Summary: The Euro eased to 1.1192 (1.1210) after European election results saw pro-Europe parties hold on to two-thirds of the seats in the EU Parliament. Some of the 28 countries saw a rise of anti-EU parties. However, the Eurosceptics did not win as many seats as they expected. Sterling slipped 0.18% to 1.2680 from 1.2720 as chances of a no-deal Brexit increased following PM May’s resignation. The Dollar rallied against the Yen to 109.55 (109.30) as Japanese companies purchased the US currency as it approached the 109.00 area. The Australian Dollar closed little changed at 0.6917 (0.6930). Trading was thin and featureless with both London and New York away due to market holidays.

European stocks and bonds rallied following the EU election results. Germany’s 10-year Bund yield dipped 3 basis points to -0.15%.

Japan’s Leading Economic Index in March slipped to 95.9 against a forecast of 96.3. There were no other prime data releases yesterday.

- EUR/USD – The Multi-currency eased from its high in Europe at 1.12152 to 1.1192. After the European elections, markets will turn their focus back on to the China-US trade relations.

- GBP/USD – The British currency saw a relief rally following the resignation of Theresa May. The focus shifted to the contenders to succeed May. With up to 10 contenders vying for May’s spot, political uncertainty increased as well as the chances of no-deal Brexit. The British Pound slipped from 1.2720 to 1.2680 after hitting a high of 1.27478 overnight.

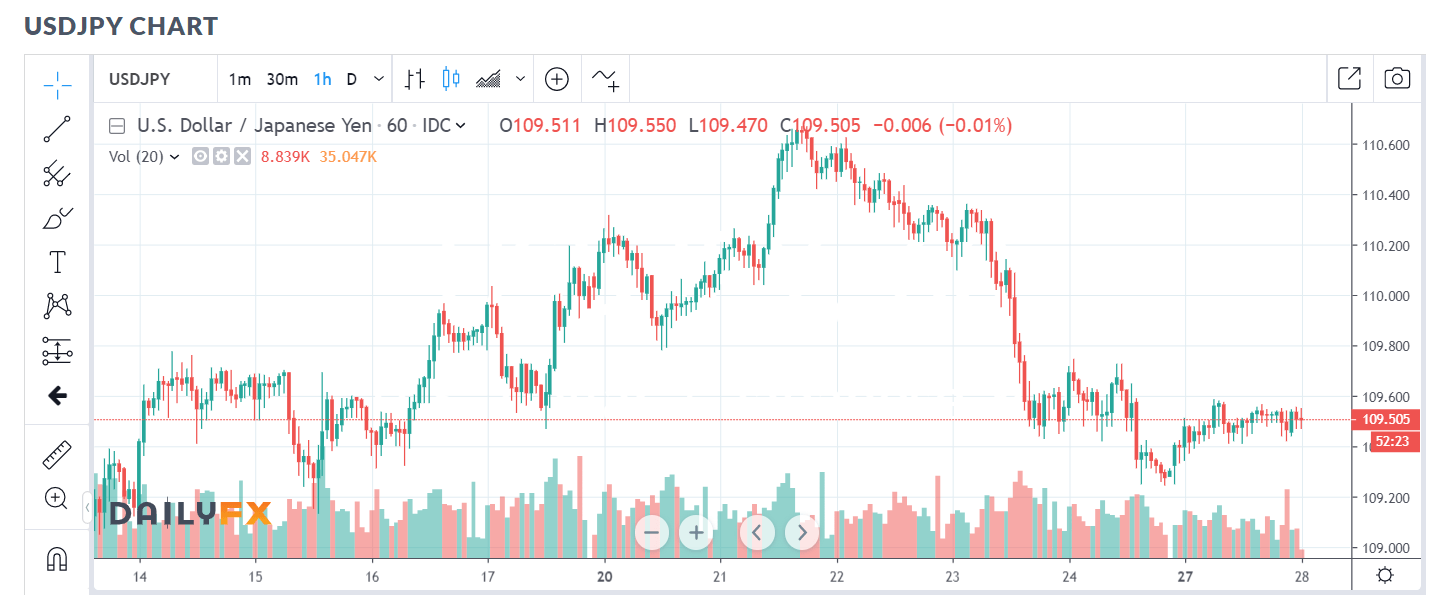

- USD/JPY – Japanese importers and bargain hunters took advantage of the 109.25/30 level and purchased the Dollar, which closed higher, up 0.2% at 109.55. USD/JPY hit a low of 109.02 two weeks ago as the China-US trade war heated up. Demand in the lower 109/s support the Greenback while the topside is limited around 110.00 by the lower US bond yields.

On the Lookout: After yesterday’s subdued trading due to the market holidays in London and New York, expect a slow start in Asia today.

US President Trump finishes his Japan trip today. Trump tweeted that his meetings with Japanese PM Abe “went very well.” He added that “getting to spend time with Japan’s new Empress and Emperor was a great honour!”

Today’s data releases are light. Asia sees Japan’s BOJ Core CPI (annual) and Corporate Service Price Index. Switzerland’s Q1 GDP (Annual and quarterly), German Import Prices and GFK Consumer Confidence Survey (May) and UK Inflation Readings data complete the European releases. The US reports on its Case-Shiller Home Price Index, Conference Board Consumer Prices and Dallas Fed Manufacturing Business Index.

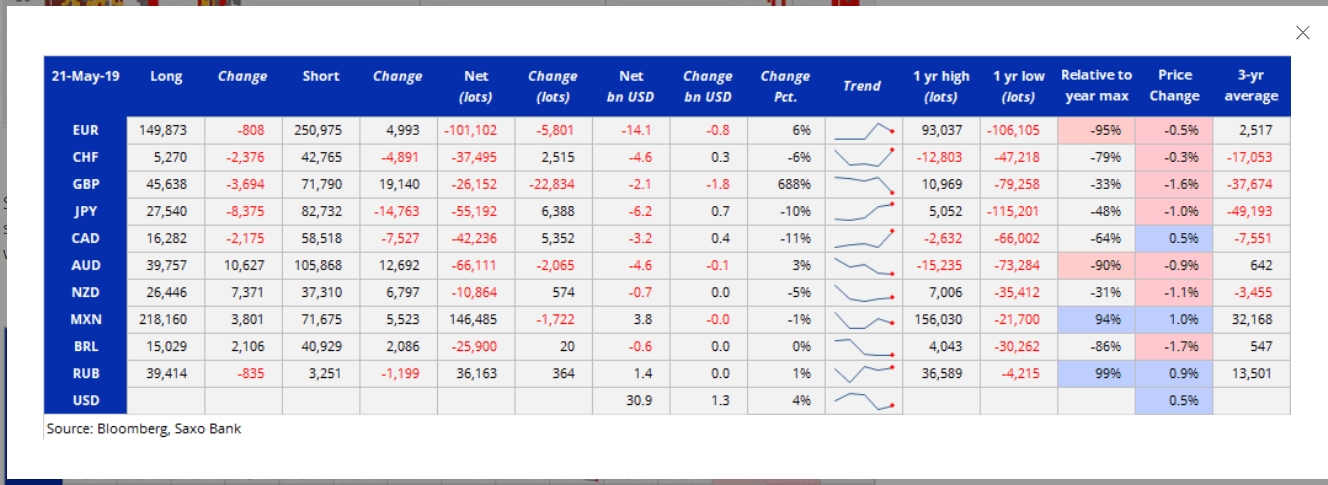

Trading Perspective: With the featureless trade following May’s resignation and the European elections we turn to the market’s positioning. Which will dictate trade in the week ahead. The latest Commitment of Traders/CFTC report (week ended 21 May) saw speculators pile back into the US Dollar. Total US Dollar long bets increased to US$ 1.3 billion against 10 IMM currencies, according to Saxo Bank. The big build was in Sterling shorts, up a total of GBP 22,834 contracts to total -GBP 26,152. Euro bears added to their Euro shorts as the Euro failed its upside attempt. Net speculative EUR short bets increased by EUR 5,801 contracts.

- EUR/USD – The Euro failed to break up through immediate resistance at 1.1220, easing to 1.1192 at the New York close. EUR/USD has immediate support at 1.1180 followed by 1.1140. The Euro would need to see a sustained break of 1.1250 on top or 1.1140 to start motoring. The latest COT/CFTC report saw net total EUR short bets increase to -EUR 101,102 contracts from -EUR 95,301, near multi-year highs. Look to buy dips with today’s likely range 1.1185-1.12455

- GBP/USD – The British currency remains heavy, weighed by negative sentiment surrounding UK politics and Brexit’s uncertainty. Last week we saw the Pound hit 1.26048. The subsequent rally hit a high of 1.27478 before easing to today’s close of 1.2680. In the latest COT/CFTC report we saw a big build of GBP shorts to -GBP 26,152 contracts (week ended 21 May) from the previous week’s -GBP 3,694. Immediate support today lies at 1.2660 followed by 1.2630. Immediate resistance can be found at 1.2710 and 1.2740. Look to buy dips with a likely range today of 1.2670-1.2730.

- AUD/USD – The Australian Dollar closed little changed at 0.6916 from 0.6930. AUD/USD has immediate support at 0.6900 followed by 0.6885. Immediate resistance can be found at 0.6930 followed by 0.6960. The latest COT/CFTC report saw a slight increase in Aussie shorts to -AUD 66,111 from -AUD 64,046. Look to buy dips with a likely range today of 0.6910-0.6960.

- USD/JPY – The Dollar rose against the Yen on Japanese importer and bargain buyers near the 109.00 level. Two weeks ago, USD/JPY traded to a low of 109.019. Yesterday USD/JPY edged up from 109.30 to 109.58 before settling at 109.54. The Dollar remains stuck in a range. Immediate support for today lies at 109.25 and 109.05. Immediate resistance can be found at 109.60 followed by 109.90. The latest COT/CFTC report saw JPY short bets trimmed to -JPY 55,192 contracts from -JPY 61,580. Look to trade a likely range today of 109.35-109.85.

Happy trading all.