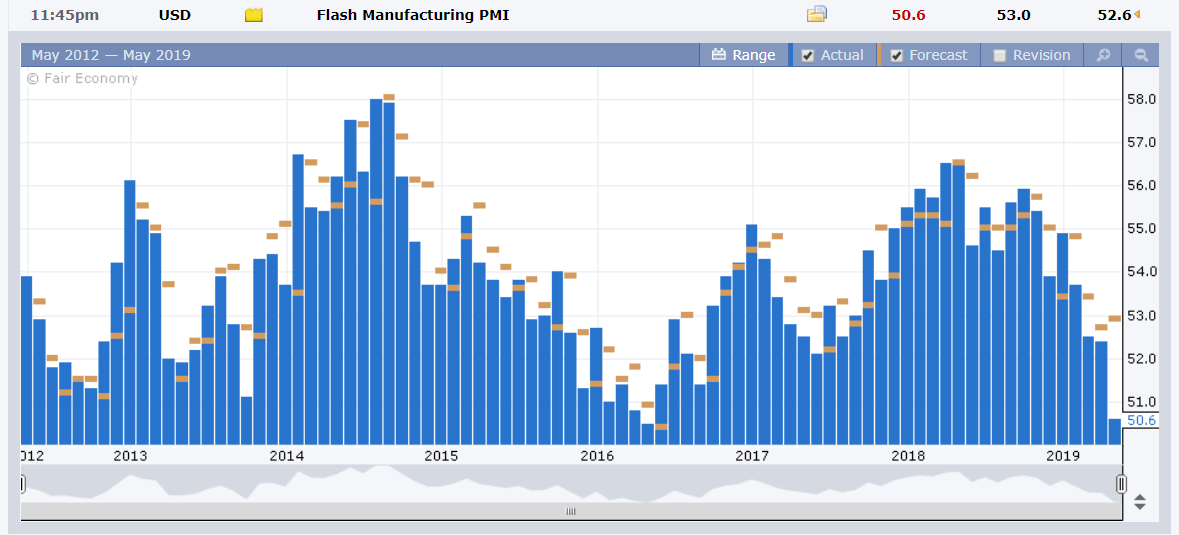

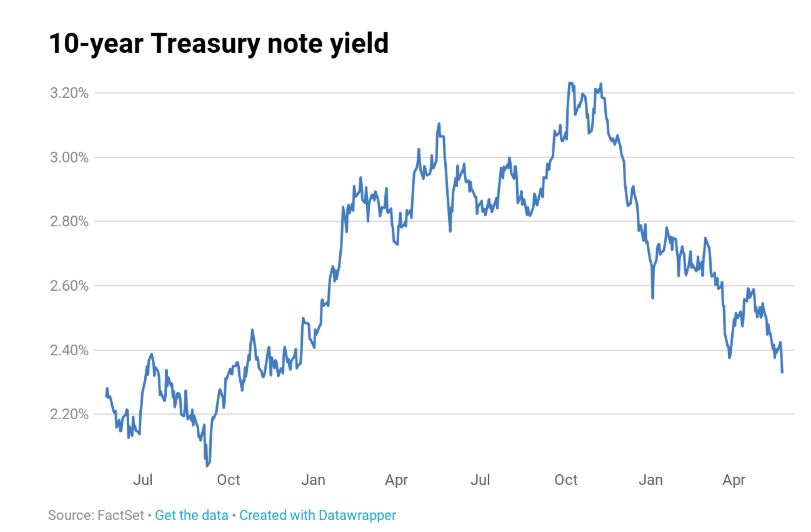

Summary: The yield on the benchmark US 10-year Treasury slumped to its lowest level since 2017 as the ongoing trade war saw business activity slow sharply in May. US Manufacturing Purchasing Manager’s Index fell to 50.6, its lowest level in almost a decade. The US 10-year bond yield closed at 2.32% (2.38% yesterday) after touching 2.308%. The economic fallout of an extended trade war lifted expectations of a Fed rate cut. The Dollar Index (USD/DXY) eased 0.2% to 97.85 (98.11). Safe- haven demand boosted the Yen and Swiss Franc against the Dollar, outperforming their peers. The Dollar fell 0.57% against the Yen to 109.59 (110.33) and 0.61% against the Swiss Franc to 1.0035 from 1.0100. Sterling closed little changed at 1.2662 as Brexit uncertainty saw pressure mount on PM Theresa May to announce her departure date. EUR/USD bounced off its lows to close at 1.1180, up 0.22%. The Australian Dollar lifted against the overall weaker Greenback to 0.6900 (0.6882). Stocks extended their losses on the market’s risk-off stance.

Australia’s Flash Manufacturing and Services PMI’s beat forecasts while Japan’s Manufacturing PMI missed. Euro-area PMI’s were mixed. France bettered expectations while Germany and the Eurozone underwhelmed. US Services PMI slumped to 50.9 in May from April’s 53.0. US May New Home Sales fell from a near 11.1/2 year high in April to 673,000 from 723,000.

- EUR/USD – the Single currency dropped to 1.11071 as the European Parliamentary elections were underway. US Dollar weakness emerged later in the day enabling the Euro to rally to 1.11875 before settling at 1.1180.

- USD/JPY – Safe-haven demand boosted the Yen which gained momentum from the drop in the US 10-year yield. USD/JPY slumped to 109.458 from 110.33, settling to finish in New York at 109.60. Japan’s 10-yaer JGB yield was one basis point lower to -0.07%.

- AUD/USD – The Aussie lifted off its lows on the overall weaker Greenback. AUD/USD rose from its overnight low of 0.6865 to close near its high at 0.6898. Australia’s Flash Manufacturing PMI increased slightly in May to 51.1 from 50.9

On the Lookout: The risk-off environment will extend to Asian markets with participants keeping a way eye on the ongoing trade war.

Today’s data saw New Zealand’s trade surplus in May miss forecasts at +NZD 433 million against a forecast of +NZD 450 million. April’s surplus was revised down to +NZD 824 million (+NZD 922 million). The Kiwi didn’t budge from 0.6520. Japan reports its Annual National Core CPI for May and All Industries Activity. UK May Retail Sales as well as CBI Realised Sales reports follow. Finally, the US reports on its Headline and Core Durable Goods Orders (May). Traders will focus on this report to see if further economic damage has been inflicted by the trade war with China.

Trading Perspective: The big drop in the US 10-Year Bond Yield has taken away the market’s focus on currency weakness and put the limelight on US Dollar. While global interest rates are expected to fall, the potential for a bigger fall in US rates exists. Even in a risk off environment, it’s about the differentials which are starting to narrow. This will erode US strength. Without yield support, the Dollar cannot strengthen.

Yesterday FX market activity picked-up with overall ranges wider. Expect this to continue.

We reported that the latest COT/CFTC saw a paring of net US Dollar longs which were mainly against the Euro and Yen. Speculators are still holding long US bets against 7 major IMM currencies (EUR, JPY, GBP, CHF, AUD, NZD, CAD). Australian Dollar short bets saw a hefty increase in the latest report.

- EUR/USD – The early weakness in the Euro was reversed by overall USD strength. The 6- basis point drop in the US 10-year yield was not matched by its German counterpart (down 3 basis points). With the differential narrowing the Euro will continue to gather strength. The European Parliamentary election results won’t be known until Sunday. The Euro had an active session last night, its biggest for the week. EUR/USD has immediate resistance at 1.1200 followed by 1.1230. A sustained move above 1.1230 could see further shorts head for the exits and push the Single currency higher. Immediate support lies at 1.1155 followed by 1.1130. Look to buy dips with a likely range of 1.1165-1.1215. Prefer to buy dips.

- USD/JPY – Slip-sliding away. The Dollar’s rally had many in the market thinking that the Yen was losing its haven status. The Yen also happens to be the most sensitive currency to moves in the US 10-year yield. USD/JPY closed at 109.60. Immediate resistance on the day lies at 109.80 followed by 110.05. Immediate support can be found at 109.40 and 109.00. Total net speculative JPY shorts saw a big reduction to -JPY 61,600 contracts from -JPY 91,700. This should slow the downside somewhat. Japanese importers will have buying interests lower down. The trend for this currency pair remains lower. Look to sell rallies with a likely range today of 109.25-109.95.

- AUD/USD – The Aussie Battler was lifted by the overall weaker US Dollar. After trading to an overnight and fresh flash crash low of 0.68648, the Aussie rebounded to 0.6900. Australia’s 10-year bond yield fell 5 basis point to 1.53%, which is the lowest on record. Geopolitical tensions will keep global treasuries supported. The latest COT/CFTC report saw net Aussie short bets increased to -AUD 64,000 contracts from -AUD 57,000. AUD/USD has immediate resistance at 0.6930 followed by 0.6960. Immediate support lies at 0.6880 and 0.6860. Look to buy dips with a likely range today of 0.6885-0.6935. Prefer to buy dips.

Happy Friday and trading all.