Summary: The Aussie outperformed, gaining 0.8% to 0.7115 (0.7069), lifted by an upbeat trade surplus while the market’s risk-on stance extended. Optimism that the US and China can forge a trade agreement soon buoyed stocks and risk currencies. The South China Morning Post reported that trade talks between the two largest world economies were 90% through to a deal. The remaining 10% though requires trade-offs from both sides which are the sticky points. Better-than forecast Euro area Services PMI’s lifted the Euro off a 16-month low to close at 1.1240 up 0.31% from 1.1199 yesterday. Sterling rallied 0.25% to 1.3162 (1.3127) as PM May and opposition Labour leader Jeremy Corbyn started talks toward moving to a softer Brexit. Wall Street stocks retreated to end marginally higher after hitting the highest levels this year. The S&P 500 ended 0.45% higher at 2,875.00 (2,867). Global treasury prices slumped, lifting yields higher. The US 10-year bond yield rose to 2.52% from 2.47%. Germany’s 10-year Bund yield gained 5 basis points to 0.00% while UK 10-year Gilt yields jumped to 1.10% from 1.00%.

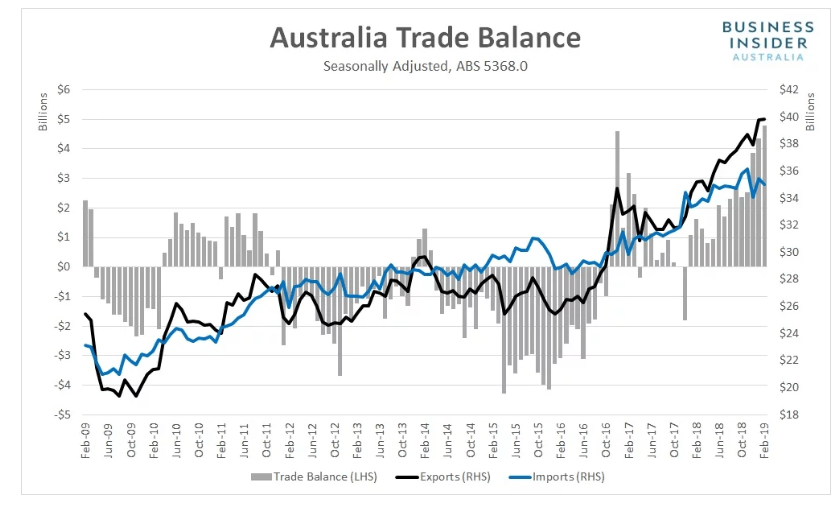

- AUD/USD – The Aussie “Roo” bounced off it’s 3-week low of 0.7050 to 0.71398 overnight before settling at 0.7115. While some analysts saw the RBA’s statement yesterday as leaning toward dovishness, upbeat Retail Sales and Trade data boosted the Battler. Australia’s February trade surplus rose to A$4.8 billion, the highest level on record. The surge in iron-ore prices and other metals boosted Australia’s trade surplus.

- EUR/USD – the raft of better-than-expected Euro area Services PMI data (from Spain to Germany, to the Eurozone) lifted the Euro. The pickup in services data served to ease anxieties that the weakness in the manufacturing sector was spreading throughout the Euro area economies. EUR/USD rallied from its 16-month low of 1.11835 to a high of 1.12546 before easing to 1.1240. We highlighted that Euro short bets increased to their biggest total in over 2 years. “Danger, Will Robinson, danger..”

- USD/JPY – The Dollar ended marginally higher against the Yen at 111.48 (111.38 yesterday). While risk-on has kept this currency pair supported, the weakness in US economic data is keeping USD/JPY from moving higher. Bond yields rose in synch. Japan’s 10-yaer JGB yield was 3 basis points up to -0.05%. USD/JPY will find it difficult to rally much further.

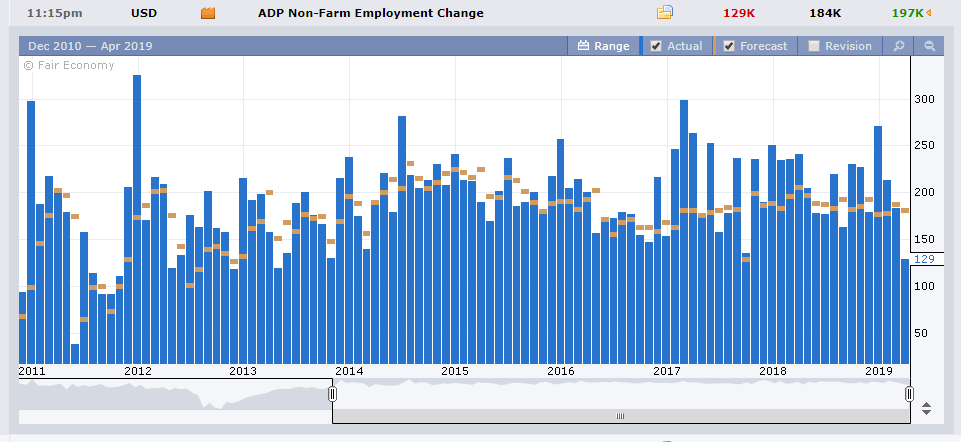

On the Lookout: The Dollar Index (USD/DXY) eased to 97.086 at the New York close, down 0.23%. Much of the move lower was due to the rebound in the Euro which takes almost 60% of the Index’s weight. While much of the Dollar’s easing was attributed to the market’s risk-on stance, US data released overnight underwhelmed once again. Noticeable was the miss on US ADP Non-Farms Employment Change, rising by 129,000 against a forecast build of 184,000. That’s a hefty miss and does not auger well for tomorrow’s US Payrolls report. Markets are expecting a gain in US March Non-Farms Payrolls of 175,000 following February’s weak 20,000 gain.

US Services PMI in March fell to 56.1 from 59.7 the previous month, its weakest print since August 2017.

Today sees the release of Germany’s February Factory Orders. The ECB releases its Monetary Policy Meeting Accounts from its latest meeting. Canada has its IVEY PMI report. US Weekly Unemployment Claims and Challenger Job Cuts end a quiet day of data releases.

Trading Perspective: US economic data has underwhelmed of late and is catching up with the rest of the globe. Last night’s contrast between European and Australian upbeat data and the US underwhelming reports will continue to weigh on the Greenback.

Market positioning, as we highlighted yesterday is also overwhelmingly long of US Dollar bets against most of the Major currencies. Dollar bulls should be alarmed. “Danger, Will Robinson, danger..”

- EUR/USD – The Euro hit a short-term bottom at 1.1180. The overall weaker US Dollar and upbeat Euro area Service PMI reports boosted the Single currency. It should now grind higher. Immediate release can be found at 1.1255 (overnight high) followed by 1.1280. Immediate support lies at 1.1220 and 1.1180. Short Euro bets are at their biggest in over 2 years. Look to buy dips with a likely range today of 1.1220-1.1270.

- AUD/USD – The Aussie Battler is in better shape after being down and out following Tuesday’s RBA policy meeting. AUD/USD has immediate resistance at 0.7130 (overnight high) followed by 0.7160. Immediate support can be found at 0.7100 and 0.7080. Metals and iron-ore prices remain strong. Speculators added to their Aussie short bets in the latest COT report. Further US Dollar weakness will see the Aussie continue to grind higher. Buy dips with a likely range today of 0.7100-0.7160.

- USD/JPY – The Dollar has steadily risen against the Yen on risk-on. However, this currency pair has struggled to make any meaningful gains. Further topside should be limited to immediate resistance at 111.60 (overnight high was 111.58). The next resistance level lies at 111.80. Immediate support can be found at 111.20 followed by 110.80. The latest Commitment of Traders CFTC report (week ended 26 March) saw speculative JPY shorts increase to -JPY 62,121 bets from -JPY 59,221. Look to sell USD/JPY rallies to 111.60 today with a likely range of 111.10-111.60.

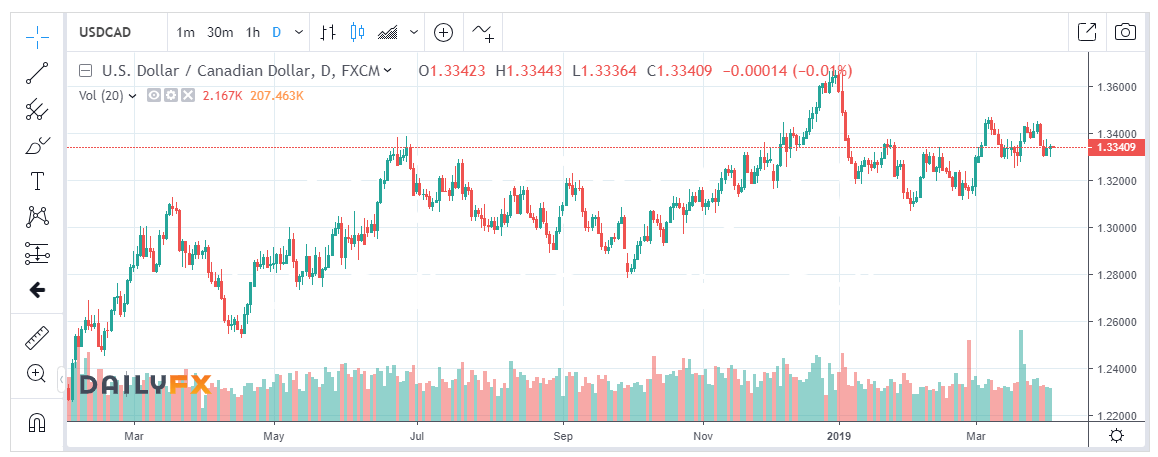

- USD/CAD – The Dollar ended flat against the Canadian Loonie at 1.3340. The latest Commitment of Traders report saw speculators trim their short CAD bets to -CAD 39,571 contracts from the previous week’s -CAD 47,174. Market positioning is still short Canadian Dollar bets. Immediate resistance lies at 1.3350/60 (overnight high 1.3353). The next resistance level lies at 1.3385. Immediate support can be found at 1.3310 followed by 1.3270. Look to sell rallies to 1.3355 with a likely range today of 1.3305-55.

Happy trading all.