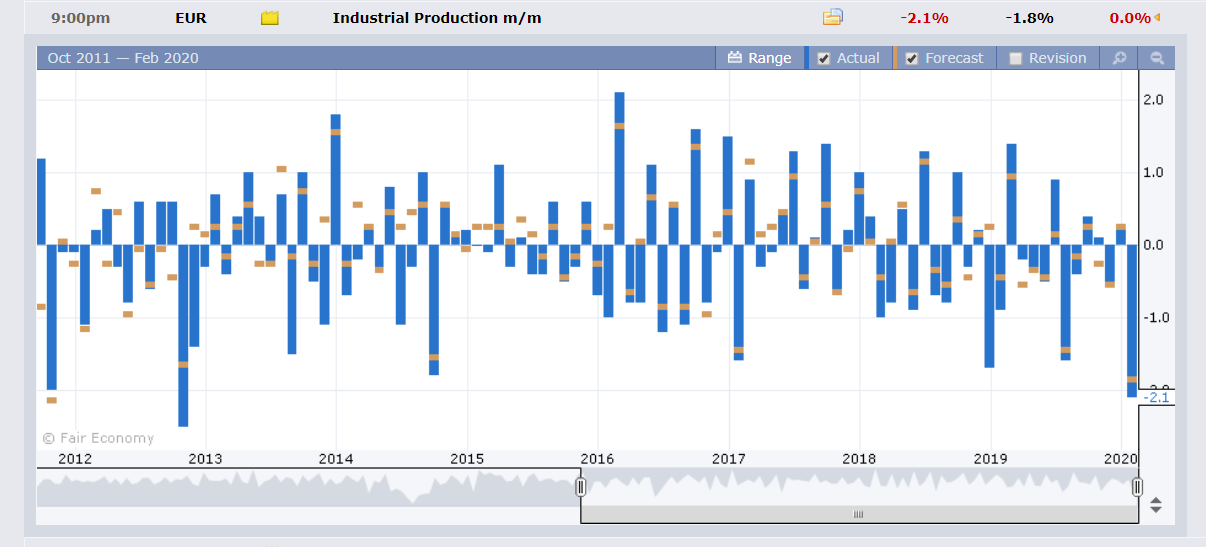

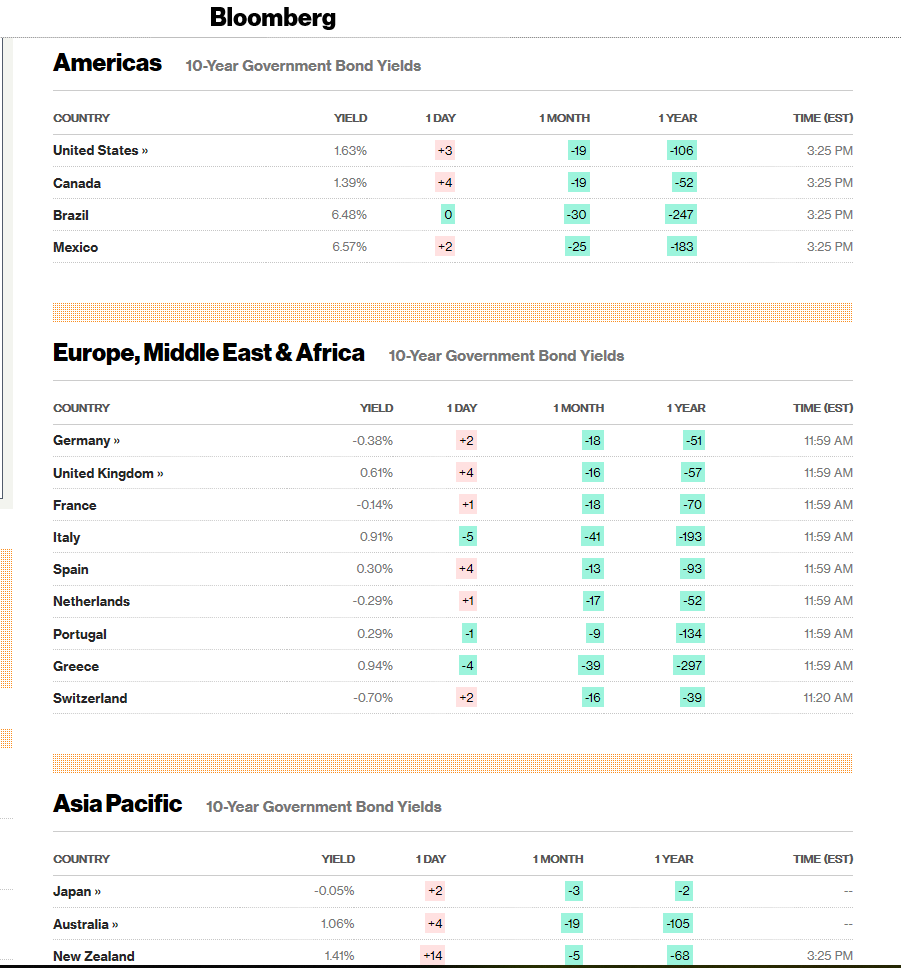

Summary: The Kiwi sprouted wings, outperforming FX after the RBNZ left rates on hold and removed the chance of a rate cut in its forward guidance. NZD/USD soared to 0.64875, overnight and two-week highs, settling to 0.6465, up 0.87% in New York. China reported that new confirmed infections of the coronavirus saw the lowest daily rise since January 30. The market’s mood improved, and it was risk on. The Australian Dollar continued its climb from decade lows last week, climbing to 0.6740, up 0.35%. The US Dollar rose 0.22% against the Yen to 110.10 (109.78). Elsewhere, Eurozone Industrial Production fell 2.1% in January from a 0.2% rise the previous months, which sparked recession fears following dismal German and French data last week. The Euro sank 0.48% to 1.0870 (1.0922), finishing as worst performing currency. The Dollar Index (USD/DXY) was up 0.31% to 99.025. Bond yields were mostly higher. The US 10-year Treasury rate rose 4 basis points to 1.63%. Japan’s 10-year JGB yield was at -0.05% from -0.07% yesterday. New Zealand’s 10-year rate jumped 12 basis points to 1.41%. German 10-year JGB’s yielded -0.38% from -0.39%. Risk-on saw equities climb to all-time highs. The DOW rose to close 0.75% higher at 29,520 (29,289) while the S&P 500 was up 0.51% at 3,378 (3,363).

The RBNZ left its Official Cash Rate unchanged at 1.00%. Eurozone Industrial Production in January fell 2.1%, bigger than an expected fall of 1.8%, from a rise of 0.2% in December.

- EUR/USD – The shared currency slumped to an overnight and near 3-year low at 1.08652 before rallying at the close to 1.0875, down 0.45%. The Euro also fell against the Yen, Sterling, Aussie and other majors.

- NZD/USD – The Kiwi soared to 0.64875, after the RBNZ gave it wings with their hawkish rate hold. NZD/USD settled at 0.6465, for a gain of 0.87%. The market’s risk-on stance also supported the Kiwi.

- USD/JPY – the Dollar edged higher to close above 110 at 110.10 against the Japanese Yen. The four-basis point rise in the US10-year bond yield and positive market mood buoyed the Greenback.

On the Lookout: Today’s main event is the release of US inflation data for January. US Headline January CPI is expected to match that of December at 0.2%. Core CPI is forecast to rise to 0.2% from 0.1% in December. If the forecast is right, the Dollar could edge higher.

Australian M1 Inflation Expectations kick off the today’s reports. The Euro area sees UK RICS Hose Price Balance and German Final CPI (January). US Weekly Unemployment Claims are also due.

RBA Governor Philip Lowe and Bank of Canada Governor Stephen Poloz will both speak and join a panel discussion in the Australia-Canada Economic Leadership Forum today in Melbourne, Australia.

Trading Perspective: While the Dollar Index (USD/DXY) gained ground, it was mostly the result of the fall in the Euro, often opposite mirrors of one another. The Dollar’s rally was not broad-based. While fears have eased on the spread of the coronavirus, the overall effect on the global economy is still unknown. While the mood is positive, markets are still cautious.

Speculators are still hanging on to their US Dollar longs which is working for them right now. The risk is still for a Dollar correction as complacency steps in.

- EUR/USD – The Euro held the 1.0865 low, rallying to 1.0875 where it currently settles. The shared currency has a heavy feel about it and should see the 1.0865 level re-tested. However, short speculative market positioning warrants caution. Immediate support lies at 1.0865 followed by 1.0835. Immediate resistance can be found at 1.0900 and 1.9030. This writer was not bearish up at 1.0920 so there is no reason to get bearish down here. Look to trade a likely range of 1.0860-1.0910. Prefer to buy dips.

- AUD/USD – The Aussie Battler continued its climb off decade lows, trading to an overnight high at 0.6750 before easing to close at 0.6740. AUD/USD has immediate resistance at 0.6750 followed by 0.6780. Immediate support can be found at 0.6730 followed by 0.6700. Look to trade a likely range of 0.6710-0.6760 today with the preference to buy dips.

- USD/JPY – the Dollar climbed to an overnight and 3-week high at 110.133 before easing to settle at 110.09. The risk-on stance of the market saw further buying of USD/JPY. US 10-year bond yields rose 4 basis point. Japan’s 10-year JGB’s were up 2 basis points to -0.05%. This should be mildly supportive of the Greenback. However, a change in risk appetite and lower than forecast US CPI could see USD/JPY slide back to the low 109/s. Look to trade a likely range of 109.65-110.15. Prefer to sell rallies.

- NZD/USD – The Kiwi squeezed out the shorts up to 0.64875 after the RBNZ kept interest rates steady and removed any chance of a rate cut in its forward guidance. RBNZ Governor Graeme Orr said he saw real wages picking up with low rates remaining necessary. NZD/USD closed at 0.6465. Immediate resistance can be found at 0.6485 followed by 0.6505. Immediate support lies at 0.6440 and 0.6410. Look to trade a likely range of 0.6435-85.

Happy trading all.