Summary: The Dollar’s retreat extended after Orders for US Capital Goods underwhelmed in April, falling at an annual 2.5% against a forecast fall of 2.0%. Which provided further proof of a slowing in the US economy due in part to the trade war with China. The Dollar Index (USD/DXY) retreated to 97.608 after hitting a new two-year high on Thursday (23 May) at 98.37. Sterling recovered from a 4.1/2 month low to 1.2720 on a combination of Theresa May’s resignation and an overall weaker Dollar. The Euro added a few pips to its NY close of 1.1200 to 1.1210 after early German Exit Polls showed a majority for Pro-European parties in the EU Parliamentary Elections. The 2nd largest democratic exercise in the world (next to India) has citizens from 28 nations electing their representatives to the EU Parliament. Early indications also showed an increase in voter turnout from the last elections in 2014, which is an ongoing challenge. CNBC breaking news reported that initial results pointed to a more fragmented EU Parliament with the established centrist bloc losing its majority. Elsewhere, the Dollar slipped against the Yen to 109.30 from 109.60. The Australian Dollar rallied to 0.6930 from 0.6915.

- EUR/USD – The Multi-currency rallied against the overall weaker US Dollar to 1.1205 from Friday’s 1.1183, up 0.12%. In early Sydney, EUR/USD was trading a tad higher at 1.1210, its immediate resistance as results from various EU polls trickled in.

- GBP/USD – Sterling rallied 0.37% to 1.2720 after PM Theresa May announced her resignation on Friday following her failure to deliver a Brexit result. The UK will elect a new prime minister with Boris Johnson as the favourite and could pursue a cleaner break with the EU. Britain voted in the EU elections even though it is planning to leave. The Brexit Party had the lead in early polls from the UK.

- USD/JPY – the Dollar eased further to 109.30 Yen as the US 10-year bond yield remained anchored near 2017 lows at 2.32%. Rising trade tensions between the globe’s two largest economies have stoked expectations of a rate cut from the Federal Reserve. BOJ Governor Haruhiko Kuroda is due to speak today in Tokyo.

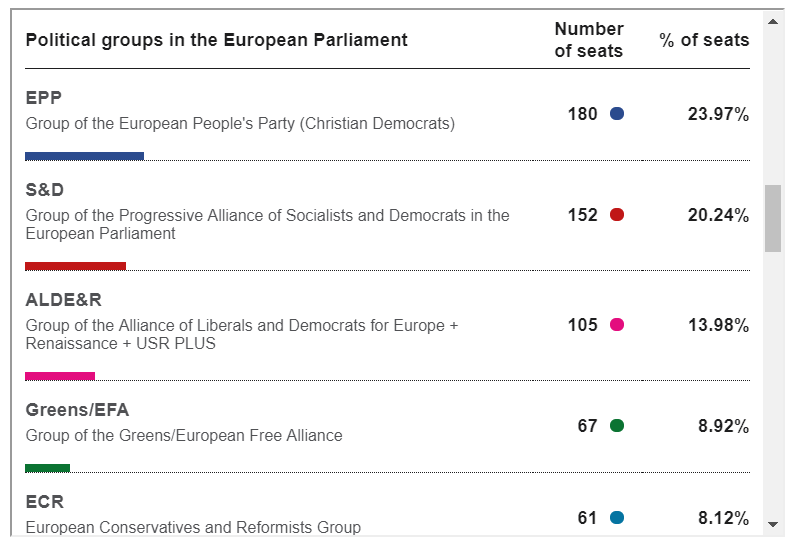

On the Lookout: Markets will keep their eyes on news reports for the results of the EU parliamentary elections. While the pro-EU parties are expected to hold their majority of two-thirds of the seats at the EU Parliament, traders will focus on the gains of populist parties. Markets will continue to monitor any developments on the China-US trade war.

UK and US markets are away today for the Spring Bank Holiday and Memorial Day celebrations respectively. Economic data releases are light today.

Bank of Japan Governor Haruhiko Kuroda speaks at the Think 20 Summit in Tokyo (1.00 pm Sydney time).

Trading Perspective: The Dollar’s retreat extended as speculators began trimming their exposure after increasing long USD bets in the latest Commitment of Traders/CFTC report (week ended 21 May). Total net speculative Dollar long bets increased to +USD 100,800 contracts from the previous week’s +USD 93,900 contracts. The Dollar Index (USD/DXY) hit new 2-year highs at 98.371 before retreating traders started trimming their long bets. The US economy has begun showing signs of slowing partially affected by its trade war with China. Money markets are expecting one Fed rate cut in October with another one in early 2020. The 10-year US bond yield has dropped to 2017 lows.

The Dollar’s correction against the Majors looks set to extend in the week ahead.

- EUR/USD – The Euro, which is a mirror of the Dollar Index, recovered from it’s 2-year low of 1.1107, to close at 1.1205. The 1.1100 level is strong support. Early Sydney sees the multi-currency settling around 1.1210 which was initial resistance. While the nationalist, populist parties have shown gains in early polls at the EU election, centrists are still expected to get two-thirds of the 751 total seats. Which has implications for the functioning of the bloc as well as internal politics in many countries. This will remain a weight on the Euro looking ahead. The overall weaker US Dollar will continue to support the multi-currency which is headed further north. Net speculative Euro short bets increased in the latest COT/CFTC report to -EUR 101,100 contracts from -EUR 95,300. Immediate resistance lies at 1.1230 followed by 1.1260. Look to buy dips with a likely range today of 1.1190-1.1240.

- GBP/USD – Sterling recovered to 1.2725 boosted by the weaker US Dollar and the resignation of Theresa May. Speculators increased short GBP bets in the latest COT/CFTC report to -GBP 26,200 contracts from -GBP 3,300. The hefty increase is the largest gain in short bets since late March. Which should see more short covering. Sterling retreated to a low of 1.26048 on Thursday night. The 1.2600 is strong support. GBP/USD has immediate support at 1.2680 and 1.2640. Immediate resistance can be found at 1.2740 and 1.2790. Look to buy dips with a likely range today of 1.2690-1.2790.

- AUD/USD – The Australian Dollar rallied to 0.6930 from 0.6895 on Friday buoyed by the weaker US Dollar. A good base was formed at 0.6865, last week’s low. AUD/USD has immediate resistance at 0.6935 (overnight high) followed by 0.6960. The next resistance can be found at 0.7000. The latest COT/CFTC report (week ended 21 May) saw an increase in speculative short Aussie bets to -AUD 66,100 contracts from -AUD 64,000. The Aussie bears are clamouring for a rate cut which the RBA could deliver in its June 4 meeting. That said the specs are short and we could see these shorts scramble and push the Battler to 0.70 cents. Look to buy dips with a likely range of 0.6900-0.6940.

Have a good week ahead, happy trading all.