Asian stocks extend recent rally at seven-month highs as reports favored the US-China trade deal, and PM Theresa May said she would seek another Brexit extension, voicing her opposition to a no-deal Brexit and calling for urgent talks with Labour leader Jeremy Corbyn to break the deadlock. In Japan, the Nikkei225 main index added 0,97 percent to 21,713, the Hang Seng benchmark in Hong Kong finished 1.15 percent higher at 29,965. The Shanghai Composite outperformed for one more day, finishing 1.24 percent higher at 3,216 and in Singapore, the FTSE Straits Times index gained 1.12 percent higher at 3,316. Australian equities continued its recent run of gains for a seventh straight day and hitting also the best levels in around seven months. The ASX 200 was higher throughout the day and survived a slight wobble in the afternoon to close 43 points or 0.7% higher at 6285.

In commodities markets, Light Crude Oil rallies to five-month high at 62.80, breaking above it’s 200-day moving average as the United States is considering additional sanction on Iran and shrugged off the bearish US inventory report released yesterday. Brent oil also breaks higher at $69.94/barrel. Gold continues the consolidation at the $1291 area. XAUUSD technical picture is neutral, and now immediate support stands at 100-day moving average at $1277, which can accelerate the downward move down to new YTD lows at the 200-day moving average at $1247. Strong resistance now stands at the $1300 round figure and then at the 50-day moving average. Expect the bears to defend $1307 with full force.

Positive vibes spill over to European session mirroring strong Asian equities markets as investors watching the positive developments surrounding Brexit and news that US and China are moving close to a final trade agreement. DAX30 gains 1.35 percent to 11,913, CAC40 is 0.72 percent higher at 5,462 while FTSE100 in London is 0.16 higher at 7,403 and the FTSE MIB in Milan trading 1.08 percent higher at 21,755.

In cryptocurrencies, Bitcoin (BTCUSD) is holding yesterday’s gains, the best day of 2019, and trades at 4,900, it is now facing the key 200-day moving average at $5,233. Bitcoin will find resistance at 50-hour moving average at 4,514. The rally in BTC triggered bids across the industry with Ethereum (ETHUSD) trading now at 165 and Litecoin (LTCUSD) jumping to 79.90.

On the Lookout: In Eurozone, the German Markit PMI Composite registered at 51.4, below expectations (51.5) in March, while France Markit PMI Composite came in at 48.9, above forecasts (48.7) in March.

Fitch Credit Ratings assigned a negative sector outlook on the Chinese banks, reporting that slow profit growth at China’s banks will pressure capitalization. Australia’s trade surplus improved to $4.8b which helped to lift the AUD to 71.10 US cents.

In our calendar today, we look forward to the ADP employment survey together with the ISM services index.

Trading Perspective: In forex markets, AUDUSD is trading 0.68 percent higher at 0.7119 after the RBA kept interest rates unchanged. Kiwi also managed to rebound from the losses yesterday at 0.6742 to Asian highs at 0.6785. US dollar index runs out of steam at the 70 zone and corrects back to 96.55.

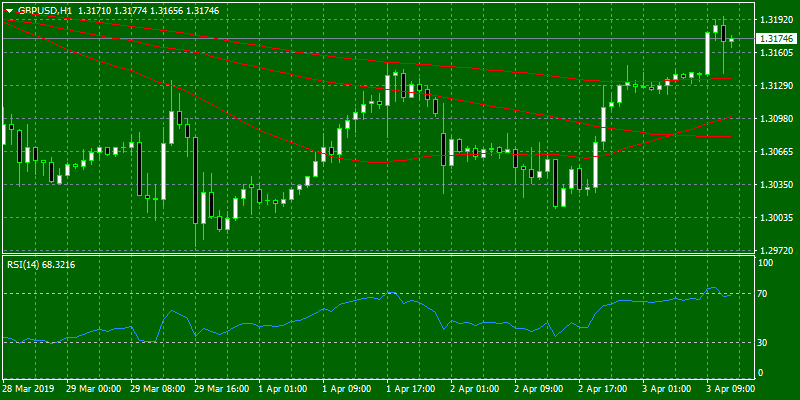

GBPUSD is trading at the weekly high, adding 0.36 percent to 1.3178 as investors digest the positive news from the UK that PM May will seek for a Brexit extension. On the downside, major support will be found at 1.3133 at the 50-hour moving average while more protection can be found at the 50-day moving average around 1.3098. On the flipside, immediate resistance stands at 1.3195, the high from Asian session, and from there, major resistance can be found at 1.3232 while 1.3382, the yearly high, will be met with strong supply.

In GBP futures, markets open interest increased 554 contracts to their open interest positions on Tuesday from the previous day. In the same line, volume partially reversed the prior drop and rose by around 19.5K contracts.

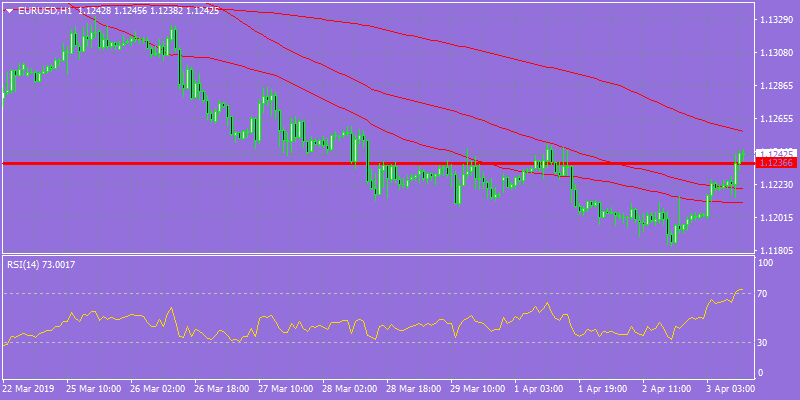

EURUSD managed to break above 1.12 with 0.30 percent gains at 1.1242 above the horizontal support line of the three-month trading range, giving signs that the rebound can drive prices to 1.1258 the 200-hour moving average. The pair needs to break above 1.13 to give bulls a breath and then approach the 50-day moving average at 1.1329 to establish short term bullish momentum. Immediate support can be found at 1.1236 the horizontal support line and then at the 100-hour moving average around 1.1220. The scenario for a move down to yearly lows has paused for now.

In Euro futures markets, open interest rose by around 3.8K contracts on Tuesday from Monday’s final 494,697 contracts, recording the fourth consecutive build according to advanced data from CME Group. On the other hand, volume dropped for yet another session, this time by around 4.2K contracts.

USDJPY keeps the positive momentum adding 15 pips and trades at the daily high to 111.58 zone having hit the low at 111.20. Major support for the pair stands at the 111 round figure if the pair manages to break below the 100-day simple moving average at 111.10. Immediate resistance for the pair stands at 112.06 — the March 2019 high.

Open interest in JPY futures markets shrunk by just 568 contracts on Tuesday, while volume increased for the second session in a row, this time by nearly 31.8K contracts.