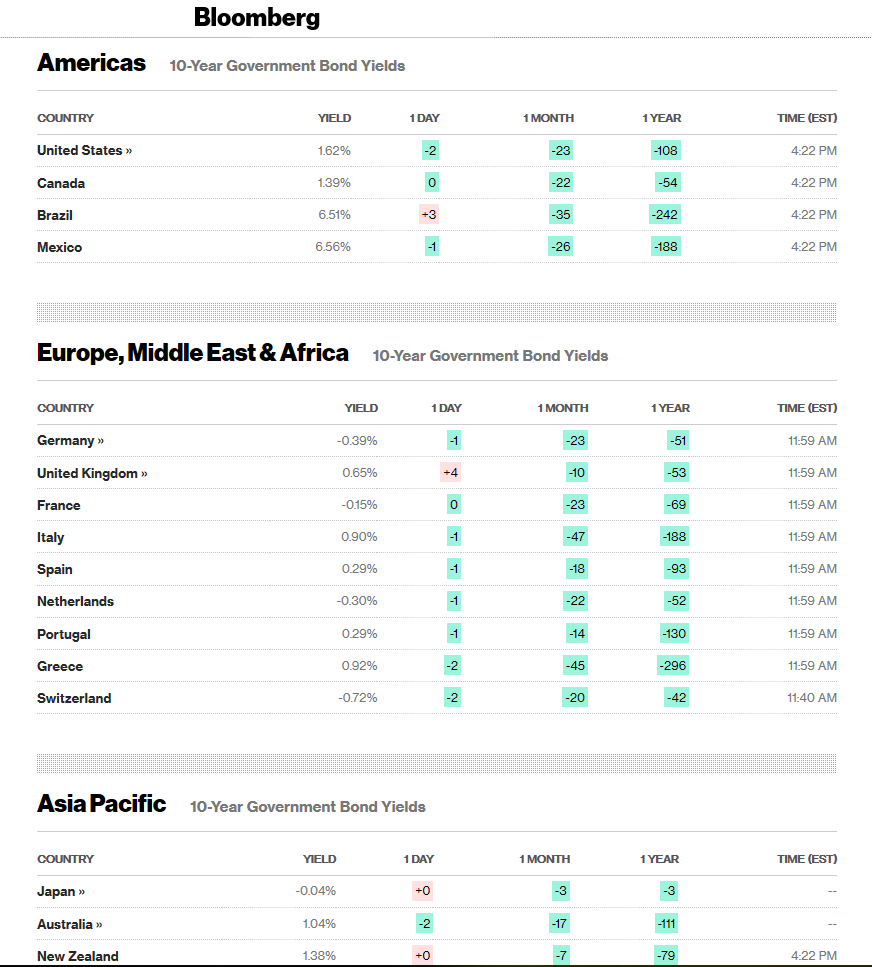

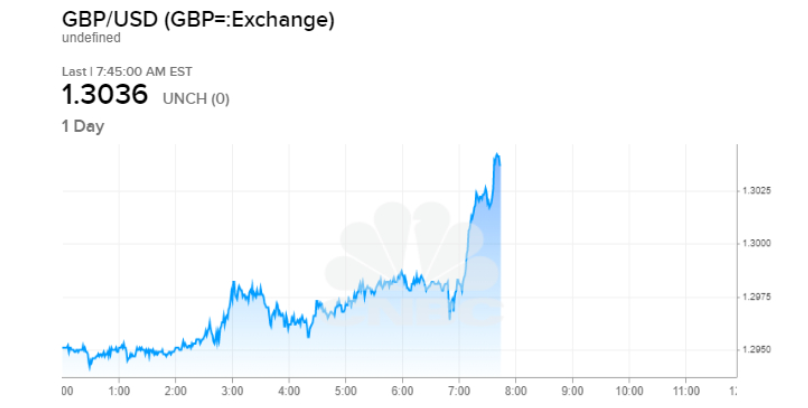

Summary: The Euro was hit anew to May 2017 lows at 1.0834 amidst a modest wave of risk-off on mixed COVID-19 (coronavirus) reports. This was due to a change in methodology in diagnosing the epidemic. The death toll from the virus in China’s Hubei province spiked to 1,310, a record increase of 242 victims. Japan became the third place outside mainland China to suffer a fatality. FX focussed on Europe’s (Germany, in particular) strong trade links to China. Which kept the pressure on the largely oversold EUR/USD pair. Against the haven sought Japanese Yen, the US Dollar slipped to 109.79 from 110.08 yesterday. Meantime Sterling soared 0.75% to 1.3055 (1.2965) after the surprise resignation of UK Finance Minister Sajid Javid. Chief secretary to the Treasury Rishi Sunak will step into the role. Sunak is said to be supportive of fiscal stimulus, which would take the pressure off the BOE to cut rates. UK 10-year bond yields climbed 4 basis points to 0.65%, while the US 10-year treasury yield dipped to 1.61% (1.63% yesterday). The Dollar Index (USD/DXY) was little changed at 99.06 from 99.03 yesterday. The Australian Dollar slipped to 0.6725 from 036740 yesterday while the Kiwi settled modestly lower at 0.6445 (0.6465).

Wall Street stocks slipped after climbing to record territory. The DOW was 0.21% lower to 29,501.

US inflation remained subdued. Headline CPI dipped to 0.1% against 0.2% expected. Core Inflation rose 0.2%, matching forecasts. US Unemployment Claims rose to 205,000 from 202,000 the previous week.

- EUR/USD – The shared currency got hit anew amidst the mixed COVID-19 reports and modest risk aversion. EUR/USD dropped to fresh May 2017 lows at 1.08341 before settling at 1.0845 at the New York close. Against the surging Pound, the Euro slumped 1% to 0.8307 (0.8387).

- GBP/USD – Sterling soared 0.75% to 1.3055 from 1.2965 following the resignation news of UK Finance Minister Sajid Javid. There were reports of growing tensions between the finance minister and PM Boris Johnson’s inner circle ahead of the UKL budget release (one-month time).

- USD/JPY – The Dollar slipped to 109.79 from 110.09 as on the market’s moderate risk-off stance. USD.JPY slumped to an overnight low at 109.62 before settling at 109.80.

On the Lookout: Markets in Asia will await fresh clues following the spike in deaths from COVID-19 cases in China. Key data releases today are Germany’s Preliminary GDP (Q4) report and US Headline and Core Retail Sales. Japan reports on its Tertiary Industry Activity (January). Eurozone Q4 Flash Employment Change, GDP and Trade Balance are also due for release today. Other US reports due today at Capacity Utilization Rate, Industrial Production and Preliminary University of Michigan Consumer Sentiment Index.

Trading Perspective: While markets have generally shrugged off the coronavirus scare, broader, consequential concerns remain. While the Euro has come under strain and traders pile into the US Dollar (now considered a safe haven investment), countries outside of Europe, including the United States begin to tally up the economic impact. The risk here would be for a drop in equities and the US Dollar.

- EUR/USD – FX motto seems to be “when in doubt, sell Euro”. The Euro fell against the Greenback to May 2017 lows at 1.0834 after breaking through 1.0870. EUR/USD closed at 1.0845 and currently settles at 1.0840. Against the Swiss Franc, the Euro fell to 1.0610, its lowest level since August 2015. This would be of particular interest to the Swiss central bank.

We reported earlier in the week that the speculative Euro shorts were the most bearish since last October. EUR/USD has immediate support at 1.0830 followed by 1.0800 and 1.0770. Immediate resistance can be found at 1.0880 and 1.0930. Expect a likely trading range today of 1.0830-1.0880. Prefer to buy dips, the shorts are getting too crowded. - USD/JPY – The Dollar looks to have topped out against the haven sought Yen at 110.13. Last night USD/JPY high traded was 110.095. The current modest risk off stance should see the Dollar capped at 110.10 today. On the support side, initial support can be found at 109.60 (overnight low 109.619). The next support level lies at 109.30 followed by 108.90. Look to sell rallies with a likely range today of 109.40-109.90. We may be headed toward the low 108/s soon.

- GBP/USD – Sterling soared to an overnight high at 1.30693 before settling at 1.3055 at the New York close on the surprise resignation of the Finance Minister Sajid Javid. The up move may be overdone. Immediate resistance for GBP/USD lies at 1.3070 followed by 1.3110. Immediate support can be found at 1.3020 followed by 1.23980. Look to trade a likely range of 1.2985-1.3065 today. Prefer to sell rallies from current levels.

Happy Friday and trading all.