Summary: The Euro slipped to 1.1222 (1.1240) after German Factory Orders saw its sharpest fall since March 2017. Elsewhere, markets remained bullish on trade negotiations between China and the US. President Trump prepared to meet with Chinese Vice-Premier Liu He at the White House later today. The Dollar edged higher while Wall Street Stocks gained for the 6th day running. USD/DXY gained 0.19% to 97.277. Sterling slumped 0.72% to 1.3075 (1.3162) as growing prospects of a protracted Brexit endgame took its toll. The Australian Dollar was little-changed at 0.7116 (0.7114). Currency volatility remain depressed even as traders anticipate today’s US Payrolls with hopes of some decent moves.

Other data releases yesterday saw US Weekly Unemployment Claims dropped to 202,000 (from 211,000), the lowest since 1969. Canada’s IVEY PMI beat forecasts to 54.3 against 51.4.

Treasury prices rose, and yields slipped. US 10-year bond yielded 2.51% at the close from 2.52%.

- EUR/USD – The Single currency topped out at 1.12476, slipping to 1.1222 in late New York. The weaker-than-expected German Factory Orders report prevented the Euro from gaining further ground. The strong support level at 1.1170/80, remains intact for now. The topside at 1.1250 remains firm, for now.

- GBP/USD – Sterling slumped to close at 1.3075, down 0.72% from 1.3162 yesterday. The British Pound retreated after a 3-day rally as a protracted delay would only add further complication to Brexit talks. The Pound will remain volatile.

- AUD/USD – the Australian Dollar ended little-changed with its next fate now in the hands of the US Dollar. AUD/USD traded to a high at 0.7127 before slipping at the close to 0.7116.

- USD/JPY – the Dollar continued to grind higher against the Japanese currency lifted by the market’s risk-on stance. USD/JPY rose to 111.63 before settling at 111.61 this morning.

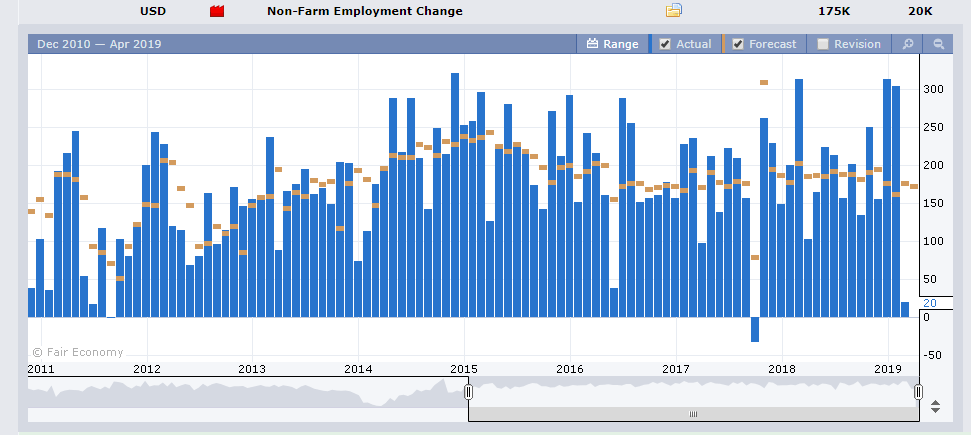

On the Lookout: The focus now shifts to the US Non-farms Payrolls report for March later today. After February’s anemic 20,000 Jobs Gain, analysts are forecasting a rise to between 175.000-180.000 jobs in March. Which would make February’s number an anomaly. The Unemployment rate is expected to remain low at 3.8%. Average Hourly Earnings (Wages) are forecasts to ease to 0.2% from 0.4%. Other data releases today which precede the Payrolls begin in Asia with Japanese Household Spending and Leading Economic Indicators for March. Euro area data follows with Germany’s Industrial Production, French Trade Balance, and UK Halifax House Price Index.

The Eurogroup meets in Brussels, and while the meetings are closed, attendees often speak with reporters. Canada’s Jobs report will be reported at the same time of the US Payrolls.

Apart from the data, trade talks between China and the US remain in focus. A deal is expected to be in the making. Certainly, from President Trump’s point of view.

Trading Perspective: It’s all about the US Payrolls today. With a trade deal already priced in, any announcements may see a fall in risk sentiment, in the short term. Currency traders will be hoping for a surprise in the US Payrolls to inject some volatility back into the FX markets. Today’s release should be interesting with March Payrolls expected to gain about 180,000 Jobs following February’s surprisingly weak 20,000 increase. Anything less than 150,000 could see some aggressive USD selling. A climb above 200,000 would see a strong US Dollar rebound. Look out for the Wages number too. The expectation is for a drop to 0.2% from 0.4%.

Bear in mind that market positioning remains long of US Dollar bets against most of the IMM rivals.

- EUR/USD – The Euro fell to 1.12059 lows following the weak German Factory Orders report. Global trade worries have seen the deterioration of output from large exporting countries like Germany, China and South Korea. The Euro held above 1.1200 ahead of the US Payrolls number. Optimism on China-US trade negotiations also buoyed the Single Currency. Immediate support lies at 1.1200 followed by 1.1170, strong support. Immediate resistance can be found at 1.1250 and 1.1280. On Wednesday we highlighted the fact that net speculative Euro shorts are at multi-year highs. Likely range until the numbers, 1.1200-40. Prefer to buy dips.

- USD/JPY – The Dollar Yen is almost always impacted by the US Payrolls report. Any big swings in the number will see a reaction in US bond yields. US 10-year bond yields have steadied around 2.5% after their drop to a low of 2.37%. A bad Payrolls number (gain of +150,000 or less) could see 10-year yields slump back. This would weigh on USD/JPY. Immediate resistance lies at 111.70 (overnight high 1.1163). Immediate support can be found at 111.30. Look for a likely range of 111.20-70 until the report. Prefer to sell rallies.

- AUD/USD – The Australian Dollar closed little-changed after testing a low of 0.7052 following the RBA policy meeting where some analysts saw a dovish twist in their statement. However, upbeat retail Sales and trade data and optimism of a trade deal between the US and China boosted the Aussie Battler. AUD/USD traded in a 0.70977-0.71272 range last night. Expect similar today with immediate resistance at 0.7130 and immediate support at 0.7100 to hold. Outside levels are 0.7160 and 0.7070. Look for a likely range today of 0.7100-30. Prefer to buy dips.

Happy Friday and Payrolls Day. Hoping for some good old volatility to come back into the FX markets! Happy trading all.