Upbeat Chinese data and Trump’s comments boost risk appetite, key US stock earnings and NFP/ISM data to provide short term profit opportunities.

Upbeat Chinese data and Trump’s comments boost risk appetite, key US stock earnings and NFP/ISM data to provide short term profit opportunities.

Summary: US Wall Street yesterday closed on dovish note over conflicting Sino-U.S. trade deal headlines which took caused risk appetite to fade away in market. Asian market opened soft on cues from Wall Street but unexpectedly positive Chinese data helped improve risk appetite causing major indices and key stocks to trade and close on positive note. European market opened on positive note over cues from Asian market and upbeat Chinese macro data. Gains in mining stocks in European market – the world’s largest consumer of metals also helped major indices trade positive. However, profit booking activity on last trading session of the week kept gains in check. In forex market, decline in USD to 10-day lows ahead of today’s US NFP data helped major and emerging market global currencies to trade positive against USD.

Precious Metals: Rare metals were trading mostly flat as Chinese data led cues helped improve risk appetite in the global market. Further profit booking activities also ate away at gains made earlier this week. But loss was capped on account of weak USD and cautious surrounding geo-political events which kept demand surrounding precious metals steady to some extent.

Crude Oil: Crude oil price is seeing positive activity in both major global benchmark indices. While the price may close positive for the day, the price of crude oil when looked at from weekly basis is on decline as sentiment surrounding crude oil was skewed in favor of crude oil bears. Increasing US stockpile data and tensions surrounding Sino-U.S. trade deal continues to weigh down Crude oil.

AUD/USD: The price action of the pair is positive as AUD bulls gained positive influence from surprisingly upbeat Chinese manufacturing data. Weaker USD also provided AUD bulls with some level of support to continue positive price rally. However, lack of major bets ahead of US NFP data scheduled to release later today keeps price trapped below mid-0.69 handle.

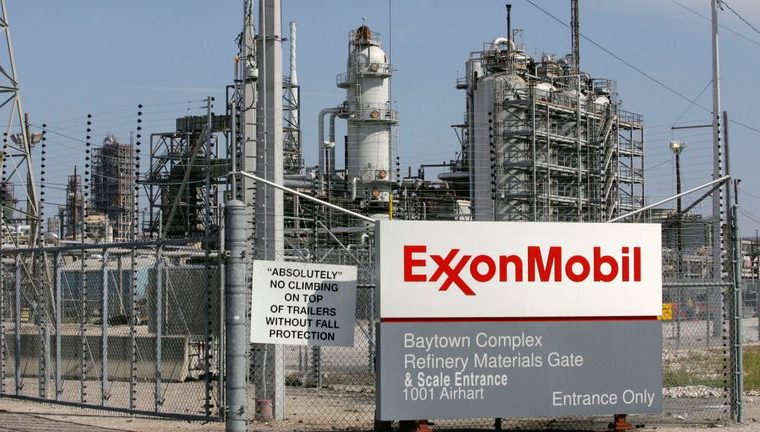

On The Lookout: All eyes are on US Payroll data set to release later today for short term profit opportunities as trading session comes to close for the week. On geo—political front, Sino-U.S. trade deal continues to see conflicting headlines. While Chinese comments yesterday took away optimism surrounding possibility of long term trade deal, US President Donald Trump mentioned that it is looking for a new venue and time frame to sign the phase 1 of trade deal which was set back owing to cancellation of APEC summit in Chile. President Trump also stated that he will meet with Chinese President Xi Jinping and two of them will sign a trade deal in near future which has resulted in tensions surrounding trade deal to ease but failed to invoke any fresh wave of optimism. On Brexit front, while UK is preparing for elections, Trump sent out a warning stating it will be impossible for the nation to sign trade deal with USA should it go ahead of its current Brexit deal approved by EU. However, ruling party has defended its Brexit draft and seems unshaken by Trump’s latest tantrum. In US, noose around President Donald Trump is tightening as impeachment proceeds move up a leg following key vote in congress. On earnings calendar front, US market will see release of quarterly report from AIG, Berkshire Hathaway B, CBOE global, Chevron, Colgate-Palmolive, Exxon Mobil, Pacific Gas & Electric and Seagate.

Trading Perspective: Forex market will see major currency pairs close on positive note for the week, but market is set to see high volume of trading activity driven by speculative bets as US market hours will see release of US Unemployment data, Nonfarm Payrolls, Manufacturing PMI, ISM Manufacturing employment data, ISM Manufacturing new orders index and prices data and ISM Manufacturing PMI update. US stock and index futures trading in the international market saw positive activity on Chinese data led cues. This along with improved risk appetite in global market and Trump’s comments surrounding Sino-U.S. trade deal suggests Wall Street will see positive opening and upbeat price action today.

EUR/USD: The common currency is trading positive against US Greenback with price steady above mid 1.11 handle as USD remains weak ahead of US NFP and ISM data set to release later in the day. Improved risk appetite on Chinese data led cues also favors EURO bulls. Traders now await US data for short term profit opportunities.

GBP/USD: The pair is trading positive as GBP bulls remain supported over election proceedings. Upbeat UK manufacturing PMI data also added support to GBP bulls keeping price steady near mid-1.29 handle. Weaker USD ahead of US NFP data also added momentum to GBP’s positive price rally. Traders now await US data for short term profit opportunities.

USD/CAD: The pair continues to trade positive but gains are capped as USD remains weak in global market ahead of NFP data update. Dovish Shift by BOC earlier this week and overall weekly decline in crude oil price keeps CAD under pressure despite crude oil positive price movement in global market today. Traders now await US data for short term profit opportunities.

Please feel free to share your thoughts with us in the comments below.