Equities head for week’s close with sharp declines while major forex pairs capitalised on USD’s weakness to gain positive momentum. Investors now await US GDP data for directional trading cues.

Equities head for week’s close with sharp declines while major forex pairs capitalised on USD’s weakness to gain positive momentum. Investors now await US GDP data for directional trading cues.

Summary: Equity market in Asia and Europe are headed for the end of the week with sharp declines. Amid lack of progress in geo-political front, cues from macro data updates and central bank forward guidance statements served as the factors influencing price action in the market. Aside from economic data based cues and prolonged standstill scenario of geo-political events with no signs of positive resolution any time soon is also adding to investors concerns of slowdown in global economy. While equity market is seeing mixed price action, Forex market is seeing major pairs trade with relatively high positive momentum today. Despite US Dollar index holding steady above $98 handle, the Greenback fell against six major global currencies during Asian and early European market hours ahead of release of US GDP later today. As week comes to close profit booking on short term trades are likely to drag market further downwards by end of today’s trading session.

Precious Metals: As equities head for dovish weekly close in major markets across the globe while US dollar declines from two-year highs hit earlier this week, precious metals gained positive momentum. A decline in US T.Yields ahead of US GDP data also provides some level of dovish influence to US Greenback supporting precious metals on their positive price run.

Crude Oil: Crude oil price fell sharply in both global benchmarks today down by more than 1% each ahead of US market hours. Speculations that OPEC could terminate their supply cut enforcement earlier than announced previously to compensate for possible supply crisis in case US stops its sanction waivers for Iran caused price of WTI to crash below $64 handle ahead of US market hours and is currently trading at $63.87 per barrel.

EM Asian Currencies: Emerging market currencies from Asia saw positive price action today as US Dollar weakened ahead of US GDP announcement. A decline in US T.Yields also supported USD’s decline helping EM Asian currencies to see positive price action post week long declines. Philippine Peso, Malaysian Ringgit, Indonesian Rupiah are the currencies which gained positive momentum today.

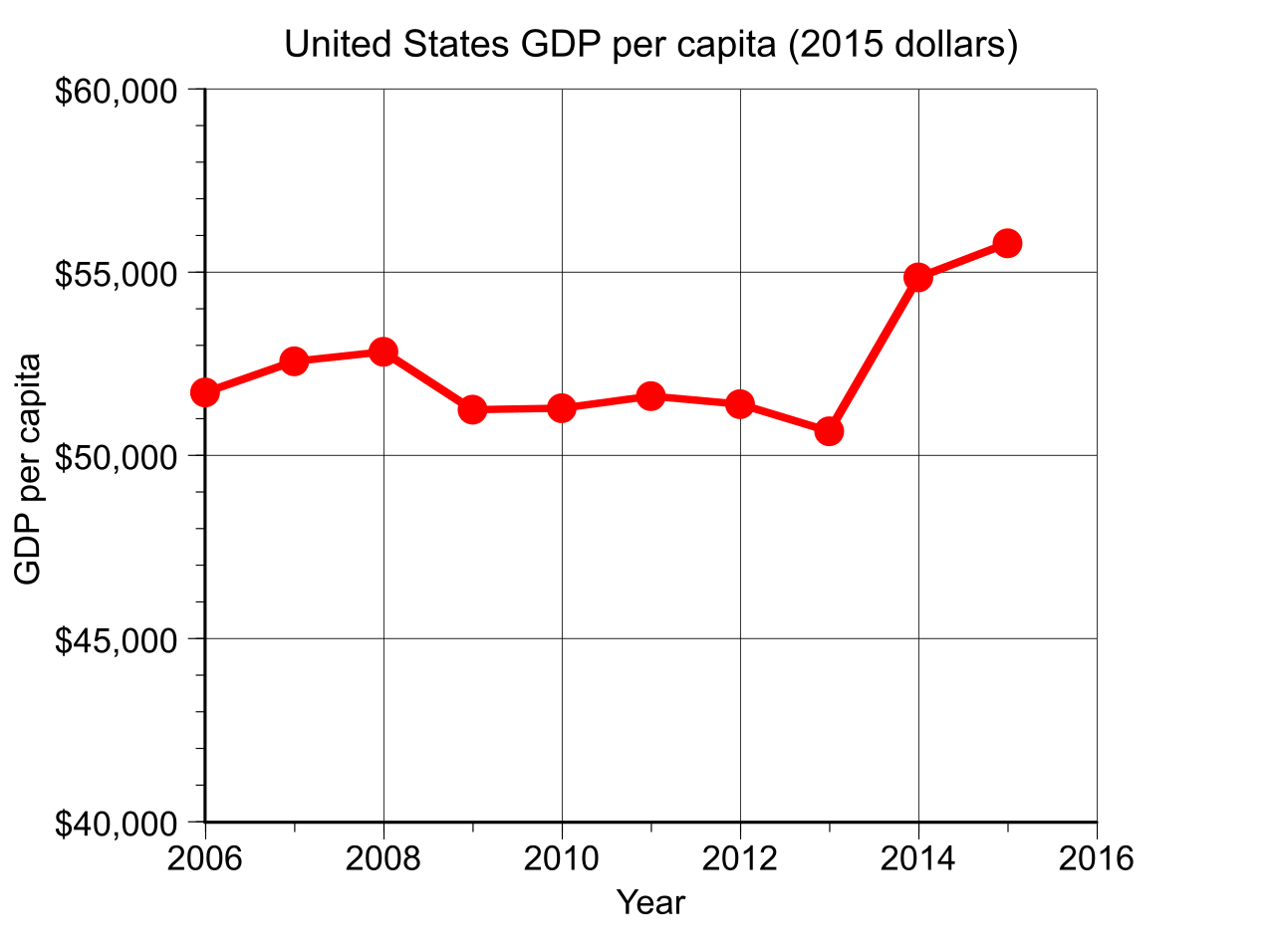

On The Lookout: The main focus on investors today as trading session comes to close for the week is on US GDP. Reuters poll suggest a great turnout in forecast of US GDP update compared to market expectations a few week earlier. Given positive Chinese GDP update earlier this month, a positive/better than expected US GDP data can have great impact on market as positive GDP could influence expectations in market for US Feds to change their stance on interest rate decision later this week. While interest rate is likely to remain unchanged in the upcoming meeting, chances are a positive GDP data could influence Fed’s to hint at possible rate hike considerations during the year ahead. Aside from US GDP, investors focus is on Sino-U.S. trade talks. US President Donald Trump yesterday commented that he is going to host Chinese President Xi Jinping soon and this has raised hopes for trade deal being signed between two nations in the face to face meeting between two presidents during their face to face meeting at white house.

On The Lookout: The main focus on investors today as trading session comes to close for the week is on US GDP. Reuters poll suggest a great turnout in forecast of US GDP update compared to market expectations a few week earlier. Given positive Chinese GDP update earlier this month, a positive/better than expected US GDP data can have great impact on market as positive GDP could influence expectations in market for US Feds to change their stance on interest rate decision later this week. While interest rate is likely to remain unchanged in the upcoming meeting, chances are a positive GDP data could influence Fed’s to hint at possible rate hike considerations during the year ahead. Aside from US GDP, investors focus is on Sino-U.S. trade talks. US President Donald Trump yesterday commented that he is going to host Chinese President Xi Jinping soon and this has raised hopes for trade deal being signed between two nations in the face to face meeting between two presidents during their face to face meeting at white house.

Trading Perspective: US Wall Street is likely to see positive price action as forecast hints at positive GDP and investor risk appetite in US market remains high post yesterday’s comments from US President Donald Trump.

US Indices: US benchmark index futures trading in international market were positive ahead of Wall Street opening. Update from Reuters, which hinted that their survey results showed forecast for positive US GDP data greatly boosted sentiment surrounding US equities. However, decline in US T.Yields and lower USD in the broad market are likely to cap sharp upside move.

EUR/USD: Post the pair’s decline towards multi-month lows below mid-1.11 handle, the pair has entered consolidative price action. While there were some sharp price swings once in a while the price has moved slightly above 22-month lows hit earlier this week and is seeking to find stability near mid-1.11 handle ahead of US GDP update. The outcome of US GDP update could greatly change the price action of the pair as trading session closes for the week.

USD/CAD: While the pair traded with slight positive bias earlier in the day, strong resistance at 1.3500 handle caused the pair to initiate a bearish decline despite sharp drop in crude oil price. While crude oil price declined by more than 1% on both sides of Atlantic, decline in US T.Yields and prevalent USD’s weakness in the global market ahead of US GDP update helped the pair move towards mid 1.34 handle. Investors now await US GDP data for short term directional trading cues as trading session comes to close for the week.