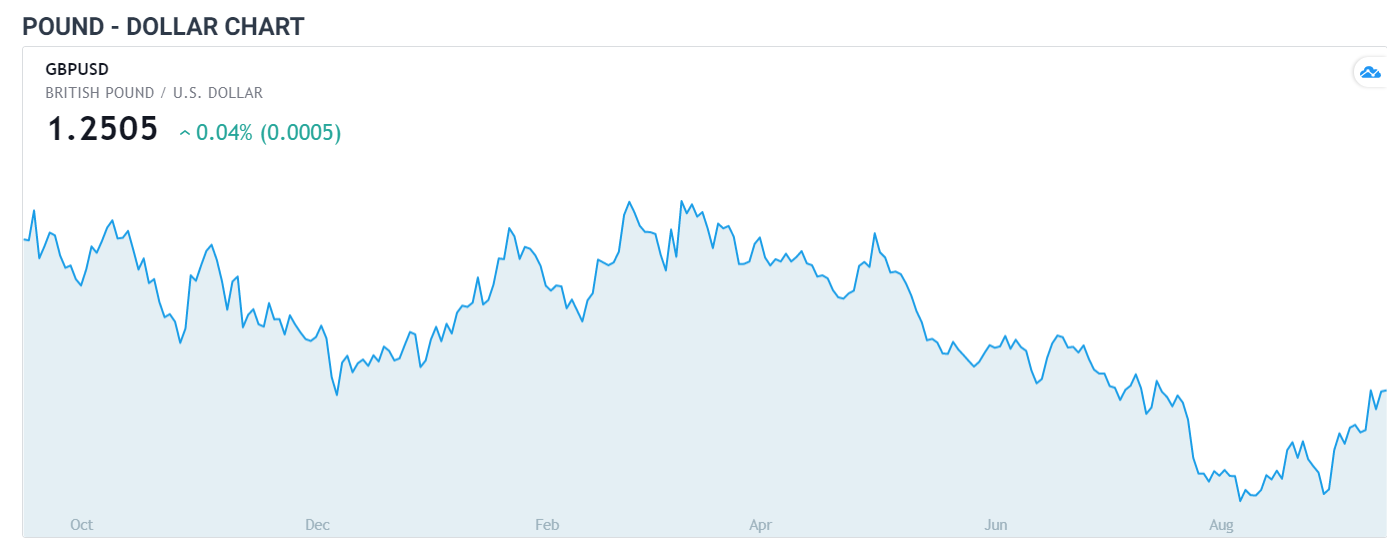

- GBP/USD – The British Pound rallied against broad-based US Dollar weakness as speculative shorts continued to cover their positions. GBP/USD rose to a fresh 6-week high at 1.2527 before easing to settle at 1.2498. Meantime the latest Commitment of Traders/CFTC report saw an increase in speculative net GBP shorts, the total of which are near 12-month highs.

- AUD/USD – The Australian Dollar dropped to an overnight low at 0.6830 before rallying against the broad-based weaker US Dollar to close unchanged at 0.6865. The RBA’s latest meeting minutes revealed that policymakers left the door open to further rate cuts if needed.

On the Lookout: It’s all about the Fed. The US central bank is expected to cut the Fed Funds rate to 2.0% from the current 2.25%. Which would be the second time in a decade. The Fed is unlikely to signal future rate cuts and is expected to point to some improvement in the US economy. Markets will focus on the outlook for the rest of the year (dot plot) as well as any dissensions to a rate cut from within the FOMC.

Data released today are: New Zealand current account printed -1.11 billion, just matching forecasts of -1.10 billion. Japanese Trade Balance follows. Europe sees Eurozone Final Headline and Core CPI. The UK reports its Headline and Core CPI, PPI Input and Output, and RPI. Canadian Headline, Core and Trimmed Mean CPI follow next. US Building Permits and Housing Starts follow ahead of the Fed meeting.

Trading Perspective: Asian trading will keep major FX pairs within recent ranges. Expectations of a 0.25% cut are already in the current FX. It will come down to what Jerome Powell will signal for the days ahead.

Meantime we look at the latest market positioning which would have an impact on FX heading into tomorrow morning’s Fed meeting.

Saxo Bank released the latest Commitment of Traders/CFTC report (week ended September10). Net speculative total USD longs bets declined 6% to a total of US$12.7 billion. Out of the 7 major IMM currencies, 5 were bought against the US Dollar. Only the Euro and Sterling saw increased selling. The Aussie and Kiwi shorts were reduced while the Canadian Dollar and Yen longs increased.

- EUR/USD – The Euro rallied the most among the Majors against the Greenback. The ECB’s rate cut last week was probably its last for this year. With the Fed expected to deliver a 0.25% rate reduction, it will boil down to any signal of future cuts. The Shared currency closed near its high at 1.1071 (1.10746 overnight high). Immediate resistance today lies at 1.1085 followed by 1.1110. Immediate support can be found at 1.1060 followed by 1.1030. The latest COT report saw net speculative Euro shorts increase to -EUR 49,842 contracts from the previous week’s -EUR 49,136. Ahead of the Fed announcement (4.00 am Thursday, Sydney time) expect a likely range of 1.1035-1.1085.

- GBP/USD – Sterling rallied 0.56% to close at 1.2498 after trading to 1.2527, fresh 6-week highs. Despite the Brexit uncertainty, the British currency continues to climb on short covering. The latest COT/CFTC report saw net speculative GPB shorts increase to -GBP 92,233 contracts (week ended Sept 10) from -GBP 84,959. This should keep Sterling underpinned and a softer US Dollar will see Sterling soar. Immediate resistance lies at 1.2530 followed by 1.2580. The next resistance level is at 1.2610. Immediate support can be found at 1.2460 and 1.2420. Look to trade a likely 1.2460-1.2510 ahead of the Fed.

- USD/JPY – The Dollar closed little changed against the Yen at 108.12. Overnight high was 108.370. Immediate resistance can be found at 108.40 followed by 108.80. Immediate support lies at 107.90 and 107.60. The latest COT report saw an increase in net speculative JPY longs to +JPY 32,591 contracts from +JPY 27,682. These are highs not seen since late 2016. Which is a danger sign if the Fed are less dovish than markets expect. Geopolitical tensions though will keep demand for the haven Yen buoyant. Meantime look to trade a likely 107.85-108.35 range prior to the FOMC.

- AUD/USD – The Aussie had a good bounce on the overall weaker US Dollar as well as improved risk sentiment on the Saudi announcement of its oil production restoration. Markets saw the RBA meeting minutes as dovish because policymakers left the door open to further rate cuts if necessary. This would depend much on the global economic situation and other central bank reactions. The latest COT report saw a small reduction in net speculative Aussie short bets to -AUD 53,014. From -AUD 59,318. AUD/USD has immediate resistance at 0.6885 followed by 0.6905. Immediate support can be found at 0.6830 followed by 0.6800. Look to trade a likely 0.6840-0.6890 range. Prefer to buy dips.

Happy trading all.